Treehouse: The Decentralized Fixed-Income Layer On Avalanche

Treehouse is building the essential fixed-income foundation on Avalanche by creating reliable, decentralized interest rate benchmarks and yield-optimized staking products to drive DeFi maturity.

If DeFi wants to grow up, it needs two things: reliable interest rates and products that run on them. Treehouse is building exactly that - standardized on-chain rates and yield tokens that make understanding returns effortless. In this article, we’ll explore how Treehouse works, the products it’s building, why it matters to Avalanche users, and a new incentive program helping it grow across Avalanche.

Project Overview

Treehouse describes itself as a decentralized fixed-income layer.

In TradFi, fixed income refers to investments that pay regular interest over time, like government or corporate bonds. These assets rely on benchmark interest rates such as London Interbank Offered Rate (LIBOR) and Secured Overnight Financing Rate (SOFR), which act as the standard reference point for how much investors earn and what borrowers pay. When you see a bond, mortgage, or savings account rate, it’s almost always set in relation to that benchmark.

Treehouse takes that same foundation and rebuilds it for crypto. Instead of central banks or institutions setting the rates, Treehouse uses on-chain mechanisms to define them transparently and in real time. The goal is to make DeFi’s interest markets as predictable and reliable as traditional fixed income - without the middlemen.

Treehouse does this through two core pillars:

tAssets – these are yield-bearing tokens (such as tAVAX and tETH) that optimize returns by combining staking rewards with interest-rate arbitrage on lending markets. The aim is to balance fragmented on-chain lending and staking rates while delivering higher yields to holders.

DOR (Decentralized Offered Rates) – This is a decentralized rate-setting system that gathers input from several sources to produce reference (baseline) interest rates. dApps can use the data to price and settle rate-based products such as forward rate agreements (FRAs) and notes, which are debt-style instruments that pay a set return over time. All of this happens without relying on a single, centralized oracle.

Together, these two systems bring structure and transparency to DeFi’s interest-rate layer and lay the groundwork for a true on-chain fixed-income market. In other words, Treehouse’s DORs give DeFi developers the same kind of reliable pricing data that TradFi has used for decades. But now it’s fully decentralized and on-chain.

Let’s take a deeper look at Treehouse’s key offerings:

Products & Features Deep Dive

tAssets (tAVAX on Avalanche)

All tAssets, including tAVAX, are built on the same core principles: yield optimization, safety mechanisms, and efficiency.

Each tAsset is built on the liquid staking ecosystem of its native chain, then boosted by Treehouse’s interest rate arbitrage strategy, which then generates an arbitrage yield known as Market Efficiency Yield (MEY). In simple terms, users earn their regular staking rewards plus extra yield from rate differences across DeFi lending markets.

On Avalanche, tAVAX is backed by sAVAX from Benqi and currently runs a multi-strategy vault (Aave + Benqi Lending), targeting baseline staking yield + MEY. Users can mint/redeem and also deploy tAVAX across DeFi in protocols such as Silo.

Treehouse also set up a Balancer v3 liquidity pool for tAVAX/sAVAX with a boosted stable pool and “stable surge” protection.

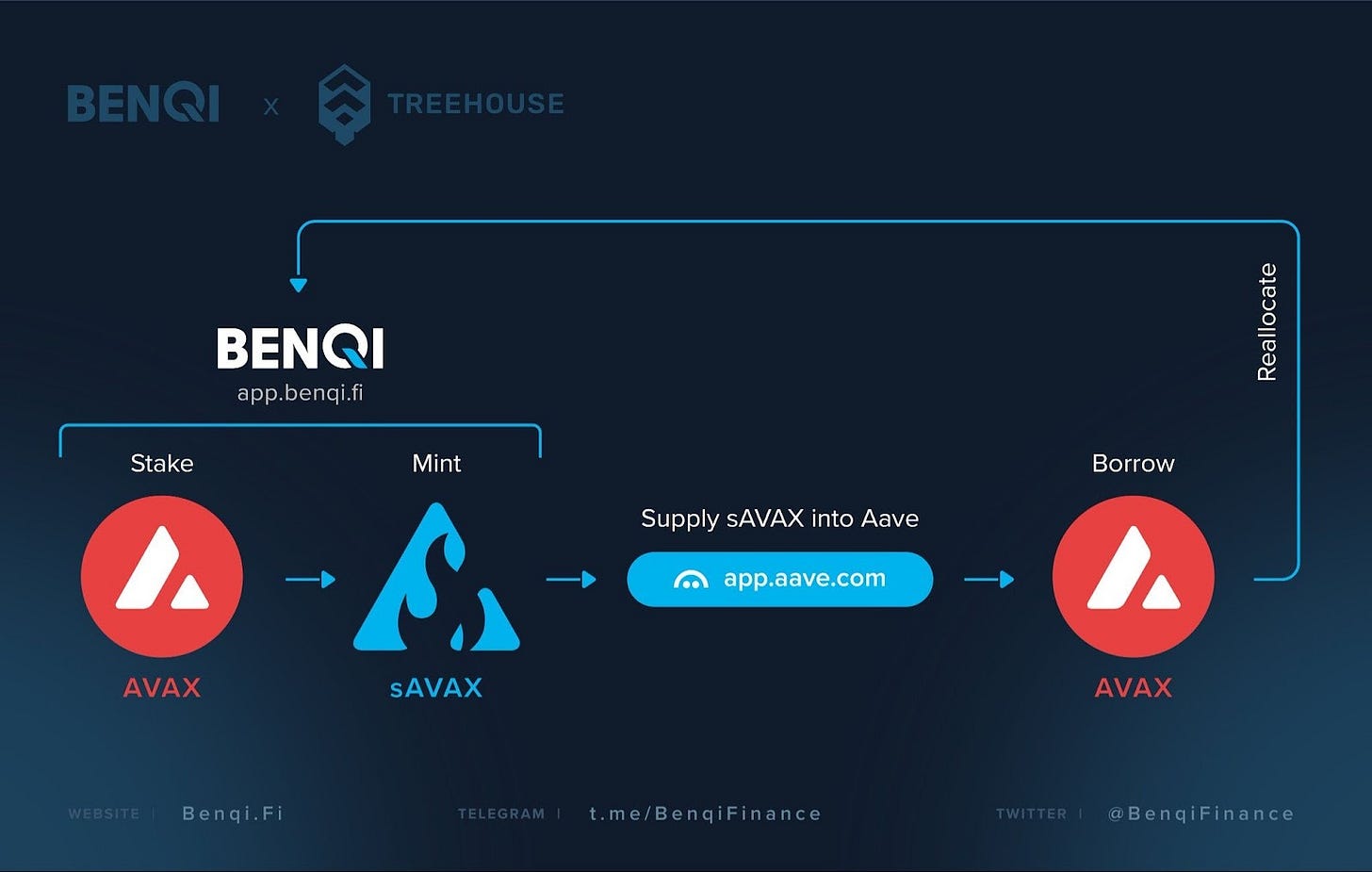

Here’s how it works in practice:

Deposit: When you deposit AVAX into Treehouse vaults, it’s automatically staked through Benqi to mint sAVAX.

Supply to Aave: That sAVAX is then supplied into Aave, where the strategy safely borrows additional AVAX.

Reallocate and Restake: The borrowed AVAX is restaked through Benqi to mint even more sAVAX at a safe loan-to-value ratio (LTV) of around ~80%, creating a tokenized single-loop strategy that compounds returns.

Daily Risk Management: The loop is managed daily to maintain healthy collateral ratios and prevent overexposure, keeping the strategy stable through market fluctuations.

Enhanced Yield: This approach boosts staking yields while balancing fragmented lending and staking rates, effectively tightening the gap between them over time.

DeFi Composability: Users can also deploy tAVAX on its own or paired with sAVAX into protocols like Balancer, Silo, and Folks Finance to earn additional fees.

Liquidity & Incentives Management: For users to easily redeem the underlying assets, Treehouse set up a Balancer V3 pool with an oracle-guided stableswap that continuously updates the tAVAX–sAVAX reference rate as tAVAX generates MEY over sAVAX. The Stable Surge hook further defends the peg under volatility. Meanwhile, the pool’s sAVAX is supplied to Aave to earn ACI incentives in addition to swap fees.

The result is an enhanced yield profile where holders can earn the base rewards of sAVAX, leveraged returns through Benqi and Aave, and swap fees from LP positions.

DOR (Decentralized Offered Rates)

Treehouse’s Decentralized Offered Rates (DOR) reimagine how interest rate benchmarks are created. In TradFi, benchmark rates are decided by a handful of institutions behind closed doors. The Federal Reserve oversees the publication of SOFR overnight rates, but there are no direct incentives for ensuring accurate and transparent reporting. DOR replaces that with a transparent, market-driven system that lives entirely on-chain.

It works through a network of five participant types: Operators, Panelists, Delegators, Referencers, and End Users. Each role plays an important part in gathering, verifying, and using interest rate data. For example, Panelists submit rate forecasts based on proprietary models and software, while Delegators stake their assets behind the Panelists they trust. The protocol then aggregates these inputs, filters outliers, and publishes a unified rate that reflects the true state of the market.

The result is a decentralized and democratized benchmark rate. This rate cannot be manipulated by any single entity, and anyone can verify and build upon it.

This open rate infrastructure allows developers to create fixed-income products knowing that the data behind them is accurate, transparent, and community-governed.

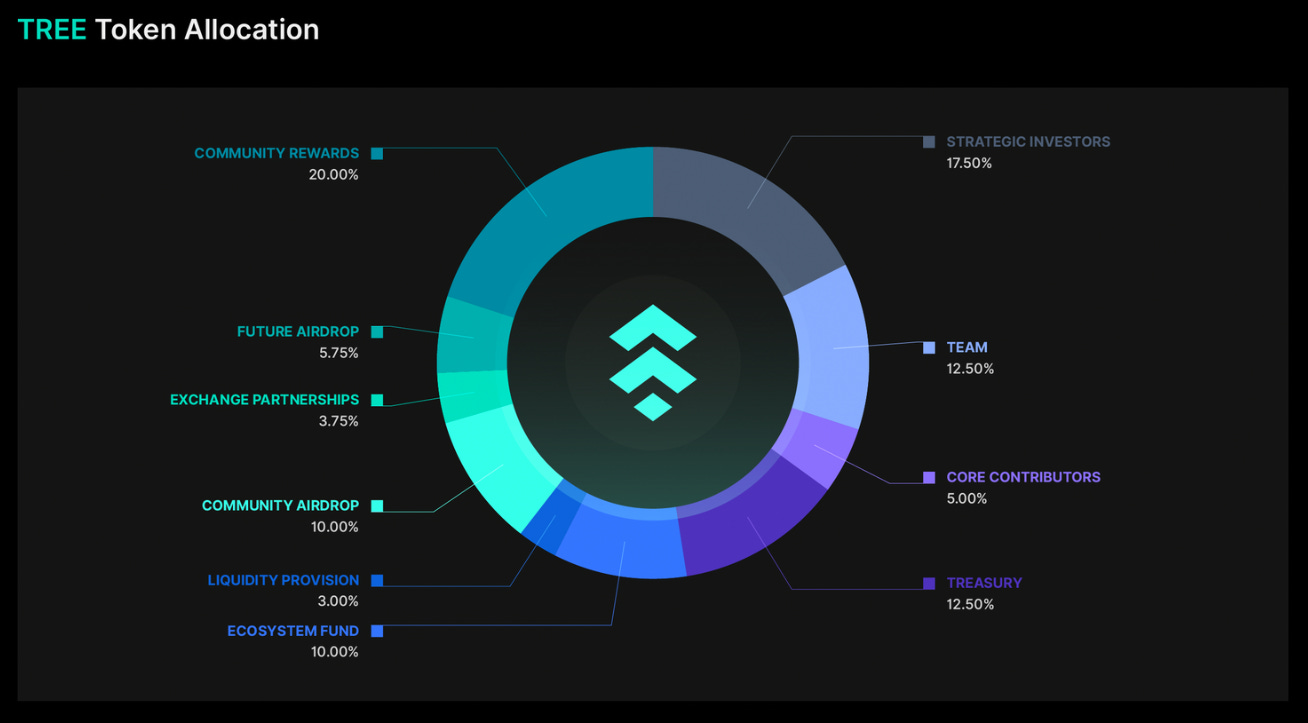

TREE Token

TREE is what keeps DORs running. It drives incentives, governance, and long-term alignment across the network. It powers every interaction in the ecosystem and rewards those who contribute to its accuracy and growth. Here’s how:

Querying Fees: Protocols and apps using DOR data pay fees in TREE, creating revenue for the network and its stakeholders.

Panelist Staking: Panelists stake TREE or tAssets to participate in rate-setting, ensuring skin-in-the-game and data integrity.

Consensus Payouts: Accurate rate predictions earn TREE rewards, motivating participants to stay active and honest.

Governance: TREE holders vote on Treehouse Improvement Plans (TIPs) for protocol upgrades, parameters, and ecosystem initiatives, keeping control decentralized.

DAO Grants: The DAO allocates TREE to fund partnerships and new products that expand adoption and innovation.

In short, TREE ties together data accuracy, decentralized governance, and ecosystem growth, all while ensuring everyone in the network has a stake in keeping the system honest.

How Treehouse Brings Value to Avalanche Users

Earn more, without the hassle: tAVAX finds the best way to earn yield by combining staking rewards with rate arbitrage so users can earn more than they would by just staking AVAX on its own.

More rewards and better liquidity: The tAVAX/sAVAX pool on Balancer v3 makes trading and providing liquidity smoother, while also offering extra incentives from partners like Aave. It’s designed to give both traders and liquidity providers more capital efficiency.

Reliable rates for builders: As Treehouse’s benchmark rates (DORs) become more widely used, Avalanche developers will have easy access to consistent, trusted interest rate data to build new financial tools. Things like fixed-rate loans and interest rate swaps won’t need to be created from scratch.

Current Incentive Programs

As part of its “GoNuts” Season 2 rewards program, Treehouse launched the Avalanche Ascent campaign to expand tAVAX adoption on Avalanche. Here are the highlights:

Avalanche Ascent Buff: 100% boost on all tAVAX holdings (no minimum).

Ski Goggles Badge: Permanent badge on first mint ≥ 2 tAVAX (counts toward future badge progression).

Balancer LP Buff: Supply tAVAX/sAVAX liquidity on Balancer v3 for an additional 100% boost that’s stackable to 200% with the Ascent Buff.

The campaign runs through November 2, 2025.

Final Thoughts

Crypto can’t unlock its full potential without credible rates and products priced off of them. Treehouse’s approach of using tAssets for yield + DORs for rate benchmarks is trying to make fixed income a native building block of Web3. On Avalanche, that means tAVAX as a better-than-staking core position for users, Balancer v3 pools as efficient liquidity for LPs, and a roadmap for builders to ship rate-centric products without centralized choke points. If that sounds like the boring plumbing of finance - good - because that’s exactly what resilient markets are built on.

Learn More Here:

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.