DeFi Starter Playbook: Navigating On-Chain Trading on Avalanche (Part 1)

A practical intro for moving off CEXs and into the Avalanche ecosystem, from your first swap to avoiding shady tokens.

Welcome to OnChain Freedom

Are you still doing most of your trading on a centralized exchange (CEX) because DeFi feels overwhelming? Or maybe you’ve dipped your toes into DeFi but still have questions about slippage, gas fees, or spotting scam tokens.

Wherever you’re starting from, this guide is for you.

Moving off centralized exchanges is a big milestone. It means you now self-custody your assets, gain access to a wider range of tokens and dApps, and avoid withdrawal freezes or "maintenance pauses." It also means you're fully in charge of your transactions, and that can feel intimidating.

That’s why we created this three-part series. In Part 1, we’ll walk through the key concepts like swapping, slippage, staking, and gas fees, so you can start trading on Avalanche with confidence and avoid costly mistakes.

Swapping, Slippage & Price Impact

What a Swap Really Does

Most of the time, when you swap tokens on a DEX, you’re not trading against an order book. Instead, you’re trading against a liquidity pool (more on that in a bit). Every trade slightly changes the prices inside the pool up or down.

Swapping is straightforward. Just select the token you are selling and buying from the dropdown menus, or enter the contract address if you can’t find one or the other in the menu. Enter the amounts you want to swap, hit the Swap button, and you are all set. But there is more that happens behind the scenes.

Slippage in Plain English

When you hit Swap, your trade doesn’t execute instantly; it sits in a queue known as the mempool until a validator picks it up and finalizes the trade. During those few seconds, prices can move. Slippage is the gap between the price you expected and the price you actually get after the transaction is confirmed.

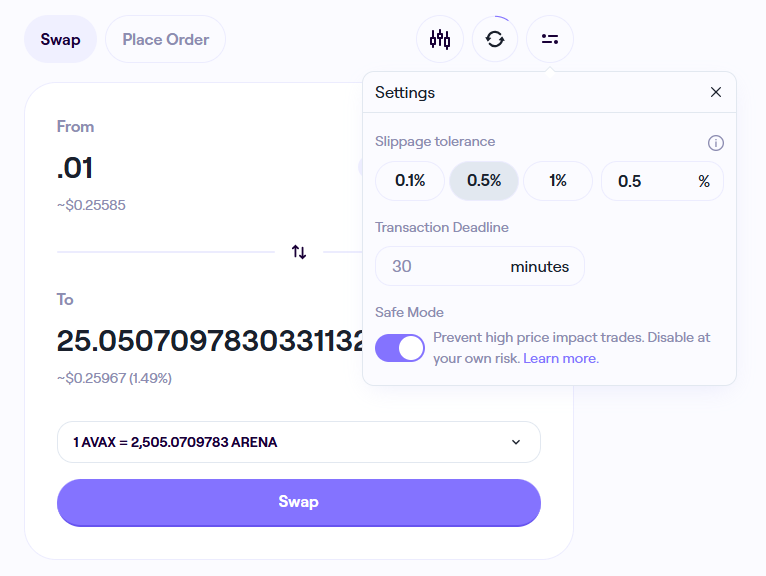

Most DEX interfaces let you set a slippage tolerance. Think of this as a safety valve that cancels the trade if the price moves outside of your chosen percentage. It's like a budget for how much price drift you’re willing to accept.

Stable Pairs (USDC/USDT): Suggested slippage tolerance is 0.1 – 0.3 %. These pairs usually have deep liquidity and very low volatility, so the price is unlikely to move significantly during the swap.

Larger Market Cap Pairs: Suggested tolerance is 0.3 - 1%. These are moderately volatile but generally have good liquidity, so some price fluctuation is expected but manageable.

Micro‑cap or Meme Tokens: Suggested tolerance is 1 - 5% or more. These tokens often have shallow liquidity pools and experience large price swings, so a higher slippage tolerance is needed to ensure your trade goes through. If you are trying to buy a token 10 minutes after it launches, you will probably have to set the slippage at 5 - 20% because the price will be changing so quickly.

Here is the trade‑off: Lower tolerance protects you from bad trades but increases the chance your transaction will be canceled. Higher tolerance increases execution likelihood but may cost you more if the market is moving fast.

Price Impact

The bigger your order is relative to the pool, the larger the price impact. Even without network volatility, a 10 $AVAX buy in a tiny pool could move the price against you by several percent. When in doubt, swap in smaller chunks or look for deeper liquidity elsewhere.

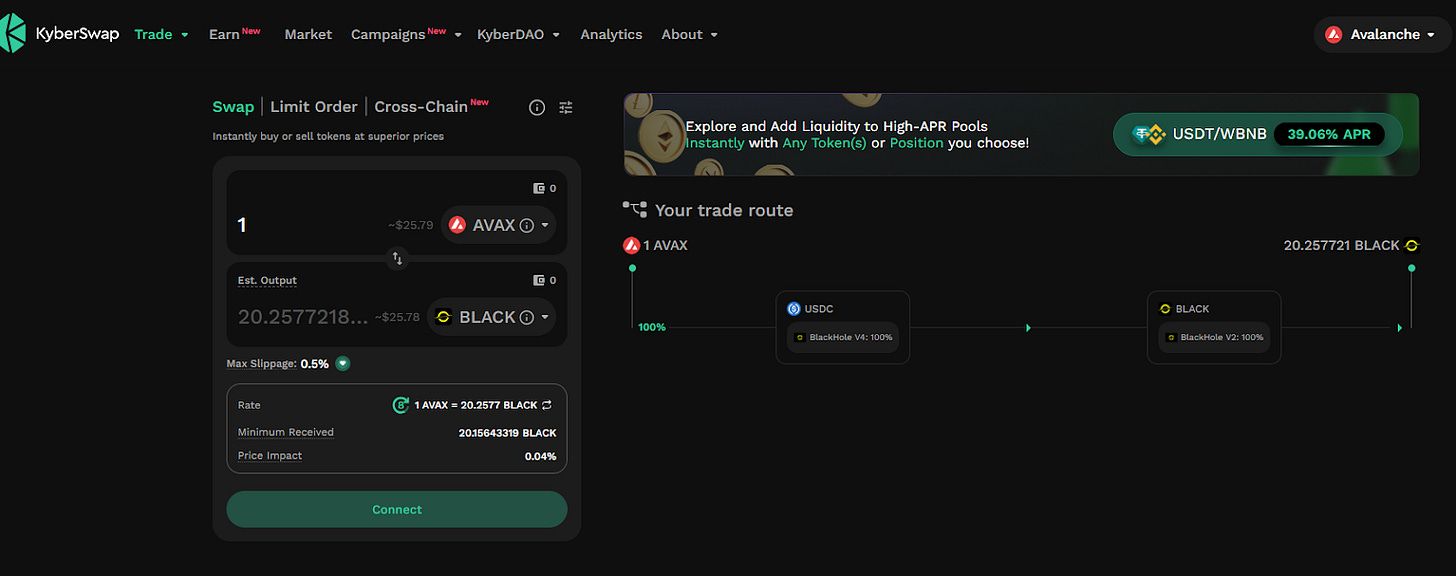

DEX Aggregators = Better Prices

Instead of hopping between different DEXs to compare prices, you can use a DEX aggregator. On Avalanche, top choices include 1inch, Kyberswap, Velora (formerly Paraswap), and CoW Swap. These tools automatically search dozens of liquidity pools to find the best possible trade route and split your order across multiple sources if needed. This helps you get better pricing after factoring in fees and slippage.

Beginner Tip: Aggregators also help avoid shallow pools with poor pricing or hidden risks. If you’re trading a new or low-volume token, an aggregator might be your safest bet for execution.

Liquidity, Depth, and Automated Market Makers

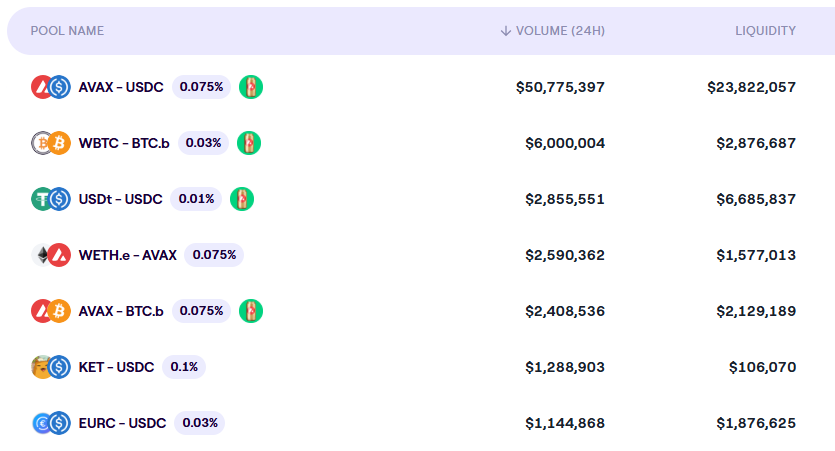

Liquidity refers to how easily you can buy or sell an asset without drastically affecting its price. In crypto, liquidity comes from pools of tokens provided by users, not big banks or centralized dealers. To facilitate smooth trading, tokens are paired (like AVAX/USDC) so there's always something to swap with. The more tokens in the pool, the more "liquid" the pair is, meaning large trades won’t cause wild price swings.

Why Depth of Liquidity Matters

Deep pool (millions of dollars): Small trades barely move the price because the large number of tokens can absorb buying or selling pressure without shifting the token ratio much. This stability attracts traders who want predictable pricing and low slippage.

Shallow pool (thousands of dollars): Even modest trades can push the price up or down dramatically because there's not much liquidity to absorb the trade. This means high slippage and the potential for major price swings from even small volume trades.

Low liquidity dangers: In extremely shallow pools, your trade may not complete at all, or only partially execute, leaving you up a creek with no paddle. Additionally, shady developers can manipulate these pools more easily, increasing your risk of loss. Always check the liquidity before buying a token.

Automated Market Makers, Simplified

Automated Market Makers (AMMs) eliminate the need for traditional brokers or centralized order books by using algorithms to facilitate trading. Instead of matching buyers with sellers, an AMM uses pools of paired tokens. These pools allow you to trade directly against the available assets.

In a typical AMM, both tokens are held in equal value (50% AVAX and 50% USDC). A mathematical formula ensures balance: as more people buy AVAX, the supply decreases and the price goes up slightly, and the next person who buys $AVAX would receive less $AVAX per unit of $USDC. This dynamic pricing is how the AMM adjusts to supply and demand without relying on human market makers.

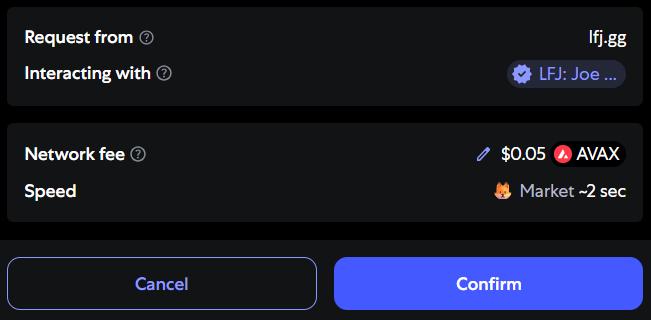

Gas Fees

Gas fees, sometimes called network fees, exist to compensate validators (the computers running the network) for confirming transactions and maintaining blockchain security. On networks like Avalanche, every interaction requires a bit of computational effort, and gas fees ensure that validators are paid fairly for their work. These fees also help prevent spam by making it costly to overload the network with frivolous transactions.

How the Avalanche 9000 Upgrades Significantly Reduced Gas Fees

In 2024, Avalanche implemented the "Avalanche 9000" upgrades, its most comprehensive performance overhaul to date. These upgrades dramatically reduced gas fees across the board:

Lower Base Gas Fees: The minimum gas fee for smart contract transactions on the Avalanche C-Chain dropped from 25 nAVAX to just 1 nAVAX (where 1 nAVAX = one-billionth of 1 AVAX). This slashed average transaction costs by 75–96%, bringing fees down to fractions of a cent in many cases.

Dynamic Fee Adjustments: With new systems like Etna and Octane, Avalanche now adjusts gas fees in real time based on current network traffic. This dynamic fee model keeps fees low during normal usage and only temporarily increases them during spikes in activity.

Together, these improvements make Avalanche far more cost-effective for traders who are excited to swap tokens.

If you see that gas fees on Avalanche are abnormally high, you can try your trade again during non-peak hours.

Staking - Earn While You Chill

Staking means locking up tokens that earn yield either to help secure a proof-of-stake network or to collect protocol rewards. On Avalanche, you’ll see three common flavors:

Native staking - Delegating $AVAX to a validator for 8 - 10% APR. This is typically done with the Core app and wallet. Check out this article for more information on delegation staking in the Core app.

Protocol staking - Locking a DEX’s token (LFJ's $JOE) to earn a share of trading fees.

Liquid staking - Staking $AVAX to receive sAVAX (a liquid-staking derivative). A popular site for this is Benqi.

Risk note: Unstaking often has a lock-up or unbonding period (2 weeks for AVAX delegations). During the unstaking period, you won't be able to send or swap your tokens.

Spotting Fraudulent or Scam Tokens

There are multiple types of fake or scam tokens. Some of the variations include rug pulls, honeypots, disabled selling, extremely high buy and sell taxes, and simply just copycat contracts with identical token names and similar contract addresses. Before swapping into a new token, and especially if it’s a newly launched token, ensure the following:

Verify the contract address: You can cross-check the contract address against CoinGecko, the project’s official X account, a website if available, DexScreener, and CoinMarketCap. All the contract addresses should be the same, with nearly identical market caps and liquidity. If the liquidity looks super low, especially for a well-known token, it’s probably the wrong contract address.

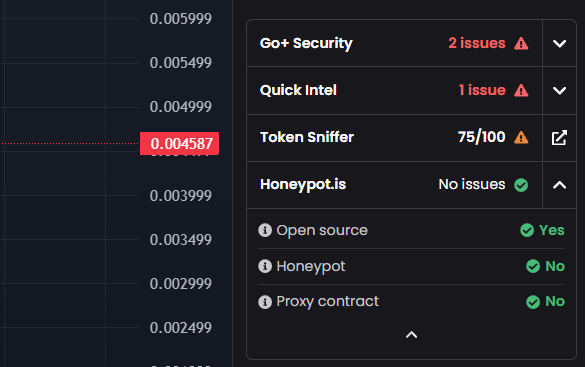

Beware of honeypots: These are malicious tokens or smart contracts that let you buy a token but block or restrict you from selling it, trapping your funds. Use tools like TokenSniffer to test whether a token can actually be sold back once bought.

Further DexScreener research: When you’re in DexScreener, you can paste the contract address into the search bar. About halfway down on the right-hand side of the screen, you’ll see an area that has details about the token. The amount of information varies, but usually, you can see if the token is a honeypot and whether or not ownership has been renounced.

At the end of the day, go with your gut. If something feels off, it probably is. Always pause to double-check before swapping into lesser-known assets. And remember, there will always be a new opportunity in crypto. Never feel like you have to buy anything. It’s better to not buy than to lose your money to a fraudulent token.

Token Approvals & Revoking Them

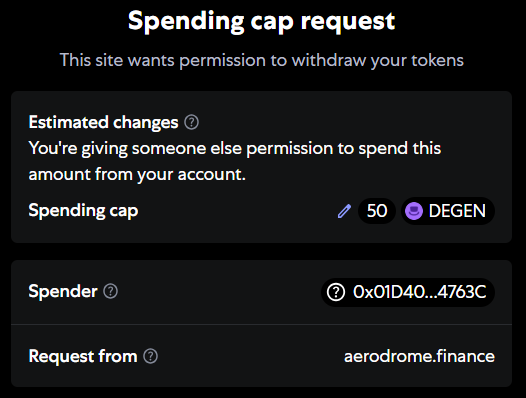

When you first swap a token, some DEX contracts enable unlimited spending permission, although this is becoming less common. If that contract gets hacked, a thief could drain your entire balance. Some good ways to mitigate this include:

Using the “Approve Exact” option if available. This allows you to approve only the amount of tokens you are trading for the current trade.

Visit an app like Revoke.cash every month and disable permissions you no longer need. Each revocation costs just a few cents of gas.

Final Thoughts

You’ve just taken a major step toward confident on-chain trading. From understanding swaps and slippage to navigating gas fees, liquidity, and token safety, you’ve got a solid foundation that every DeFi trader needs.

Habits like verifying contracts, using aggregators, and managing approvals aren’t just for beginners. They’re how you stay safe and efficient, no matter what your experience level is.

In Part 2, we’ll go beyond the basics: exploring smarter order types, how leverage and liquidations work, and why understanding MEV can protect your trades. The tools get more advanced, but so do the rewards. Till next time, trade safe.

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.