Blackhole Arrives on Avalanche with a Focus on Sustainable Liquidity

The testnet is live and early users are invited to explore a fresh approach to DeFi incentives, built around long-term alignment and community governance.

Blackhole DEX is a high-conviction project with serious ambitions, major Web3 personalities at the helm, and a fresh approach to on-chain liquidity. And now, its public testnet is live on Avalanche. Let’s dig in and see what Blackhole has to offer the Red Dorito chain.

What Is Blackhole?

It’s a new DEX purpose-built for sustainable liquidity. At its core, Blackhole wants to solve the problem of capital inefficiency inherent in traditional liquidity provisioning and bootstrapping.

Instead of relying on users to deposit assets and pray for trading fees, Blackhole offers a flywheel approach powered by innovative tokenomics and incentives that reward long-term alignment over short-term opportunistic farming.

The protocol draws inspiration from established DeFi frameworks, including Curve, Aerodrome, and Uniswap. It integrates the best parts of these protocols into a system built for active governance and evolving rewards. At a time when many DEXs are losing momentum, Blackhole feels like a calculated leap forward.

The Founders: Ellio Trades and Alex Becker

Two of the biggest voices in Web3 are backing this project: Ellio Trades and Alex Becker.

Ellio has long been a vocal supporter of decentralized platforms and a founder of multiple crypto-native startups. He brings strong experience building communities and products in the NFT and gaming space. You’ve probably heard of Superverse, a major gaming and community-building platform.

Becker is known for his hilarious takes on crypto and business, and offers a unique perspective on market psychology and retail adoption. One of his best-known projects is Neo Tokyo, a platform for connecting web3 gaming builders and investors.

Together, the two bring a rare mix of media presence, market knowledge, and builder credibility. Their involvement alone makes Blackhole worth watching, but the project stands on more than just big names.

The Avalanche Announcement: Public Testnet Goes Live

On May 28, Blackhole launched its public testnet on Avalanche. This is a major step toward mainnet deployment, giving users a first look at the DEX’s interface, token mechanics, and liquidity tools.

The testnet launch is an invitation for early users to stress test the mechanics and provide feedback ahead of the full rollout. Participants in the testnet can stake LP tokens, vote, test emissions mechanics, and participate in bug bounties and feedback contests. It's all designed to get the community aligned and engaged before Blackhole flips the switch on mainnet.

Key Elements of Blackhole’s Design

The $BLACK Token

The BLACK token powers the protocol in two big ways: governance and incentives. Token holders help decide where tokens are distributed and which projects should receive funding. At the same time, the token is used to reward users and projects who provide liquidity. This creates a feedback loop that rewards participation and supports the entire ecosystem.

$BLACK Token Emissions

$BLACK tokens will be distributed following a four-phase plan:

Phase 0: 10 million tokens distributed to various users and community members.

Phase 1: Emissions increase 3% each week to encourage early participation.

Phase 2: Emissions decrease 1% each week to keep inflation in check.

Phase 3: Emissions are adjusted based on community votes, allowing flexible economic tuning.

This setup strikes a balance between early growth and long-term sustainability, while allowing the community to have a say in how the system evolves.

Rebase Mechanics

Users who lock their tokens are rewarded with additional BLACK tokens each week. This reward, known as a "rebase," is essentially a periodic increase in your token balance based on your share of the total tokens that are locked. If you’re holding a Supermassive veNFT (which means you permanently locked (burned) your tokens), you get a 10% boost on your rebase rewards.

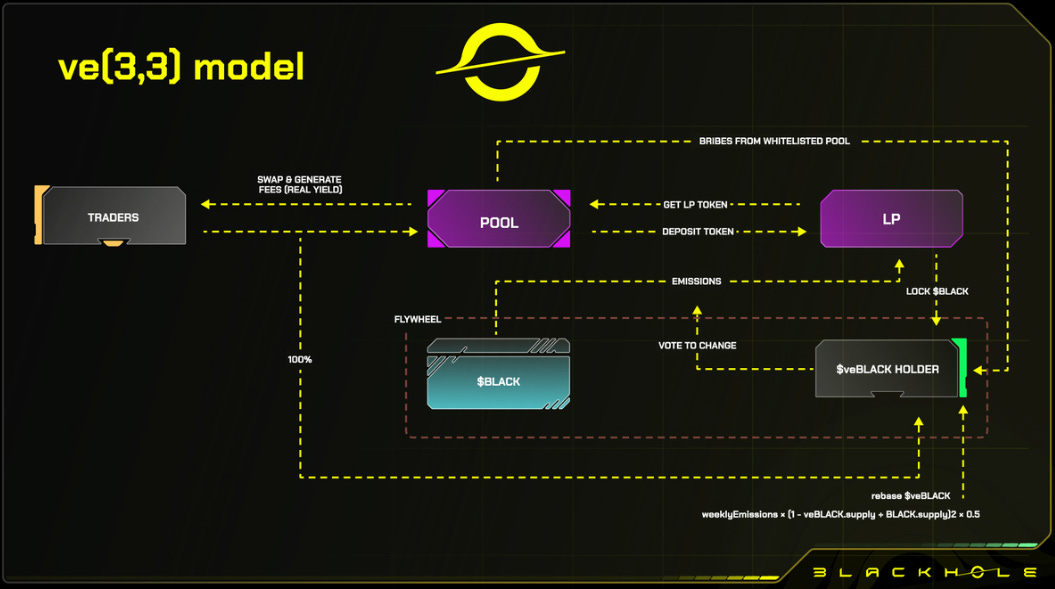

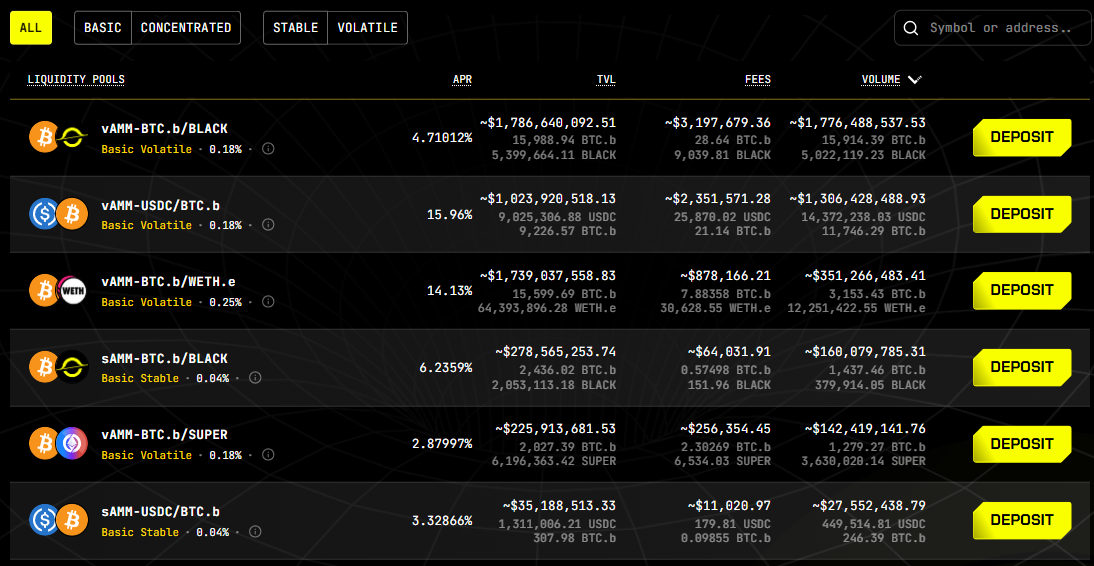

Rewards and Emissions Distribution

Each week, emissions are distributed to liquidity pools based on the number of votes each pool receives. Liquidity providers can stake their LP tokens to earn rewards based on their contribution and the time staked. Projects can influence voter behavior by offering extra incentives.

ve(3,3) Tokenomics

This model encourages users to lock tokens for voting power and rewards. It’s based on a game theory principle known as (3,3), which means that when all users cooperate by locking tokens and voting, the collective rewards are greater than if they acted alone. Everyone wins more by playing together. Blackhole improves this model with two kinds of voting and escrow (veNFTs):

Singularity veNFTs lock tokens for up to 4 years in various increments.

Supermassive veNFTs burn tokens forever for permanent voting power, rebase boosts, and extra voting strength. All Blackhole team tokens will be burned to mint these, eliminating any chance of sell pressure from unlocks and demonstrating the team’s commitment to the sustainability of the project.

Liquidity Pools & Automated Market Maker Models

vAMM (Variable AMMs): For volatile assets like BTC/USDC. Designed to handle big price swings.

sAMM (Stable AMMs): For stablecoins with tight pricing, e.g., USDC/USDT. Offers low slippage.

Concentrated Pools: LPs choose the price range for their capital. Designed for advanced users and market makers. 10% of fees go to LPs; 90% go to voters.

Locks and Voting

BLACK tokens can be locked to mint veBLACK (the governance NFTs). The longer the lock, the more voting power. Supermassive locks are permanent, never decay, and unlock extra benefits. Each week, veBLACK holders vote for which liquidity pools receive rewards. Those who vote get a share of trading fees, incentives, and bribes.

Auto Voting & Claiming Rewards

Voting happens in weekly cycles. You can vote manually or use the auto-vote feature to distribute your votes to top-performing pools. Rewards (trading fees, bribes, and rebase tokens) are available for claim after each cycle ends. There are minimum token lock amounts in order to use the auto-voting feature.

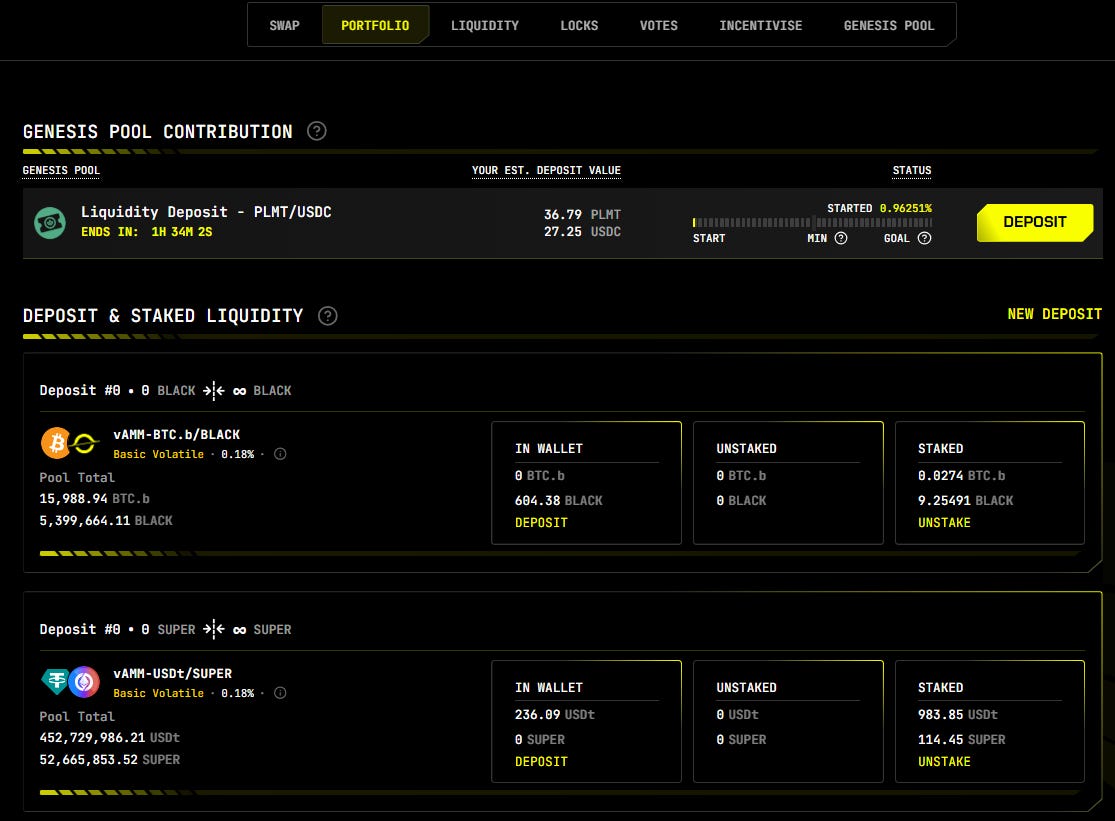

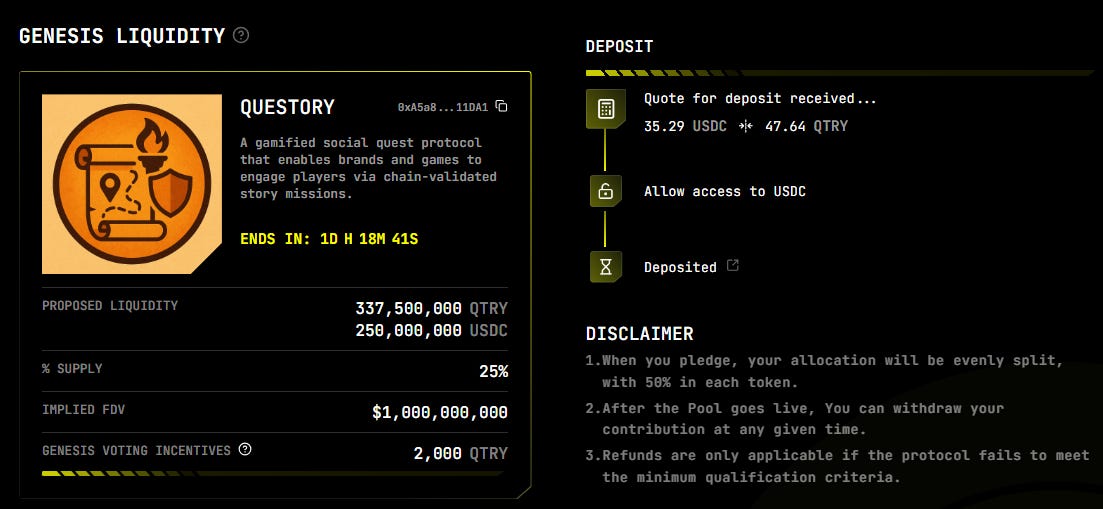

Genesis Pools

Genesis Pools offer a more efficient and transparent way for new crypto projects to raise liquidity compared to traditional launchpads. Instead of setting volatile token prices and relying on venture capital or centralized exchanges, Genesis Pools allow projects and community members to jointly provide paired assets to seed liquidity.

If the project meets certain criteria, a fully formed liquidity pool is formed, and contributors receive LP tokens representing their share, which are automatically staked for rewards. If minimum funding goals aren’t met, contributors get their funds back with no harm done.

Early Partnerships and Community Building

The founders have a deep history in Web3 gaming, so it’s no surprise that some of the early partnerships are gaming-related. And since Blackhole is operating on Avalanche, it just makes sense that you will likely see some of your favorite meme projects forming partnerships as well. Here are a few of the most recent developments:

Freshly launched memecoin $LAMBO, inspired by the return of Daniele Sesta to the Dorito chain, might make an appearance in some liquidity pools.

The team recently hinted that something is brewing with $KET.

A partnership of some type with Galaxy Lab and their flagship game called Haunted Space.

An official partnership with Spellborne Game to support their upcoming TGE for $BORNE.

Utilization of Pindora, an AI-based protocol for tracking social metrics and wallet interactions.

BloodLoop, a 5v5 tactical shooter game, will move its $BLS liquidity to Blackhole at launch. The game is set to debut June 23.

Player identity protocol XBorg will bring $XBG to Blackhole through a new partnership, further expanding the platform’s ecosystem reach.

Plus lots more to come.

Final Thoughts

Blackhole is more than another DEX chasing TVL. It’s a deliberate attempt to rewire how liquidity, governance, and incentives interact in DeFi. With industry veterans leading the charge, a utility-driven token design, and a growing list of early ecosystem partners, it feels more like a coordinated campaign than a casual launch.

But the real test starts now. As the public testnet plays out on Avalanche, Blackhole has a chance to prove that sustainable DeFi isn’t a contradiction in terms. If the protocol delivers on its flywheel mechanics and community-first promises, it could help reset expectations for what a modern DEX should look like.

Blackhole is a bet on participation, alignment, and long-term vision. And in a space that often moves too fast to build anything lasting, that alone makes Blackhole worth watching.

Dive in here: Main Website (Coming Soon) | Test dApp Site | X | Docs

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.

Boolish Blackhole

👀👀👀 Can't wait for the Blackhole!