From Private Equity to Treasuries: How Tokenization Is Rewiring Finance

Platforms like KKR, WisdomTree, and Citi are shaping on-chain finance and Avalanche’s infrastructure is helping them do it at scale.

Tokenization of real-world assets (RWA) is rapidly reshaping the financial landscape, bridging the gap between traditional finance and decentralized infrastructure. This article examines how Avalanche’s purpose-built architecture is enabling the next generation of institutional-grade RWA platforms, while also addressing the key challenges hindering mainstream adoption.

What Is Real-World Asset Tokenization?

Real-World Asset (RWA) tokenization is the process of converting tangible assets, such as real estate, commodities, equities, or art, into digital tokens on a blockchain. This transformation bridges the gap between physical value and digital infrastructure, allowing these assets to be securely represented, traded, and managed on decentralized networks. By embedding ownership rights and transaction rules into code, tokenization introduces automation, transparency, and efficiency into asset management, unlocking new levels of accessibility, liquidity, and global interoperability across financial markets.

Advantages of RWA tokenization

Tokenization of real-world assets (RWA) is revolutionizing finance by making traditionally illiquid and exclusive assets more accessible, efficient, and secure. By leveraging blockchain technology, tokenization unlocks new investment opportunities, enhances liquidity, and streamlines processes, paving the way for a more inclusive, global, and transparent financial ecosystem.

Fractional Ownership

In the past, investing in assets such as commercial real estate or private equity funds was largely limited to wealthy individuals or large institutions due to high minimum investment requirements. Tokenization changes that by breaking assets into smaller, more affordable pieces. Instead of needing millions to invest in real estate or funds, anyone can buy just a few tokens. This makes it easier for more people to access investment opportunities that were once out of reach.

Improved Liquidity

Tokenization can make historically illiquid assets, such as real estate, more straightforward to buy and sell. By breaking assets into smaller token units, fractional ownership becomes possible, allowing investors to trade even small stakes quickly on secondary markets. This fractionalization injects liquidity, as one doesn’t need to sell an entire building or loan – just trade the tokens representing a portion of it. Blockchains also enable a 24/7 global marketplace for these assets, meaning tokens can potentially be traded at any time, from anywhere, rather than only during limited market hours.

Faster Settlement & Efficiency

Blockchain speeds up settlement by replacing slow, paper-based processes with automation. On networks like Avalanche, transactions can finalize in under a second, compared to the days or weeks it takes in traditional finance. Smart contracts eliminate the need for intermediaries by automatically handling trades and updating ownership. This reduces delays, costs, and manual errors, making the whole system faster and more efficient.

Security & Privacy

Tokenization makes asset markets more transparent by recording every transaction on a tamper-proof blockchain. This creates an auditable history that investors and regulators can verify in real-time, reducing fraud. At the same time, institutions highly value privacy and confidentiality, especially regarding sensitive data. Blockchain enables permissioned access and advanced techniques, such as zero-knowledge proofs (ZKPs), to keep data private, hidden from the public, while still making it verifiable when needed. This balance between auditability and confidentiality is critical for institutional adoption.

Global Market Access

Tokenization allows assets to reach a global investor base, removing the need for costly cross-border intermediaries. For asset owners, this opens up new sources of capital. Investors can access multiple opportunities worldwide that were previously out of reach. With proper compliance, local markets become internationally accessible, boosting demand, liquidity, and valuations. It’s why many view tokenization as a trillion-dollar opportunity in the years to come.

Avalanche: The Future of Institutional Blockchain

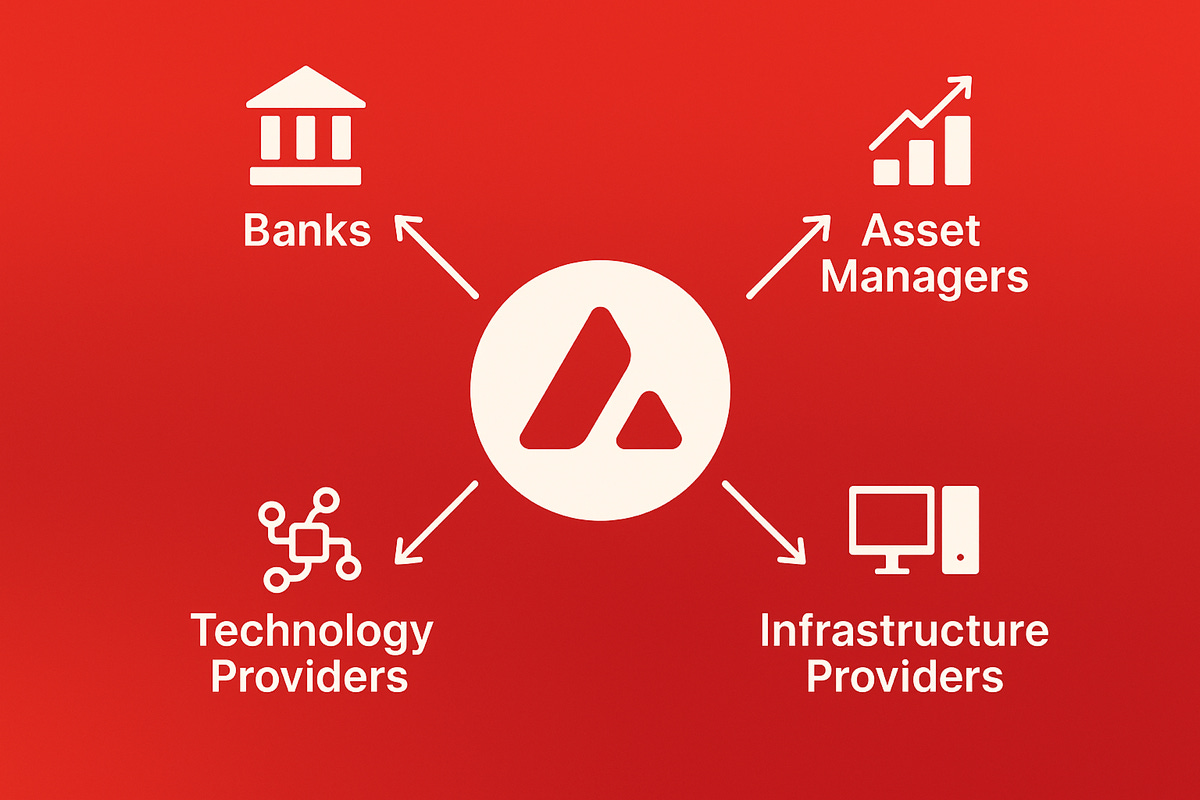

Avalanche offers a customizable blockchain architecture tailored for institutions, enabling scalable and compliant real-world asset tokenization.

L1 architecture

Avalanche’s core innovation is its L1 architecture, which allows institutions to launch their custom blockchain within the Avalanche ecosystem. Each L1 has its own validators, rules, and configurations. For example, a bank, real estate fund, or asset manager can create a dedicated blockchain that fits their compliance and business needs.

Native Interoperability

Avalanche enables seamless communication between L1 using its built-in messaging protocol, Avalanche Warp Messaging (AWM). AWM allows L1s to transfer data and assets directly between each other, eliminating the need for third-party bridges. This architecture avoids network silos and allows each L1 to serve a specific purpose while staying connected.

For RWAs, this is a game-changer. It means a tokenized asset created on a private institutional L1 can be securely transferred to a public L1 for liquidity, while still enforcing compliance rules. Institutions can operate in isolated, permissioned environments and still interact with DeFi platforms, other L1s, or marketplaces when needed.

Permissioned and Permissionless Flexibility

Avalanche’s L1 architecture allows institutions to choose between permissioned networks with pre-approved validators for compliance and control, or permissionless networks open to all. This flexibility ensures each L1 can match the specific regulatory and operational needs of the project.

Built-in regulatory compliance

Avalanche was designed to offer tools that support built-in compliance with regulatory requirements. L1s can enforce KYC/AML checks and transaction restrictions at the protocol level. This enables RWA issuers to operate in regulated environments while utilizing decentralized infrastructure.

Fine-tuned permissions system

Institutions require precise control over who can access, validate, and interact with their blockchain infrastructure. Avalanche addresses this need by enabling fine-grained permissions through custom pre-compiles, allowing Layer 1 chains to define distinct roles for validators, developers, and users. This architecture empowers institutions to enforce advanced control over key network functions, such as who can deploy smart contracts, mint tokens, modify fee structures, or even execute transactions. This ensures both security and regulatory compliance in enterprise-grade deployments.

Flexible fee structures

Avalanche empowers L1 creators with the flexibility to define custom transaction fee structures, a key advantage for enterprises with unique economic models. Avalanche enables developers to fine-tune gas fees, offer subsidized transactions, or introduce native tokens for fee payments. This level of customization ensures the platform can seamlessly support both enterprise-grade infrastructure and retail-facing applications, making it an ideal foundation for scalable RWA tokenization.

Avalanche’s Institutional Adoption in RWA Tokenization

In addition to the institutional integrations highlighted in the article below, Avalanche continues gaining strong momentum in tokenizing real-world assets (RWA). The following initiatives further underscore Avalanche’s position as a leading blockchain infrastructure for institutional-grade RWA tokenization.

Real-World Assets on Avalanche and How They Are Changing Asset Ownership

In 2024, Avalanche strengthened its position as a top Layer-1 blockchain by forming key partnerships that helped drive adoption across multiple industries. These collaborations highlighted Avalanche's advanced technology and reinforced its commitment to delivering scalable and efficient solutions for real-world use cases.

Structured Finance Platforms

IntainMARKETS – Asset-Backed Securities Issuance: A regulated marketplace for asset-backed securities (ABS), bringing together issuers, trustees, and investors on an Avalanche L1. It automates the full ABS issuance lifecycle while maintaining compliance.

Citi x WisdomTree x Wellington – Private Equity Pilot: A proof-of-concept using Avalanche’s Evergreen Subnet to tokenize a private equity fund, enable distribution via WisdomTree, and use tokenized shares as DeFi-style lending collateral.

KKR & Securitize – Tokenized Healthcare Fund: KKR tokenized a portion of its $4B Health Care Strategic Growth Fund II on Avalanche, expanding private equity access to accredited investors via Securitize.

Tokenized Funds & Fixed Income

WisdomTree—Tokenized Treasury & Equity Funds: WisdomTree offers 13 SEC-registered tokenized funds via its Connect platform, enabling institutions to access money markets, equities, and fixed income directly on the blockchain.

Ondo Finance – Tokenized U.S. Treasuries (OUSG): Ondo provides 24/7 access to yield-bearing Treasury products, such as OUSG, through smart contracts. Initially on Ethereum, its model is ideal for Avalanche’s fast and low-cost infrastructure.

Alternative Assets & Venture Exposure

Republic Note – Tokenized VC Profit Sharing: A regulated, profit-sharing token that distributes stablecoin dividends from Republic’s venture portfolio. Built on an Avalanche Subnet for compliance and eventual trading via INX.

Challenges of RWA Tokenization

Regulatory Uncertainty & Compliance & Custody

Regulatory compliance is a significant challenge for RWA tokenization, as traditional financial assets are subject to stringent rules regarding investor eligibility, custody, and anti-money laundering (AML) regulations. These constraints limit accessibility and require complex infrastructure to enforce compliance on-chain.

Interoperability and Technical Standards

A major challenge in scaling real-world asset (RWA) tokenization is achieving seamless interoperability across blockchains. For institutional adoption, tokenized assets must move securely across networks without compromising compliance or regulatory integrity. Robust interoperability standards are essential to prevent asset silos, unlock cross-chain liquidity, and enable the frictionless transfer of value, laying the groundwork for a truly scalable, institutional-grade RWA infrastructure.

Liquidity Constraints & Valuation

Liquidity remains a major hurdle for RWA tokenization, as regulatory restrictions and legal complexity limit transferability and secondary market activity. Fragmented liquidity hampers investor access and price discovery, undermining the core promise of seamless and global asset accessibility.

Security and Technical Risks

Tokenization brings efficiency but also introduces security and technical risks that can threaten institutional trust. Smart contract bugs, misconfigured permissions, and reliance on off-chain providers create potential vulnerabilities. To scale safely, RWA platforms must enforce strong security practices, including contract audits, permission controls, and real-time risk monitoring.

Conclusion

RWA tokenization transforms the traditional finance market by making real-world assets more accessible, liquid, and transparent. Avalanche’s customizable L1s, compliance-ready infrastructure, and growing institutional adoption position it as a leading platform for this shift.

While challenges such as regulation, liquidity, and security persist, the momentum remains undeniable. Tokenization is here, and Avalanche is where institutions are building.

How long do you think it will take before we see large-scale tokenization of RWAs?