DeFi Playbook: Intermediate Tactics for Avalanche Traders (Part 2)

Master leverage, refine your execution, defend against MEV, and start earning with yield farming.

Congratulations on executing your first few swaps, staking some $AVAX tokens, and avoiding sketchy scam contracts; now it’s time to level up.

Once you start diving deeper into the Avalanche DeFi ecosystem, you’ll start to see it as a powerful toolbox that goes far beyond simple token swaps. And if you're already trading regularly, these tools can dramatically increase your efficiency, reduce your risk, and even unlock new earning opportunities.

Part 2 of this three-part DeFi series is for users who are ready to take the next step, whether that means placing smarter trades, managing leverage, or understanding how MEV affects your transactions.

If you didn’t catch Part 1, read it here for a full walkthrough of starting with Avalanche DeFi, from your first swap to avoiding shady tokens.

If you’re ready to move on, let’s get tactical.

From Basic Swaps to Strategic Execution

A swap is a great entry point, but it’s just the beginning. Swaps execute at the best available price in the pool, which can be good enough in low-volatility environments. But in more complex market conditions, or when trading large amounts, basic swaps can lead to slippage, missed opportunities, or unwanted front-running.

That’s why more advanced order types and trading strategies exist. They give you control over how and when your trade executes, especially in volatile or low-liquidity environments. Before we get to those tools, though, let’s dive into one of DeFi’s most powerful (and risky) features: leverage.

Leverage & Liquidations 101

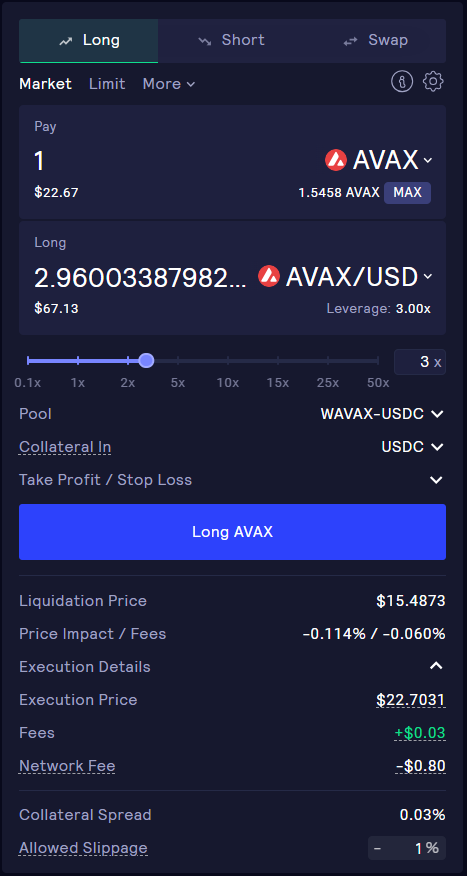

Leverage allows you to borrow funds to increase your position size. For example, if you only have 1 $AVAX and you use 3x leverage, that means you can enter a position worth 3 $AVAX. In this case, your 1 $AVAX acts as the margin/collateral that backs the trade. This amplifies both potential gains and potential losses.

Margin is like your “skin in the game, " allowing you to access a leveraged trade. Margin also acts as collateral for the leveraged trade, providing the lender with funds that could be liquidated if the trade moves against you. The more you borrow (the higher the leverage you use), the easier it is to get liquidated. Liquidation is the point at which the protocol automatically sells your position to cover the loan (repay the lender).

Most protocols that offer leveraged trading use funding rates to balance long and short positions. A long position means you’re betting that the asset will increase in price, and a short position means you’re betting that the price of the asset will decrease. The funding rate is a periodic payment between traders, depending on whether long or short positions are more crowded. If you're long and the market is overly bullish, you may pay a fee to short traders, and vice versa.

Additionally, leveraged trades may include borrowing interest, trading fees, or protocol-specific charges. These can vary significantly, so always read the fee structure before opening a position.

Always Set A Stop Loss

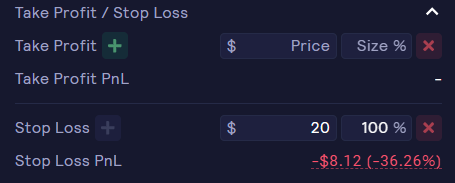

A stop loss is an order you set in advance to automatically sell your crypto if the price falls to a certain level, helping limit how much you can lose on a trade.

It’s especially important when trading with leverage because even small market moves can result in big losses. If you don’t use a stop loss, you risk losing all your margin/collateral. A stop loss acts as a safety net to quickly close your position before those losses become unmanageable.

In the example below, the stop loss is set to a price of $20 ($AVAX was worth $22.68 at the time of writing), and 100% of the position would be sold at $20. You can see how much of your position will be lost in dollars and a percentage basis. You can adjust this to fit your specific risk tolerance.

If you’re feeling particularly froggy, GMX is a solid protocol for leveraged trading on the Avalanche network.

Smarter Order Types: Limit + TWAP

Advanced orders give you more precision, flexibility, and control. These orders let you decide what to trade and exactly how and when it happens. They can help you lock in favorable prices, reduce slippage, avoid sudden volatility spikes, and even automate parts of your strategy.

Limit Orders: You specify a target price at which to buy or sell a token. Limit orders are ideal for range-bound assets, setting buy-the-dip targets, or taking profits without constantly monitoring the market. You can set the order to expire in a specific time frame or set it to have no expiration.

TWAP (Time-Weighted Average Price): This smart order breaks a large trade into smaller, evenly spaced orders over a set time period. This helps minimize slippage, reduces visible market impact, and makes it harder for bots to exploit your trade size.

Popular platforms like 1inch and CoW Swap are solid choices for checking out these advanced features. However, Cow Swap has a minimum wallet balance amount of $5,000 to initiate TWAP orders (probably not a big deal for ballers like us).

MEV

Maximal extractable value (MEV) refers to the hidden profits that can be extracted by manipulating how transactions are ordered on a blockchain. These profits are typically captured by bots or validators and come at the expense of everyday users.

Here are a few common MEV attack strategies explained simply:

Frontrunning: Imagine you’re trying to buy a token. A bot sees your transaction coming and jumps in ahead of you, buying the token first and selling it back to you at a higher price.

Backrunning: After a trade is executed, the price of a token may shift. In a backrunning attack, a bot watches for these trades and quickly jumps in after them, hoping to profit from the price change the original trade just caused. It’s like tailgating a large trade to ride the wave of price movement for a quick gain.

Sandwich Attacks: This is when a bot places one transaction before and one after yours, effectively “sandwiching” your trade. It profits from the price movement your trade creates in both directions, leaving you with a significantly worse deal.

MEV is invisible but very real, and it affects every trader unless specific actions are taken.

How Protocols Defend Against MEV

To counter MEV, some protocols use systems including:

Off-chain Intent-Based Systems: Traders submit their intent (e.g., swap token A for B at a target price), and solvers compete to execute it in the most optimal way.

Solvers: Trusted agents who bundle and execute user intents to minimize MEV.

Batch Settlement: Bundling multiple transactions into a single execution reduces the attack surface for MEV bots.

Private Mempools: Your transaction is hidden until it’s confirmed, making front-running much harder.

These improvements make DeFi trading safer and more efficient for all participants. Cow Swap is well-known for its MEV protection and allows for native Avalanche trading.

Yield Farming Starter Kit

What’s that? You’re ready to earn passive income with your crypto? Well, you’re in luck. Yield farming means depositing your tokens into DeFi protocols in exchange for interest, trading fees, or rewards.

Understand the Math

APR: Annual Percentage Rate. This represents simple interest based on the original amount you stake, without factoring in reinvested earnings. APR is generally easier to compare across protocols, but may understate total returns if rewards are compounded.

APY: Annual Percentage Yield. It factors in compound interest, showing what you’d earn if rewards are reinvested over time. This often appears higher than APR but assumes frequent compounding. APY can better reflect actual growth if rewards are auto-compounded, while APR offers a straightforward snapshot for variable or one-time payouts.

Key Strategies

Single-Asset Staking: You deposit only one type of token, avoiding exposure to price movements between two different assets. This carries lower risk but generally offers lower yield, since you aren’t earning trading fees from a pair.

LP Farming: You provide equal values of two tokens (e.g., AVAX/USDC) into a liquidity pool. You earn a share of the trading fees and often extra rewards, but you also face impermanent loss, which is a reduction in value compared to simply holding the tokens. This occurs when the prices of the paired assets change in relation to each other. For example, if AVAX’s price rises sharply, the pool automatically rebalances, leaving you with more USDC and less AVAX than you started with, potentially reducing your total value.

-Before jumping in, make sure you have a thorough understanding of the risks, mechanics, and market conditions involved. Conduct in‑depth research on becoming a liquidity provider, well beyond what’s covered here, so you’re confident before committing your coins to a liquidity pool.Auto-Compounding Vaults: Platforms like Beefy Finance and Yield Yak automatically harvest and reinvest your rewards, increasing your yield without requiring manual claiming and restaking.

Final Thoughts

At this point, you should have a solid understanding of intermediate DeFi concepts on Avalanche. We’ve covered how leverage works, explored advanced order types like limit orders and TWAP, examined MEV and its potential impact on your trades, and introduced yield farming along with its risks and rewards. Each of these areas opens up deeper strategies, tools, and considerations for optimizing your on-chain activity.

From here, you can choose to dive deeper into whichever topics spark your interest, whether that’s mastering risk management in leveraged trading, experimenting with automated execution strategies, or researching different yield generation strategies.

In Part 3, we’ll expand further into advanced tactics: mitigating impermanent loss, building multi-protocol portfolios, understanding perpetual futures in detail, and exploring flash loan arbitrage. Until then, keep researching, testing strategies in safe environments, and building your DeFi edge on Avalanche.

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.