Sierra on Avalanche: A Simple Way to Access Real-World Yield Onchain

Sierra launches today, November 13th with a simple way to earn real-world yield on Avalanche. This guide breaks down what it means for everyday users.

For a long time, getting a reliable yield onchain has felt like a choice between two extremes. You could jump into DeFi and juggle multiple protocols, or you could step into TradFi and deal with platforms that feel nothing like crypto. Sierra offers a middle path that feels familiar to everyday DeFi users and is accessible to newcomers.

Today, Sierra launches on Avalanche with a clear goal. It lets people access yield from a diversified basket of assets without needing to manage each piece themselves. Here, we’ll walk through how Sierra fits into a portfolio and explore how its design simplifies yield strategies for users of all levels, from newcomers to seasoned DeFi participants.

What Sierra Is

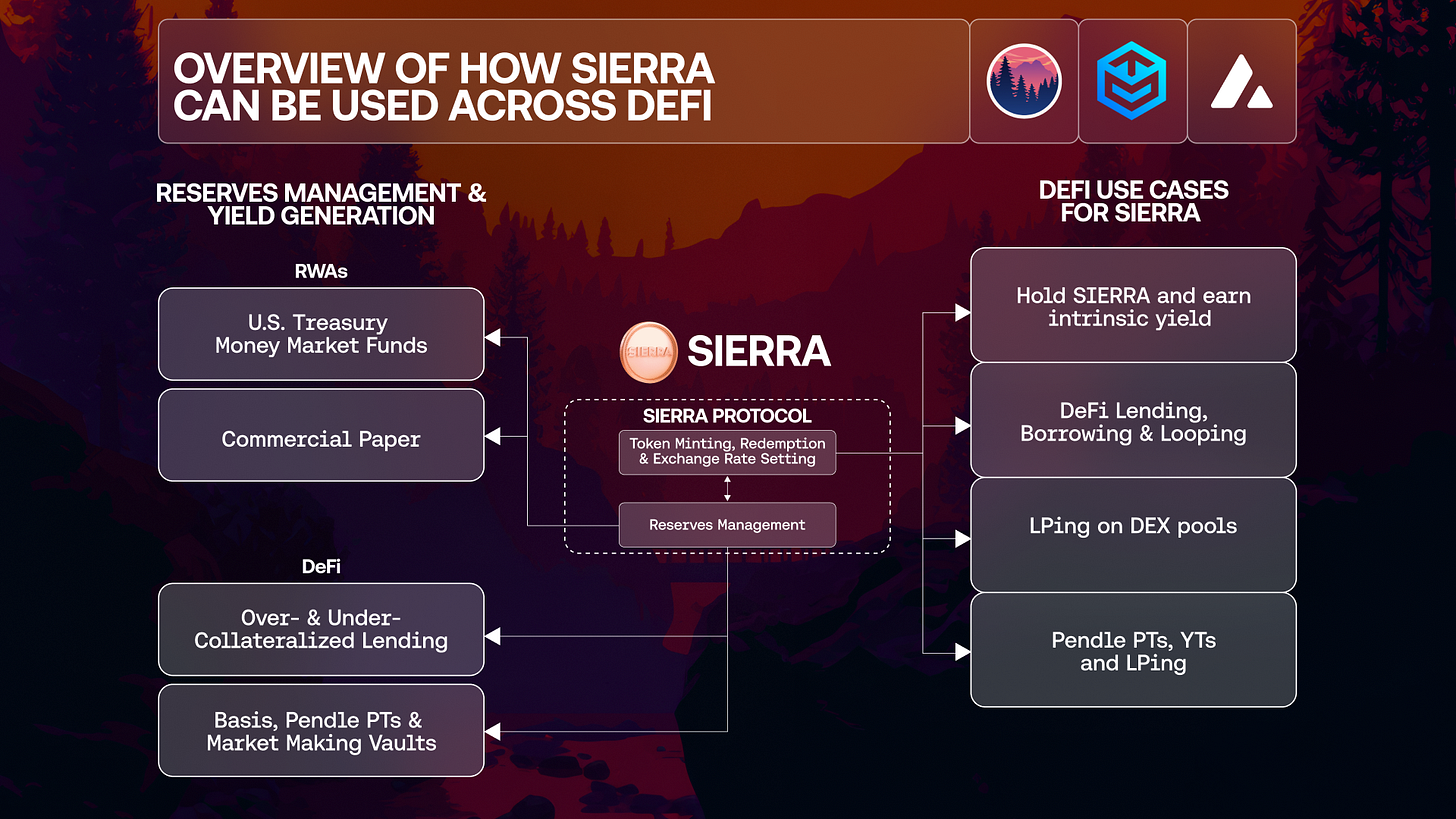

Sierra issues a token called SIERRA. It is a Liquid Yield Token, meaning the token’s value grows as the reserves backing it generate yield. These reserves come from two main places.

Investment-grade real-world assets like Treasury money market funds

Onchain sources like Aave, Morpho, and Pendle

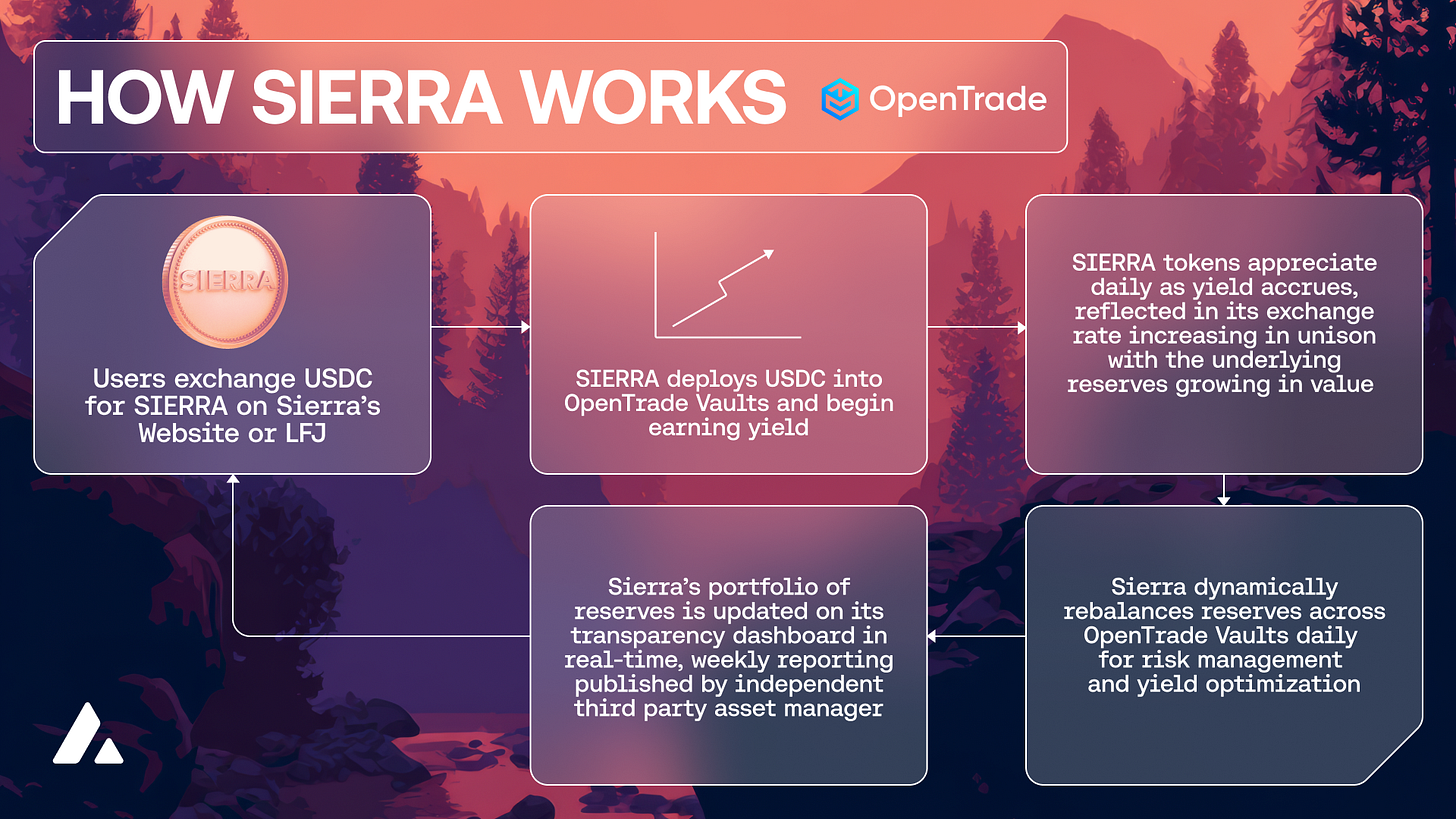

The combination is handled through OpenTrade’s regulated infrastructure. If you have read Part 1 of our DeFi Starter Playbook, you know that yield products come in several forms. Sierra keeps things simple. Simply hold the token in your wallet, and yield will accrue automatically. There are no staking screens, lockups, reward claims, or minimum deposits to manage, and Sierra’s current APY is 5.48 percent.

SIERRA also rebalances based on market conditions, enabling the protocol to adjust the allocation across different yield sources. Newer users do not need to track this. Readers who want a deeper look at how DeFi strategies shift over time can check Part 2 and Part 3 of our DeFi Playbook series.

Why Sierra Fits Into an Everyday Portfolio

Most people who explore yield products end up building a mix of stablecoins, staking positions, vaults, and lending protocols. That mix works fine, but it takes time to maintain. Sierra offers a single token that already contains a diversified yield profile.

Here are a few simple examples.

Someone who has never touched U.S. Treasuries because the process feels too complicated now has direct onchain access.

A DeFi user who rotates between Aave, Morpho, and Pendle can choose Sierra instead of manually rebalancing.

A long-term stablecoin holder can add Sierra as a yield slot without changing their entire strategy.

Access is simple. You can swap USDC for SIERRA directly in the Sierra app. You can also use LFJ, which we covered in our LFJ article. That guide walks through how swaps and routing work, and why Avalanche’s low gas fees help users keep more of their returns.

How Sierra Handles Risk and Rebalancing

Sierra adjusts its portfolio through a rules-based framework. When conditions change in DeFi or in traditional markets, the reserves shift. The protocol also provides a Transparency Dashboard that lets users view current allocations, asset types, and performance data without additional tools. Anyone who has read our Intermediate DeFi Playbook will recognize that visibility and risk management are two of the most important habits in DeFi. Sierra builds those ideas into the product itself.

Where Sierra Fits in a Portfolio Strategy

Sierra can play several roles depending on your experience level.

As a yield slot in a stablecoin-heavy portfolio

As the passive piece in a broader DeFi strategy that includes active positions

As a starter, exposure to RWAs for users who want something simpler than managing T-bills or multiple vaults

Advanced users can explore how Sierra interacts with other tools on Avalanche by revisiting the Advanced DeFi Playbook. New users can reference Part 1 of the series for a refresher on how swaps, slippage, and price impact work before their first transaction.

How to Try Sierra

You can mint SIERRA through the Sierra app by swapping USDC for the token. You can also acquire it through LFJ, which many Avalanche users are already familiar with. Yield begins accruing as soon as you hold the token in your wallet. No onboarding hoops to jump through.

Final Thoughts

Sierra gives users a straightforward way to explore real-world yield on Avalanche. The timing aligns with a month when institutional adoption moved forward globally. This combination of accessible products and large-scale financial activity is shaping Avalanche into one of the most active RWA ecosystems onchain.

You can learn more about Sierra and OpenTrade at https://sierra.money/ and http://opentrade.io

Good write-up about Sierra! Thanks!

give me yield and i will lift the world