The State of RWA Tokenization and How Avalanche Solves the Biggest Industry Challenges

Fragmented liquidity and compliance barriers stall RWA growth. Learn how Avalanche’s multi-chain architecture delivers a secure, compliant, and scalable institutional solution.

Real-World Assets (RWAs) are digital tokens circulating on a blockchain that represent traditional financial or physical assets, such as private credit, real estate, gold bars, and fine art.

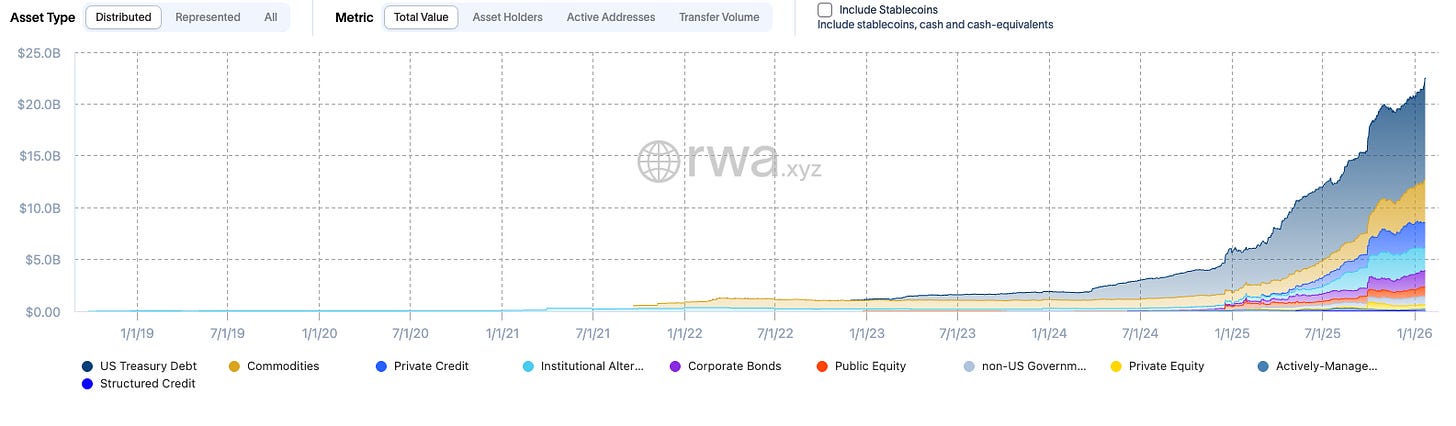

While tokenization has been discussed and tested for years, it has recently gained adoption, moving beyond niche pilots and starting to shape how certain parts of traditional finance operate.

As of late 2025, the tokenized RWA market (excluding stablecoins) has surpassed $36 billion. This is only the beginning, institutional projections from leaders like Boston Consulting Group suggest the market could balloon to $16 trillion by 2030.

However, despite the momentum, tokenization has yet to reach its full institutional scale. RWAs are growing inside disconnected ecosystems. Liquidity is fragmented, standards are inconsistent, and interoperability is the missing component for global scale.

In this article, we’ll explore the biggest challenges facing RWAs going into 2026 and how Avalanche’s architecture is specifically engineered to address key structural constraints in the market.

The Biggest Challenges in RWA Tokenization

Despite the momentum, moving trillions of dollars onto the blockchain isn’t as simple as minting a token. Several structural barriers currently prevent large-scale institutional commitment.

Compliance & Regulation

For institutions, tokenizing Real-World Assets (RWAs) is fundamentally a compliance problem, not a technology one, because while a token moves in seconds, the asset behind it remains subject to real-world laws, regulators, and enforcement. This challenge collapses into three core friction points:

First, fragmented jurisdictions equal fragmented liquidity, as the global nature of RWAs conflicts with localized regulation, causing cross-border transfers to trigger new rules and paperwork.

Second, tokens can’t provide for real ownership. A blockchain, in and of itself, cannot prove that the token is a representative of a legally valid claim to the underlying asset, and this implies that a strong bridge is needed between smart contracts and real legal rights in order for the token not to become just a “digital receipt”

Third, compliance must be embedded in the token, as off-chain compliance doesn’t scale; RWA rules must travel with the token and be automatically enforced at the protocol or smart contract level (e.g., KYC/AML eligibility and investor restrictions) to maintain control as assets move freely.

Liquidity Fragmentation

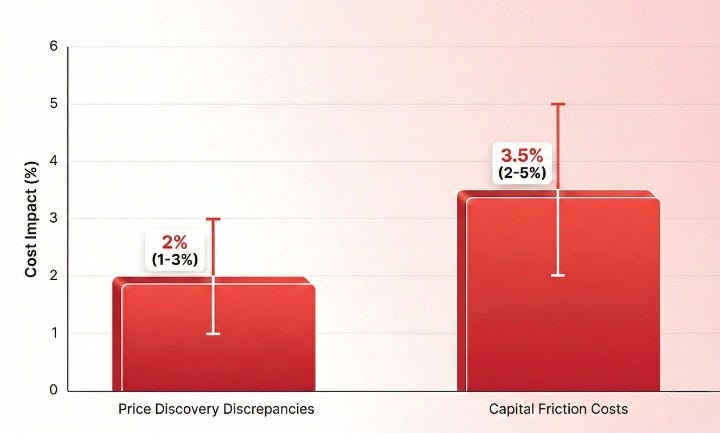

The RWA market today looks less like a single global marketplace and more like a disconnected archipelago. Tokenized assets are spread across dozens of blockchains, each with its own liquidity pools and local pricing. That fragmentation traps capital in isolated silos, and it shows up directly in the numbers, with 1-3% price spreads for economically identical RWA instruments across major chains.

In a healthy market, these gaps wouldn’t last long. Arbitrage desks would buy the cheaper version and sell the more expensive one until prices converge. But RWAs break that self-correcting loop because moving capital across chains is still too expensive and operationally heavy. The cross-chain capital reallocation can result in 2-5% losses per transaction, making many arbitrage trades uneconomical.

Settlement + Scalability

For institutions, settlement speed is table stakes. High-volume bond trading and multi-million-dollar rebalancing depend on fast, predictable finality. When network performance degrades during retail surges, that uncertainty becomes a real operational risk.

When a public blockchain becomes congested, whether from a viral NFT mint or a meme coin frenzy, settlement can suddenly face delays, unstable execution, and fees that turn a routine trade into an uneconomical one.

In fact, chain-level instability is a real systemic risk for institutions: assets can become temporarily untradeable or inaccessible, which institutions cannot tolerate.

Custody, Trust & Auditability

For institutions, tokenization only works if it meets bank-grade security and audit standards, the same expectations they apply to custody, settlement, and fund administration in TradFi. That means infrastructure backed by recognized certifications such as SOC2 (an independent audit of security, availability, and related controls) and ISO27001 (an international standard for operating an information security management system), plus strong operational controls that reduce the risk of failures, such as key compromise or manipulation.

But security alone isn’t enough. Institutions also need a single source of truth for asset data, a real-time, tamper-proof “golden record” that answers the only question that truly matters: what is this asset worth right now? This is why the market is shifting toward oracle-driven NAV infrastructure, where systems deliver live Net Asset Value data directly on-chain, as in Aave’s institutional RWA market (Horizon).

Interoperability

Interoperability is a critical but structurally weak point in the current RWA landscape. While the goal is a seamless global flow of tokenized assets, moving a tokenized bond or real estate share from one chain to another often requires “bridges.” These cross-chain mechanisms have historically been high-risk targets, responsible for billions in hacks, making them an unacceptable risk for institutions. Reliance on insecure third-party infrastructure for collateral movement prevents the establishment of a robust, unified global market and creates operational risks institutions simply cannot tolerate.

Privacy Requirements

Privacy Requirements represent a fundamental conflict between blockchain transparency and institutional necessity. Traditional banks cannot have every transaction detail, such as the borrowers’ identities or the size of a trade, visible to the entire public internet. This public ledger transparency conflicts with the stringent data protection, audit, and confidentiality mandates of the traditional financial sector, necessitating advanced privacy-preserving solutions such as zero-knowledge proofs or permissioned subnets to shield sensitive counterparty and trade information.

How Avalanche Solves the Biggest RWA Challenges

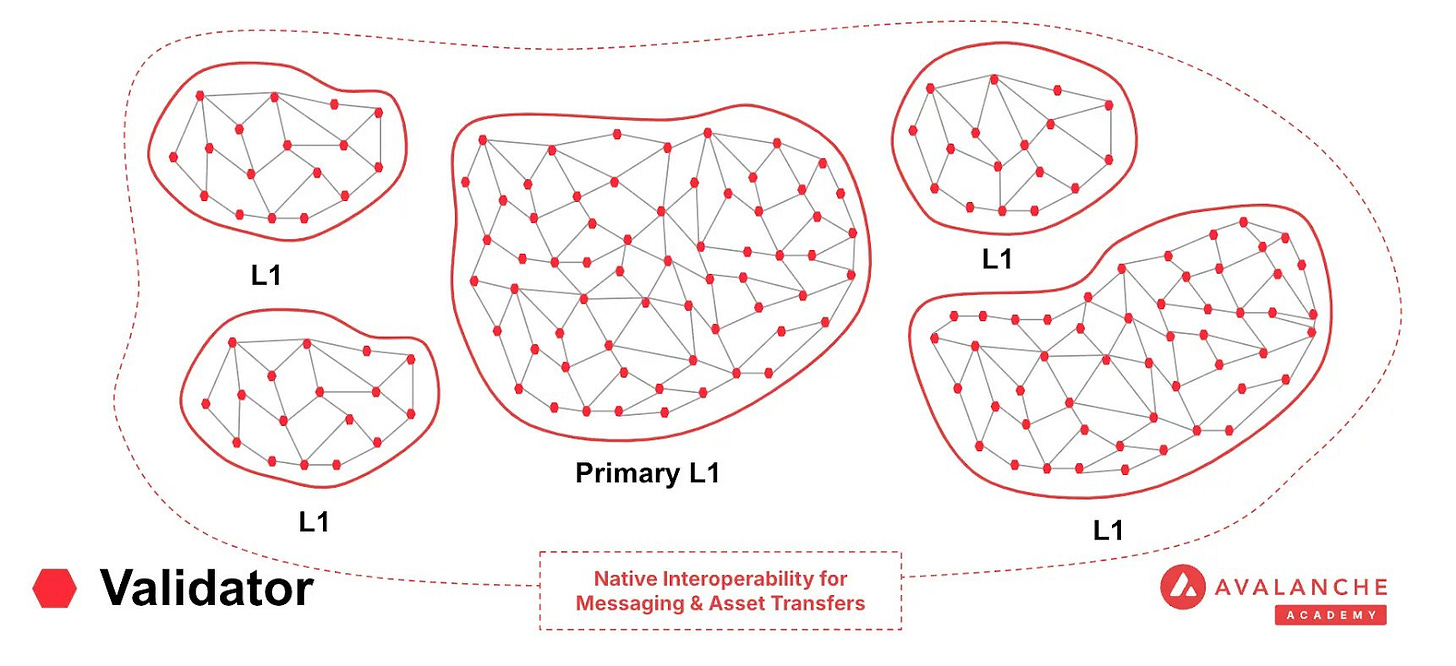

Avalanche is positioned to solve the structural problems in Real-World Asset (RWA) tokenization. Instead of forcing institutions onto a single chain, its multi-chain architecture is designed to handle the complexity of traditional finance, making fragmentation flexible and enabling native compliance and interoperability.

Avalanche leans into the reality that the future of finance is multi-chain, making multi-chain execution work securely and efficiently.

Avalanche L1s: Sovereign Chains for Institutional Control

The core model is centered on Avalanche L1s: sovereign, EVM-compatible blockchains designed for enterprise and institutional deployments. These controlled environments are specifically designed to allow for

Custom execution environments

Custom gas tokens (including stablecoin-like fee settlement)

Compliance-friendly controls via permissioning

This approach has been demonstrated in practice, for example, when KKR worked on a deal with Securitize to offer eligible investors tokenized exposure to its Health Care Strategic Growth Fund on an Avalanche L1, combining a controlled, compliant issuance environment with on-chain settlement and connectivity to broader liquidity.

Interchain Messaging (ICM): Secure Communication Between L1s

Interchain Messaging (ICM) is Avalanche’s application-layer protocol that enables secure operations between Avalanche L1s and the broader ecosystem (including the C-Chain liquidity hub), making cross-chain movement a native feature rather than an afterthought. This built-in approach supports vital functions like Cross-L1 settlement and Cross-L1 collateralization, and allows controlled environments to stay connected to open liquidity. The result is a powerful narrative: fragmentation becomes a flexibility when interoperability is built directly into the protocol.

Compliance: Permissioning at Every Layer

Avalanche L1s enable embedding regulatory constraints directly into the infrastructure, rather than relying solely on applications. This is crucial because institutions need controlled issuance and compliant execution without losing the ability to connect to the broader market.

Avalanche explicitly supports permissioning at three critical levels:

Validator Level

Smart Contract Level

Transaction Level

These features ensure regulatory adherence travels with the asset and is enforced by the protocol, thus significantly reducing operational risk for financial institutions.

Reducing Institutional Risk with a Pragmatic Design

Avalanche’s model supports a safer, structured path for institutions to adopt blockchain technology.

Controlled Environment: RWAs can reside within controlled Avalanche L1s.

Native Interoperability: Cross-chain operations are handled securely through native Interchain Messaging (ICM).

Optional Public Exposure: Exposure to public liquidity is optional and structured, allowing institutions to retain control.

This pragmatic design allows institutions to choose sovereignty where required while still connecting to the wider market when they seek liquidity.

Conclusion: A Pragmatic Path to Institutional Adoption

Real-World Asset tokenization is on a trajectory to become a multi-trillion-dollar market. Yet, its full institutional scale is currently hindered by structural compliance barriers, fragmented liquidity, and high-risk interoperability solutions. Avalanche’s architecture is engineered to address these core problems specifically. By providing sovereign, permissioned Avalanche L1s, institutions gain the bank-grade control and compliance they require, while native Interchain Messaging (ICM) securely connects these environments to global liquidity. This pragmatic approach doesn’t force a simple chain onto a complex financial world, it enables a multi-chain future to work securely and efficiently, turning fragmentation into a source of flexibility. If you’re a builder or an institution ready to structure the next generation of tokenized finance, start exploring the possibilities and resources at the Avalanche Builder Hub.

References:

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.