Blackhole: A Performance Update on One Of Avalanche’s Fastest-Growing DeFi Engine

Beyond the initial launch, this article details Blackhole's measurable impact, veNFT system, and strategy for long-term sustainability on Avalanche.

Introduction

The decentralized finance (DeFi) space has never been short of innovation, but every so often, a project emerges that forcefully redefines the standards for the entire ecosystem.

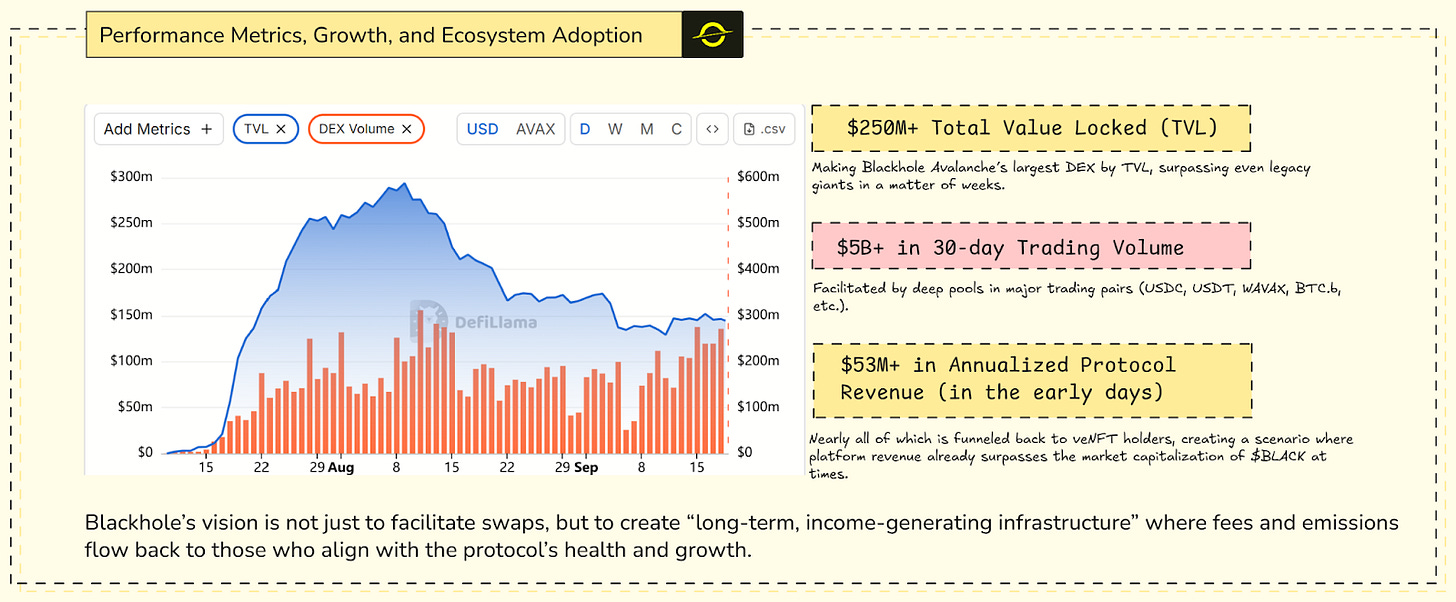

Launched in 2025 on Avalanche, Blackhole DEX became one of the network’s largest and fastest-growing exchange within weeks, setting new benchmarks in total value locked (TVL) and trading volume.

Unlike fleeting DeFi trends, Blackhole’s rise stems from a blend of advanced tokenomics, sharp design, and an unwavering commitment to returning power, yield, and ownership to its users.

From its innovative veNFT governance system to the introduction of Genesis Pools and a modular Automated Market Maker (AMM) suite, Blackhole resembles a DeFi “supernova,” drawing inspiration from iconic protocols like Curve, Velodrome, LFJ, and Uniswap v3 and yet constructing its own orbit with game-changing features and a user-centric philosophy.

Now, months after that explosive debut, the story has shifted from launch momentum to measurable performance.

This update revisits Blackhole’s evolution — the milestones, the data, and the turning points, while outlining what lies ahead as it enters a new chapter of emissions, governance, and ecosystem growth.

To understand how it got here, let’s break down the key features that shaped its rise, and how each one tackles long-standing problems in DeFi.

User-Centric Innovations and Key Features

Dual veNFT Governance

One of the most critical pain points in DeFi governance is the reliance on developers and teams, not just for strategic vision, but for protocol alignment and integrity.

Classic vote-escrow models (like Curve’s) require frequent relocking, while many projects struggle to keep the team from wielding disproportionate power or dumping tokens after vesting.

Blackhole addresses this with an innovative dual veNFT system:

Singularity veNFTs: Users lock $BLACK from 1 week to 4 years. Longer locks mean greater voting power and rewards. This flexibility empowers both short- and mid-term participants.

Supermassive veNFTs: Created by permanently burning $BLACK, granting perpetual governance power and boosted rewards.

All team and foundation tokens are locked and burned into Supermassive veNFTs - verifiable proof that no team tokens can ever be sold.

It’s a model of permanent alignment between builders and community.

Token Emissions and Governance Dynamics

Blackhole’s synchronized emissions-and-governance framework evolves with the protocol’s growth, balancing liquidity incentives with long-term sustainability.

ve(3,3) Governance Model

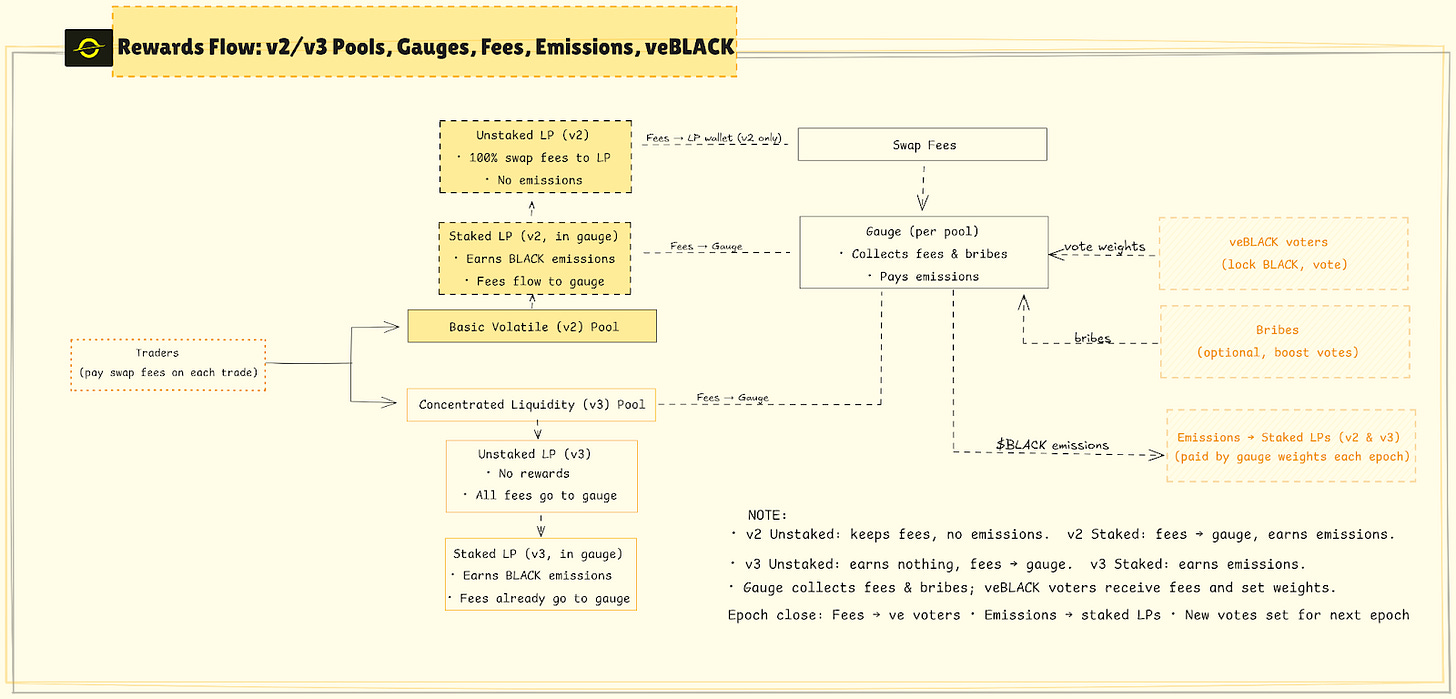

Building on its dual veNFT design, Blackhole applies an enhanced ve(3,3) system inspired by Solidly and Velodrome.

veNFT holders decide which pools receive emissions, steering rewards toward the most active pairs while earning both trading fees and external incentives.

Pools can offer bribes to attract votes, while voters earn both trading fees and external incentives, rewarding participation over passivity.

Emission Phases

The $BLACK emission schedule unfolds across four distinct phases, each engineered to guide the DEX through its growth cycle:

Phase 0 — Singularity (Epoch 0): 10M $BLACK seeded at launch to establish initial liquidity and governance.

Phase 1 — Event Horizon (Epochs 1–14): Emissions expand by 3% each epoch, fueling rapid liquidity growth. Blackhole is currently here in Epoch 12.

Phase 2 — Accretion Disk (Epochs 15–66): Emissions begin tapering by 1% per epoch to stabilize yields and curb inflation.

Phase 3 — Hawking Radiation (Epoch 67+): Emission rates become fully dynamic, decided by governance votes from Supermassive veNFTs, allowing the community to calibrate incentives based on market and protocol maturity.

Each epoch lasts seven days, during which new emissions are allocated to pools based on community voting. 5% of total emissions are reserved for the foundation to fund ongoing development and ecosystem growth.

An Adaptive Monetary System

Early epochs drive expansion, mid-epochs stabilize returns, and later epochs hand control to sustain protocol health through flexible monetary policy directly to the community.

As shown in the diagram below:

These mechanisms form the monetary core of Blackhole. What came next was applying that structure to real-world liquidity and fair token launches.

Genesis Pools: Fixing DeFi’s Liquidity Bootstrapping Challenge

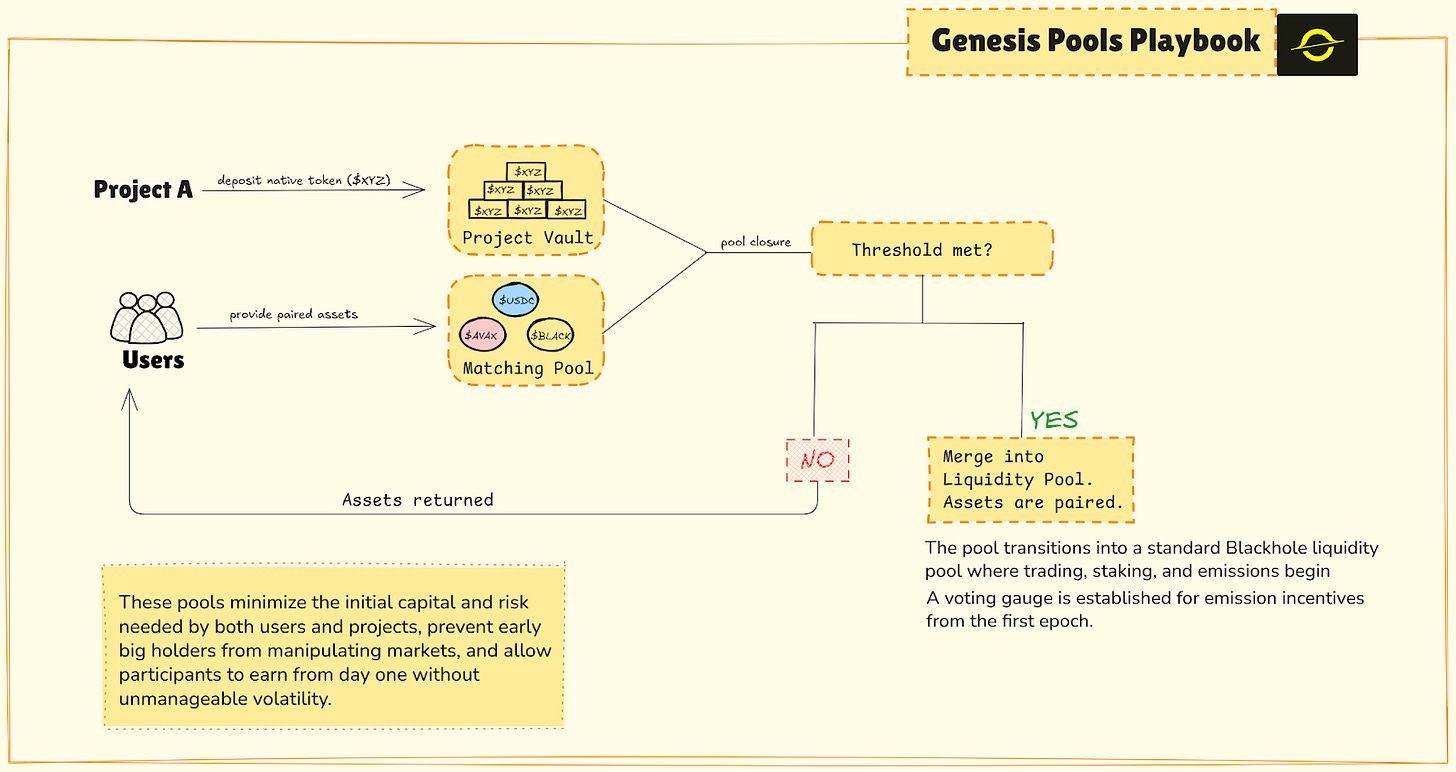

Launching new tokens in DeFi is notoriously risky as participants often face wild price swings, low initial liquidity, rug-pulls, or predatory tokenomics that reward only early insiders or teams.

Importantly, unsuccessful pools result in refunds for contributors—a level of safety and fairness that most IDOs and launchpads lack.

But is this innovation enough to ensure and sustain growth with respect to longevity?

After proving its launch model with Genesis Pools, Blackhole shifted focus toward long-term sustainability through recurring Escape Velocity campaigns.

Escape Velocity: The Push for Permanent Supply Reduction

Blackhole’s approach to sustainable expansion extends beyond liquidity mining.

Through recurring Escape Velocity campaigns, short-term rewards are transformed into long-term governance power via lock-and-burn cycles.

Across Seasons 1 and 2, users collectively burned over 30 million $BLACK, creating more than 34 million veBLACK and dramatically tightening supply.

Participation remained steady across more than 1,900 wallets, with Supermassive locks dominating both seasons, a proof that users are increasingly choosing permanent alignment.

Season 3 now introduces a sharper design: only Supermassive locks qualify for rebates, with a 6 million veBLACK pool distributed directly as NFTs.

This change marks a decisive shift from liquidity incentives to deflationary commitment, where every campaign removes supply and deepens community control.

A public Dune dashboard tracks real-time lock data, rebate rates, and wallet rankings, reinforcing transparency as a core governance principle.

But incentives are only one side of the equation, while the other is the trading infrastructure itself.

Alongside its tokenomics, Blackhole built a modular AMM suite designed for every kind of liquidity provider and trader.

Modular AMM Suite & Supercharged Pools

With the DeFi ecosystem growing increasingly diverse, Blackhole offers a modular AMM suite that caters to a wide range of liquidity and trading preferences:

UniV2-Style Pools: These use the classic constant product formula (x*y=k). In plain terms, it’s a straightforward system where liquidity providers deposit two tokens in equal value, and traders can swap between them. It works best for newer or highly volatile pairs because it’s simple, flexible, and easy to set up.

Concentrated Liquidity Pools (clAMM): Similar to Uniswap v3, these pools allow liquidity providers to focus their capital within specific price ranges, maximizing fee revenue while reducing slippage on major pairs.

Stablecoin-Optimized Pools: Designed for low-slippage swaps between pegged assets such as USDC/USDT or synthetics, delivering capital efficiency tailored to stable assets.

Plugin Architecture: Enables projects to deploy custom pool logic, fees, and incentives via Algebra Integral plugins, supporting tailored market-making strategies.

Expanding upon this, Supercharged Pools introduce a novel mechanism to boost liquidity provider (LP) yields and deepen ecosystem integration: LPs earn Blackhole emissions and swap fees plus partner rewards, stacking yields across ecosystems like Ethena.

Together, the modular AMM suite and Supercharged Pools provide Blackhole users with flexible, capital-efficient market-making options and the ability to maximize returns across interconnected DeFi ecosystems.

This innovation sets Blackhole apart by not only facilitating customizable trading environments but also by supercharging LP rewards through multi-layered incentive integration.

All of this is now visible in the data.

State of Epochs 1–13 (Data Snapshot)

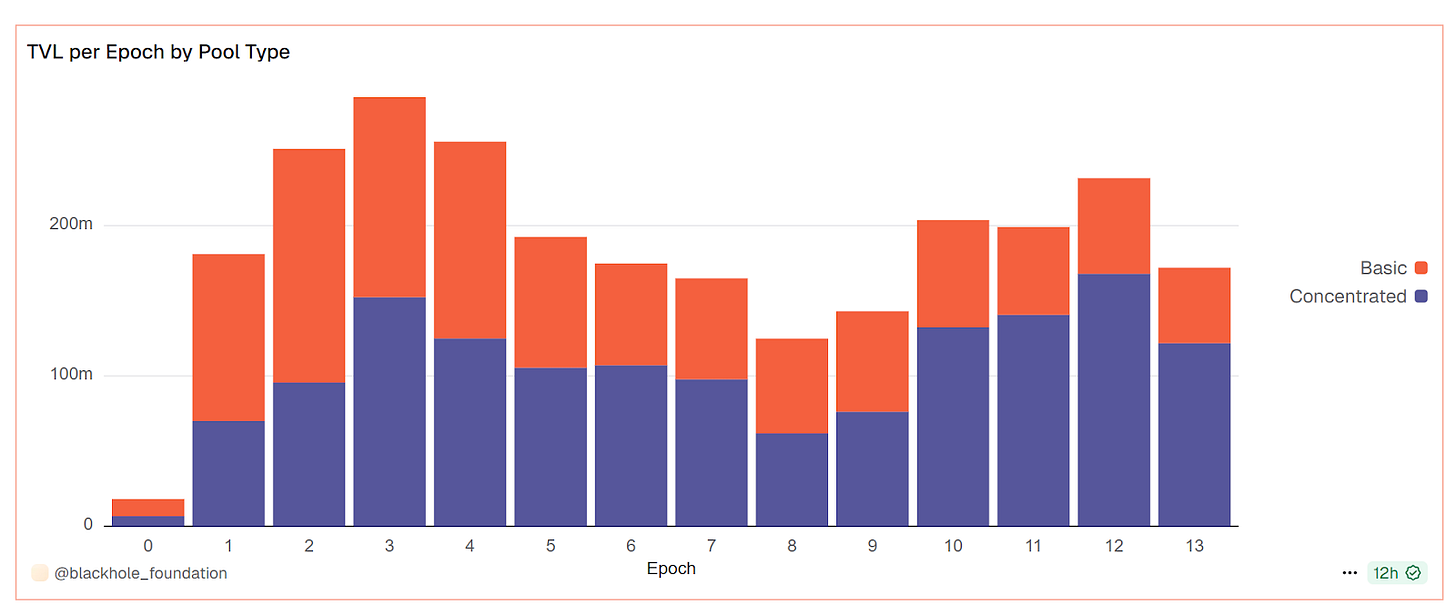

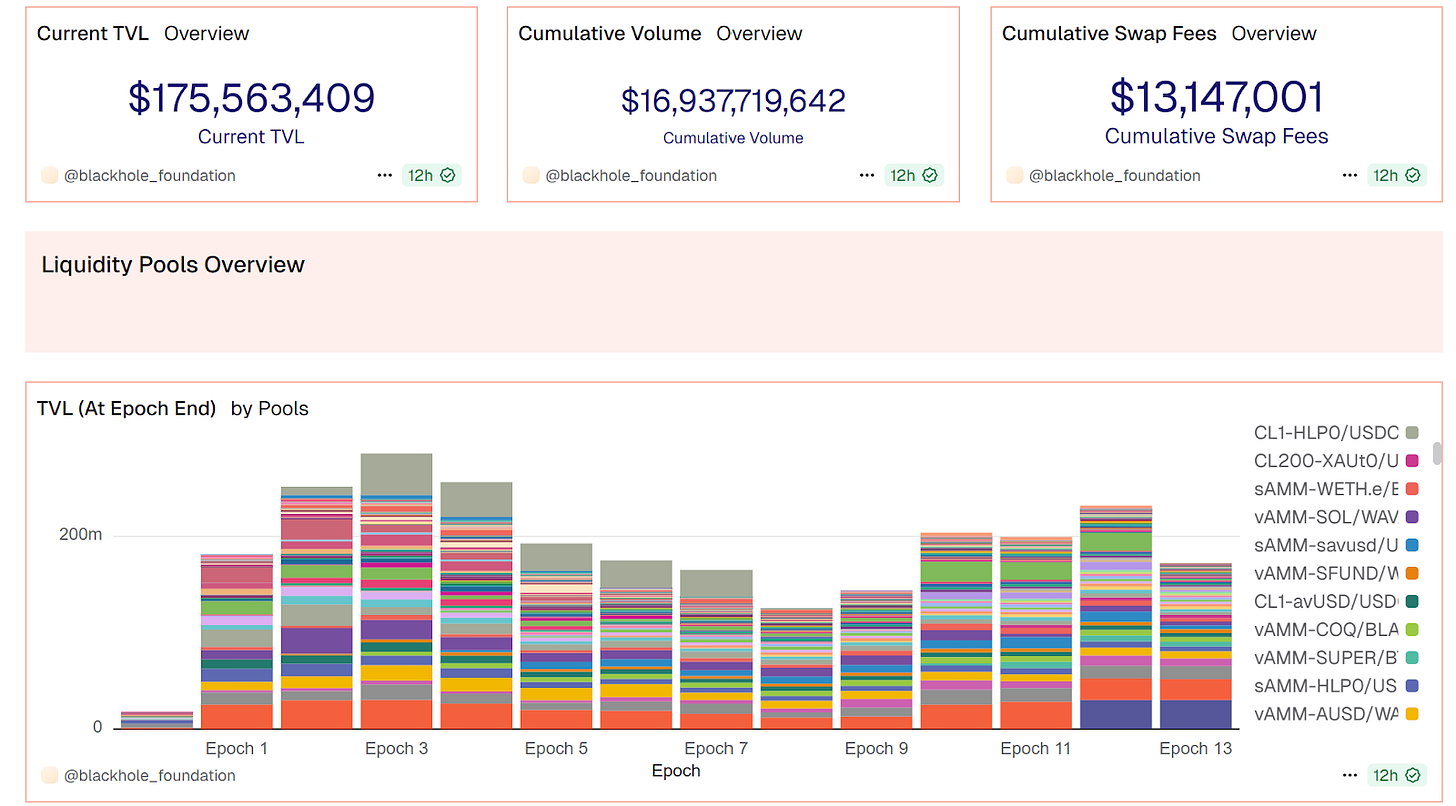

As of mid-Epoch 13, TVL stands near $175 million, showing resilience amid shifting markets.

Weekly trading volume averages $1 billion, and cumulative volume has surpassed $16.9 billion, generating over $13 million in fees.

Most of the flow remains anchored in concentrated liquidity pools, stablecoin pairs like USDC/BLACK and ecosystem staples such as WAVAX/USDC, with gaming tokens adding a growing pulse of volatility.

On the tokenomics front, roughly 14.685M $BLACK were distributed to liquidity providers under the ongoing Event Horizon phase, where emissions increase 3% each epoch to accelerate early-stage liquidity growth.

Daily fees remain strong at about $170K, though incentives still outweigh revenue, which is typical for a growth phase.

Notably, the rise of gaming-linked liquidity has been one of the defining trends of this phase.

$ARENA (The Arena App) joined with over $60K in incentives, adding PvP and prediction-market flavor to on-chain trading.

$KIGU (SuperChamps) entered with $70K+ in WAVAX rewards, bridging AI-driven gameplay and DeFi engagement.

$MOANI (Paradise Tycoon) deployed $60K to its WAVAX pool, targeting metaverse and builder-driven communities.

Together, these projects highlight Blackhole’s growing identity as the liquidity hub for Avalanche’s gaming economy.

Risks, Considerations, and Community Vigilance

No DeFi platform —however advanced— is without risks:

Market Volatility: Returns can fluctuate rapidly, especially for new tokens or pools tied to sector-specific launches.

Smart Contract Risk: Despite audits, bugs and edge-case exploits are always possible in highly composable systems.

Bribe/Inflation Spirals: Complex emission and bribe competitions may, if unchecked, create vote buying and short-term incentive traps, as seen in some veToken ecosystems.

Mercenary Capital: As yield hunters chase the best APY, TVL can be temporarily inflated, risking “TVL loss” if incentives change sharply.

To its credit, Blackhole’s transparency, community governance, and proactive security stance position it well to address these headwinds.

Still, informed participation and vigilance are always required, users are urged to educate themselves via Blackhole’s official documentation, community channels, and trusted analytics platforms before committing assets.

Conclusion

From a record-breaking launch to a maturing ecosystem, Blackhole has evolved from narrative to measurable impact.

Its blend of deflationary tokenomics, transparent governance, and modular infrastructure has turned it into one of Avalanche’s definitive liquidity engines.

As it enters the Accretion Disk phase, the focus shifts from expansion to refinement; sustaining growth, empowering governance, and deepening alignment between builders and users.

The Blackhole has opened, and with it, a new model for sustainable, user-owned decentralized finance.

Ready to explore Blackhole?

🔗 Launch the App: https://blackhole.xyz

📚 Read the Docs: https://docs.blackhole.xyz

💬 Join the Community - https://discord.com/invite/blackholedex

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.

This article comes at the perfect time. Truly amazing!