LFJ on Avalanche: More Than Just Token Swaps

In this article, we explore LFJ's powerful features, from near-zero slippage to dynamic fees, and show you why it's continues to be a staple for new and veteran users alike.

If you’re brand new to Avalanche or a veteran trader, you’ve probably heard of LFJ. It’s well-known for efficient swaps, innovative liquidity pool features, and a clean interface that doesn’t cause any confusion. In this quick deep dive, we’ll outline what LFJ is, why it’s a go-to DEX on Avalanche, and how to make the most of its core products: swaps, liquidity pools, and staking.

Project Overview

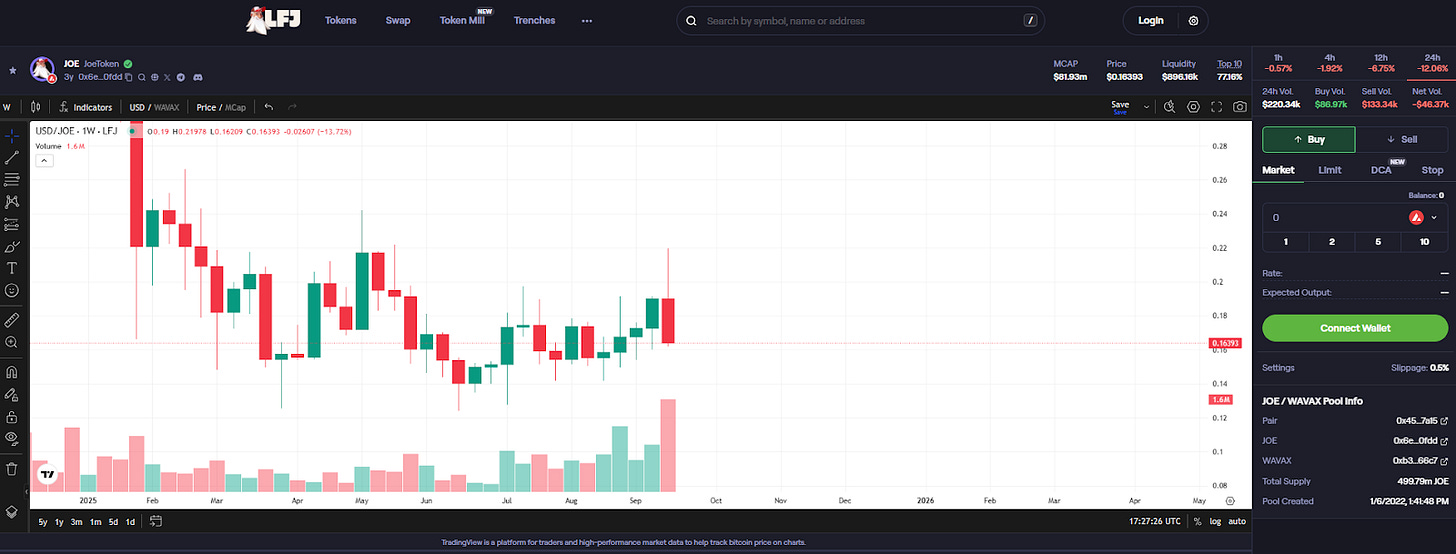

LFJ is a DEX that centers its spot markets on Liquidity Book which is a concentrated-liquidity AMM. Liquidity Book arranges liquidity in discrete price bins, enabling near-zero slippage inside a bin, and dynamically adjusts swap fees via Surge Pricing when volatility spikes. These mechanisms are designed to keep trades efficient and pools healthy.

On top of that engine, LFJ runs a meta-aggregator router. This means when you click “Swap,” LFJ can source liquidity from its own pools and other DEX routes, while charging no additional platform fee for the aggregator service. This means you get the best route it can find, not just the best route on a single venue.

Value to Avalanche Users

When you trade on Avalanche, the network’s speed and recent gas reduction already make things feel smooth. LFJ builds on that experience with:

Lower price impact thanks to Liquidity Book’s bin design and concentrated placements.

Volatility-aware fees (Surge Pricing) that discourage large liquidity withdrawals during wild markets and help LPs stay solvent.

“Safe Mode” trading: if price impact exceeds 5% during your swap, LFJ warns you and lets you reconsider the trade. These are great guardrails for newer users or thinner pairs.

Main Products & Features

Swaps

The Swap screen is intentionally minimal. Select tokens, review routes, and confirm - it’s that easy. Under the hood, the meta-aggregator checks multiple paths and can split orders when that improves your execution. The aggregator carries no extra platform fee, so what you see in quoted price impact and AMM fees is what you pay.

If you like more control, LFJ’s Terminal view adds pro-style features like limit orders, DCA, stop-loss/take-profit, and multi-route visualization. Think of it as “advanced mode” without leaving the LFJ app.

Liquidity Pools (Liquidity Book)

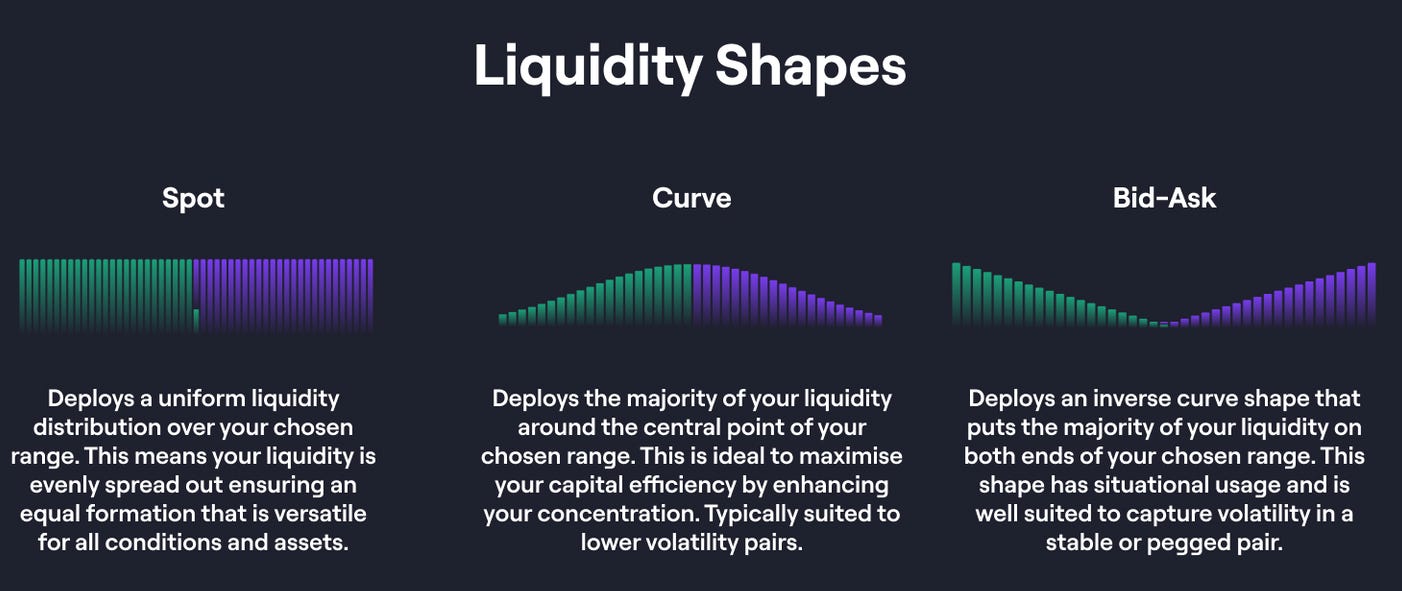

Providing liquidity on LFJ is different from the classic 50/50, set-and-forget experience. With Liquidity Book, you choose where to deploy capital across price bins, and even pick preset “shapes” (spot, curve, bid-ask) that match your view of future price movement. That can translate to higher fee capture per dollar when price trades inside your bins.

Rewards are also handled with trader and LP providers in mind. With Liquidity Book rewards, emissions and incentives accrue to specific pools and are claimable in real time. There’s no waiting through vague epochs or guessing when a claim window opens. Pool pages make it clear what’s live, and your wallet can claim directly.

If you’re new to concentrated liquidity, LFJ’s docs walk through concepts like bin drift, price impact, and strategy shapes, including pros/cons of each approach. It’s a good primer before you deposit into a liquidity pool.

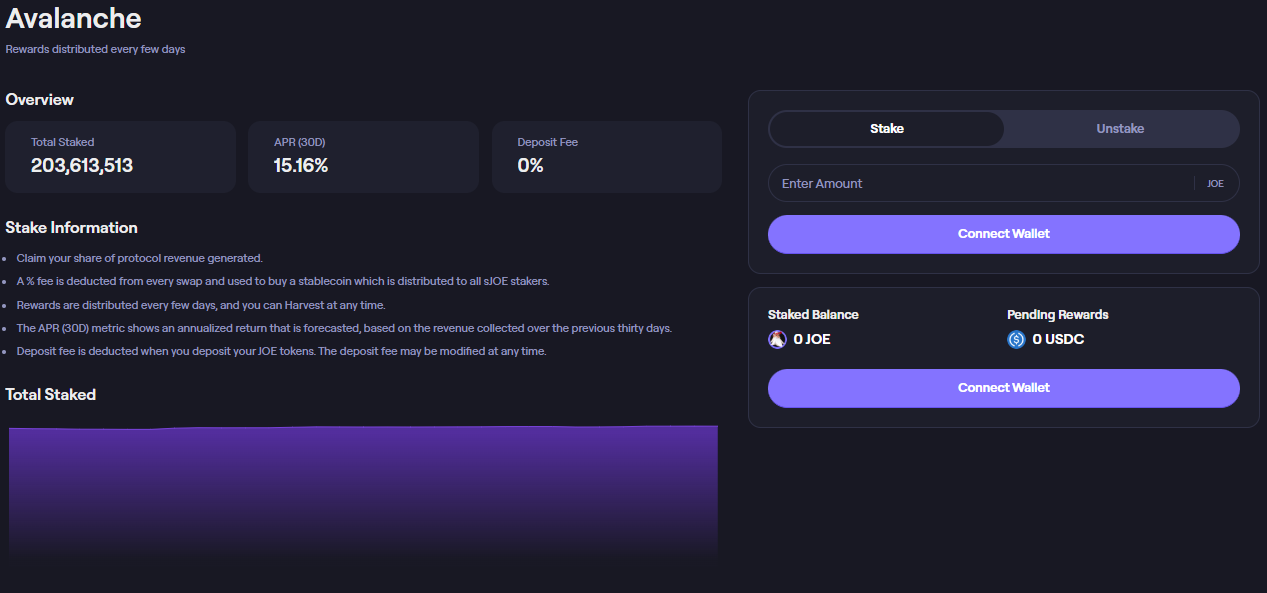

Staking ($JOE)

LFJ’s ecosystem includes $JOE staking for users who want to align with the protocol and earn a share of platform revenue streams. In practice, you deposit JOE, receive a liquid staking token, and accrue fees that stem from on-platform activity. The docs detail the mechanics, fee sources, and how redemption works so you can evaluate the tradeoffs versus simply holding or being a liquidity provider.

Final Thoughts

LFJ is an Avalanche staple because it respects the things Avalanche traders actually care about: quick finality, good routes, and LP mechanics that don’t collapse the moment markets get spicy. Liquidity Book’s bin model, surge pricing, and real-time rewards create a durable foundation, with the aggregator and terminal features adding helpful tooling on top.

If you’re here for straightforward trades, the base Swap feature is all you need. If you’re hunting for better fee capture, explore Liquidity Book’s shapes and rewards. And if you want long-term alignment, read the $JOE staking section and decide how it fits your portfolio.

Avalanche keeps getting faster and more cost-efficient, and LFJ is purpose-built to take advantage of that momentum. As new pairs and features arrive, the combination of smart routing and flexible LP design should only get more popular.

Explore More Here

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.