Real-World Assets on Avalanche and How They Are Changing Asset Ownership

From real estate to investment funds, more assets are moving on-chain, making markets more accessible and efficient. Avalanche is leading the way, bringing traditional finance to blockchain.

In 2024, Avalanche strengthened its position as a top Layer-1 blockchain by forming key partnerships that helped drive adoption across multiple industries. These collaborations highlighted Avalanche's advanced technology and reinforced its commitment to delivering scalable and efficient solutions for real-world use cases.

Before diving into these partnerships, let’s first understand Real-World Assets (RWAs) and why they matter.

What are Real-World Assets?

Real-world assets (RWAs) are physical assets like real estate, commodities, or financial instruments. In crypto, tokenization turns these assets into digital representations on a blockchain, making them easier to trade, more transparent, and accessible to more investors.

Example:

A $10 million commercial property is tokenized on a blockchain. Instead of needing millions to invest, buyers can purchase fractional ownership with as little as $1,000. Smart contracts handle rent distribution and ownership transfers; tokens can be bought and sold easily.

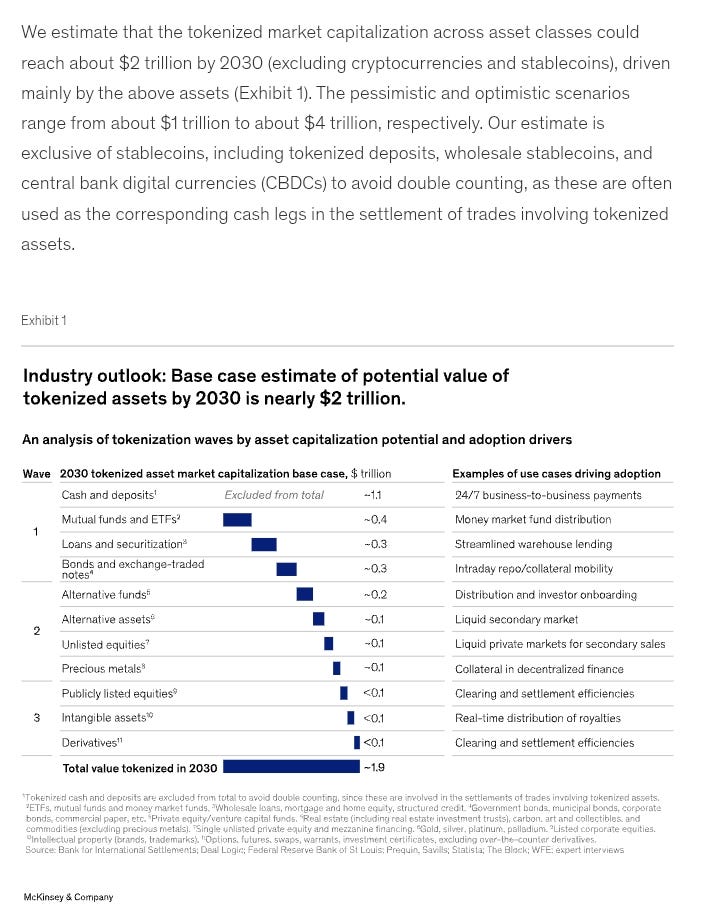

The tokenization of RWAs is rapidly growing. McKinsey & Company estimates that by 2030, the market could reach $2 trillion—or even $4 trillion in a high-growth scenario—driven by the adoption via mutual funds, bonds, loans, and alternative investments.

Real-World Assets & Avalanche.

In 2024, Avalanche took major steps to bridge the gap between blockchain and real-world applications by partnering with top companies and organizations. Here are some key collaborations that highlight its impact:

1. Digitizing Vehicle Titles with the California DMV

In a groundbreaking initiative, the California Department of Motor Vehicles (DMV) partnered with Oxhead Alpha to digitize 42 million car titles on the Avalanche blockchain. This aims to combat fraud and streamline the title transfer process, allowing over 39 million residents to access vehicle titles via a mobile app. By creating an immutable record of vehicle ownership, this project enhances transparency and reduces the need for in-person DMV visits.

The true impact of putting vehicle titles on-chain is outlined beautifully here with an example from the movie 2 Fast 2 Furious.

More details: Reuters

2. Revolutionizing Ticketing with Tixbase and PASSO

Tixbase entered an exclusive partnership with PASSO to transform the ticketing industry using Avalanche's blockchain technology. This collaboration focuses on integrating blockchain-verified tickets into PASSO's system, which manages ticketing for major events, including the Süper Lig.

This addresses secondary market regulation and introduces NFT-based digital tickets, enhancing security and authenticity in ticketing.

Details: Avalanche Blog

3. Launching Tokenized Money Market Fund with Franklin Templeton

Franklin Templeton, a global investment firm, launched its tokenized money market fund, BENJI, on the Avalanche network.

This development signifies a major step toward integrating traditional financial assets with blockchain technology, offering investors increased accessibility and efficiency in managing their investments.

Details: Avalanche Blog

4. Pioneering Asset Tokenization with Avalanche Vista

The Avalanche Foundation launched "Avalanche Vista," a $50 million initiative aimed at showcasing the value of tokenizing a wide range of asset classes, including equity, credit, real estate, and commodities.

This program underscores Avalanche's commitment to advancing asset tokenization and expanding the blockchain's applicability in various sectors.

Details: Avalanche Blog

Avalanche’s Role in the Future of RWAs

A major factor driving this adoption is Avalanche’s custom Layer 1 (L1) solutions, which allow businesses and institutions to create custom, scalable blockchain solutions tailored to their needs.

Unlike deploying on a public blockchain, a dedicated Layer 1 provides full control over network parameters, governance, and compliance measures—critical factors for government entities and highly regulated industries. Custom L1s enable organizations to implement specific security protocols, data privacy measures, and regulatory frameworks without being constrained by the broader rules and limitations of a shared network.

For a deeper look at why projects are choosing to build their own L1s—and the different use cases emerging across industries—check out our full breakdown: Building the Future: Standout Layer-1 Projects on Avalanche

RWAs in 2025 and Beyond

Avalanche is pushing the boundaries of blockchain adoption by bringing Real-World Assets (RWAs) onto its network. These partnerships have demonstrated how blockchain can solve real-world challenges—from digitizing vehicle titles and revolutionizing ticketing to launching tokenized investment funds and enhancing loyalty programs.

And this is just the beginning. Expect more innovation in 2025 as Avalanche redefines blockchain’s role in the global economy.

What RWAs are you most excited about? Let us know in the comments!

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.

Great article

IGreat article for those who want to understand how tokenization works. Avalanche makes it easy for companies and startups to scale infinitely.🫶🏼