Avant Protocol Generates Smarter Yield on Avalanche

Avant Protocol is bringing transparent, market-neutral yield strategies to everyday Avalanche users through simple tokens that let you choose your risk, earn smarter, and skip the DeFi guesswork.

Most DeFi yield products are full of hidden risk, unclear strategies, and zero transparency when things go sideways.

But Avant Protocol is doing something different. It takes serious, professionally managed market-neutral strategies and wraps them in simple tokens you can hold on Avalanche. Think of it like going after steadier, risk-adjusted odds instead of spinning the roulette wheel.

Let’s take a look at what it is, how it works, and why it matters for Avalanche users.

What Is Avant Protocol?

Avant is a DeFi protocol with a central focus of letting normal users access hedge-fund-level, market-neutral strategies through simple, tokenized positions.

Instead of asking you to manage complex basis trades, funding arbitrage, and various liquidity positions, Avant bundles those strategies behind the scenes and presents them as three families of tokens tied to core assets.

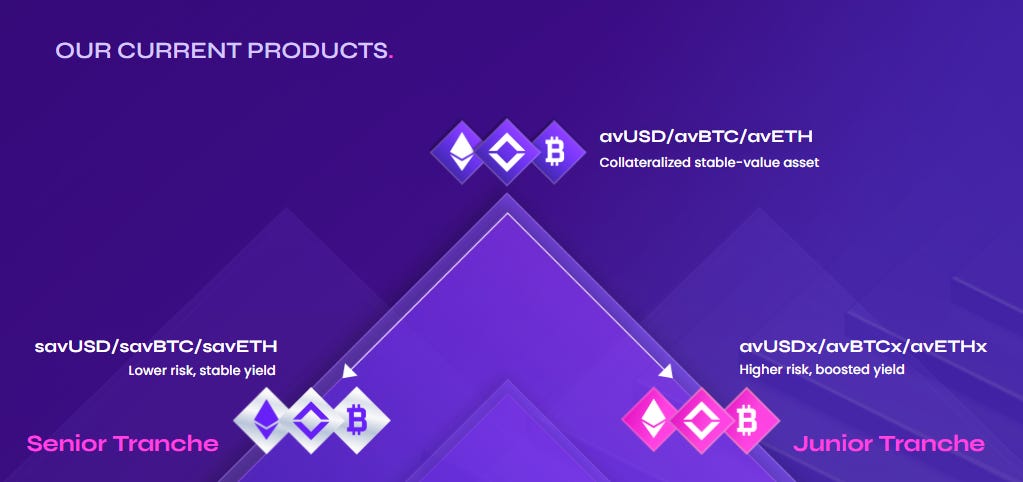

Token Infrastructure

Avant’s token system is the backbone of the protocol. This structure is similar to TradFi tranching, but wrapped in straightforward ERC-20 tokens you can move around Avalanche and plug into DeFi.

avAssets - base tokens, meaning they are backed 1:1 by the underlying assets ($USDC, $BTC, or $ETH). You mint these by depositing $USDC, $BTC.b, or $ETH into Avant. They’re fully backed and liquid, but by themselves they don’t earn yield.

savAssets - staked, senior tranche tokens that aim to deliver steadier, lower yield with extra protection. You stake your avAsset and receive a savAsset in return. Over time, each savAsset is redeemable for more of the base token as yield accrues. In a loss scenario, savAssets are the most protected because they sit at the top of the capital stack with multiple buffers underneath.

avAssetX - boosted, junior tranche tokens that take on more risk in exchange for higher upside. You “boost” your avAsset to get a higher-risk, higher-reward position. These tokens receive extra strategy yield, but they also absorb losses before senior holders if something breaks.

From the user’s perspective, you’re choosing which asset you want exposure to ($USDC, $BTC, $ETH) and how much risk you’re comfortable with (senior or junior tranche). All you do is hold and let the strategy work under the hood. Additionally, it was recently revealed that Avant plans to add $AVAX to the token infrastructure coming soon in Q1 2026.

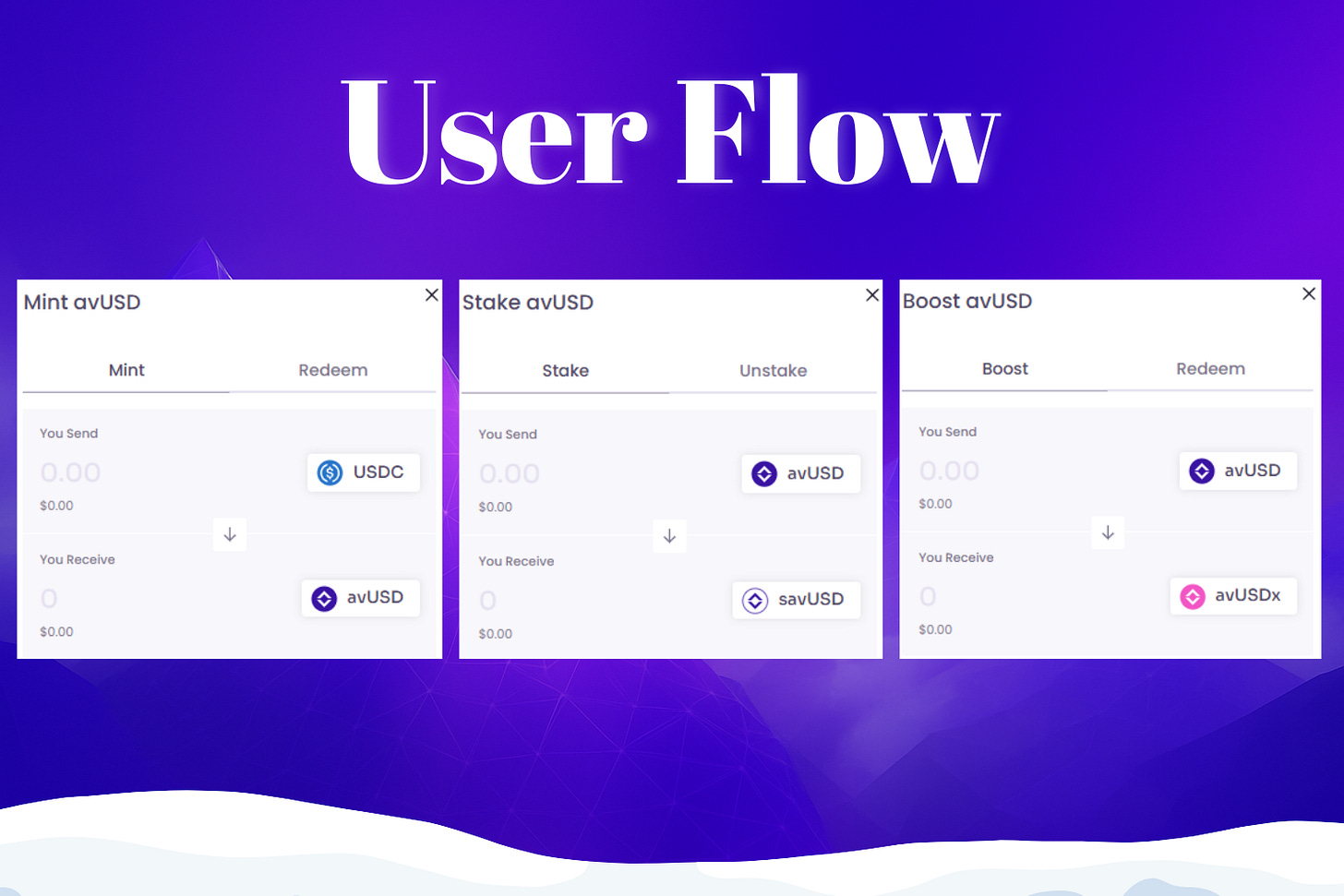

User Flow

You can think of interacting with Avant in three simple steps (all examples in $USDC for simplicity):

Mint

Convert your underlying asset into an avAsset. For example, deposit $USDC and get avUSD. The avAssets are your “base receipt” tokens and stay 1:1 with the underlying asset.

Stake

You stake avUSD and get savUSD. By doing this, you move into the safer, senior tranche yield position (savAssets). As Avant’s strategies generate yield, the amount of avUSD you can redeem per savUSD slowly increases. You’re essentially saying that you want steady, senior-tranche yield with multiple protection layers.

Boost

If you choose to boost avUSD and get avUSDx, you are opting into the higher-octane junior tranche yield position (avAssetX). avAssetX tokens get extra returns from separate, more aggressive DeFi strategies. However, the tradeoff is you’re first in line to eat losses if adverse market events occur.

The bottom line is that it’s the same capital pool, just sliced into different risk/reward layers so you can pick your lane.

How Avant Generates Yield

Avant focuses on market-neutral and yield-driven strategies that are designed to perform regardless of whether prices are pumping or chopping. The three main Avant strategy categories include:

Market-Neutral Basis & funding trades

Avant holds the real asset (like $BTC or $ETH) and then opens a short futures position of equal value. When futures markets pay funding fees or futures prices drift above spot prices, Avant collects the difference (the basis) and passes it along to you.

You’re not hoping for the asset to pump. You’re getting paid because two markets value the same thing slightly differently.

Liquidity and lending

Avant places funds into trusted DEX pools or lending markets. In return, it earns fees from traders and interest from borrowers.

Sometimes Avant also strikes direct liquidity deals with other projects. These are basically private agreements to provide capital for better rates. All positions are spread out so no single protocol creates too much risk.

Yield-token strategies

In some markets, you can trade a token’s future yield separately from the token itself. Avant taps into those markets by looking for moments when that future yield is mispriced, then running mostly market-neutral trades to earn extra return without betting on coin prices going up or down. In short, certain markets turn yield into something you can trade and Avant tries to harvest the inefficiencies.

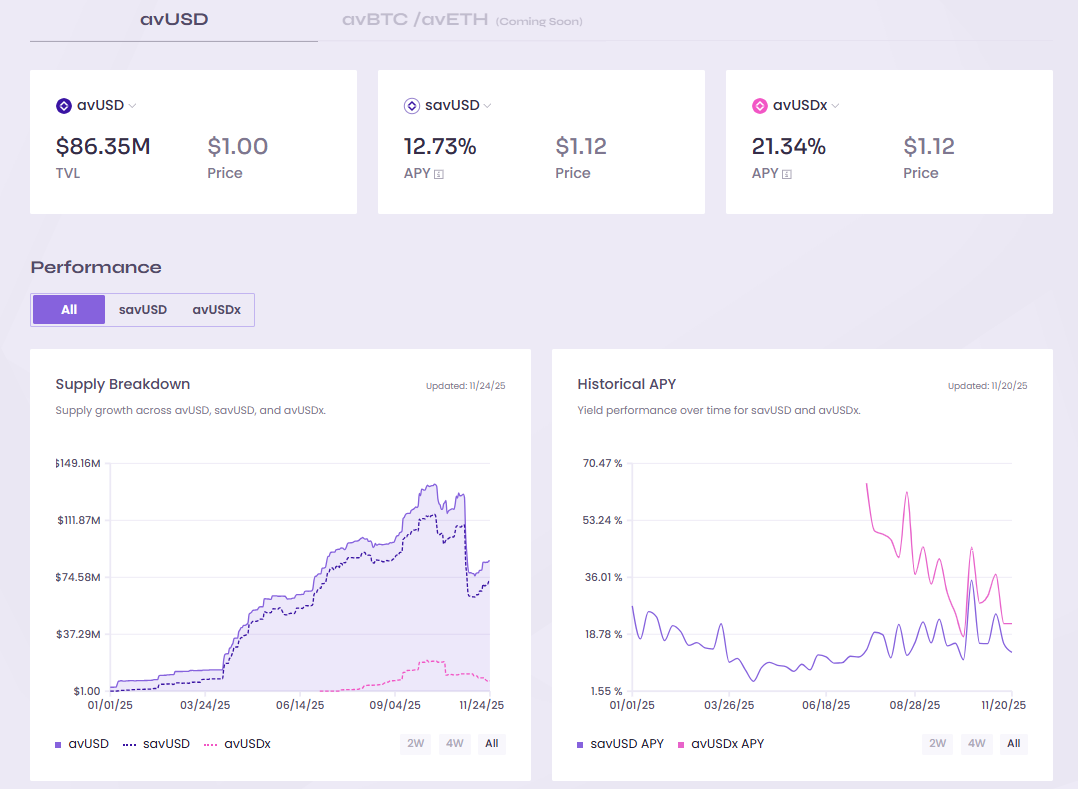

Every strategy is actively managed by strategists from Boreal Capital Management, with shifting allocations as conditions change. The end result is aggregated into APY that flows back to savAssets and avAssetX holders at different levels and frequencies (daily for senior, weekly for junior).

On top of that, Avant charges performance and redemption fees and routes part of those revenues into a Reserve Fund, which serves as the first line of defense in loss events before user capital is touched.

Not mentioned in this article is Avant’s extensive security solutions and its rewards program. You can learn about both in more detail by reading the Avant Protocol Documents. And as a heads up, it was recently released that Avant will have an airdrop with heavy weighting pointing to referrals.

If you want to learn more about complex DeFi strategies, you can check out the following article:

Also, don’t forget Intermediate Tactics and the Starter Playbook to brush up on foundational DeFi concepts.

Why Avant Matters for Avalanche Users

Avant offers several advantages for the Avalanche ecosystem, including:

Keeping liquidity on Avalanche by giving $USDC, $BTC.b, and $ETH holders a way to earn structured, risk-adjusted yield without moving funds off-chain or to centralized platforms.

Acting as a modular yield layer that other Avalanche apps can integrate, strengthening our overall DeFi stack.

Providing a smarter alternative to chasing unstable APRs by offering transparent, market-neutral strategies that don’t require quant expertise.

Scaling with the ecosystem, meaning more integrations lead to more liquidity flows, more utility for a future protocol token, and more on-chain activity across Avalanche.

Final Thoughts

Avant lets regular users tap into sophisticated yield strategies without needing a math degree from Harvard. Its three-token system gives you different ways to earn on $USDC, $BTC, and $ETH, all backed by layered risk protection and robust security measures.

Avant reminds us that our assets don’t have to sit around doing nothing, and you don’t have to gamble your way through DeFi just to find a decent return. As more wallets, apps, and products plug into Avant’s tokens, it has a real chance of swallowing a large chunk of Avalanche’s DeFi TVL.

Learn More Here

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.

More defi in avalanche, it’s just what we need

that's exactly what DeFi needs, accessible, transparent yield.