The BENQI Blueprint For Maximizing All Things $AVAX

BENQI is the essential suite of decentralized finance products on Avalanche, turning staked $AVAX into liquid, usable capital while enabling lending, borrowing, and network decentralization.

Imagine a place where you can stake $AVAX with the ability to use it instantly while you borrow against your own supplied assets as you rent a validator with minimal upfront cost.

These concepts aren’t science fiction - they’re what BENQI is doing on Avalanche as we speak. In this discussion, we’ll unpack how the protocol’s core products make this possible, and why every Avalanche user should care.

What is BENQI?

BENQI is a suite of DeFi products running natively on Avalanche. It’s currently ranked #2 by total value locked ($597.98m at the time of writing), and it’s become key infrastructure for liquidity, capital efficiency, and decentralization.

At a high level, BENQI does four jobs:

It turns staked $AVAX into liquid, usable capital through liquid staking (sAVAX).

It lets you lend and borrow assets without going through a bank.

It lowers the barrier to running Avalanche validators.

It distributes liquid staking rewards to validators through a community-driven Node Voting system.

If you’re new to DeFi, this might sound a bit abstract. So let’s strip it down, starting with liquid staking.

What is liquid staking?

Normally, when you stake $AVAX to help secure the Avalanche network, your $AVAX gets locked. You earn staking rewards, but you can’t use that capital anywhere else while it’s staked.

BENQI solves that problem with BENQI Liquid Staking. You deposit $AVAX, and you receive sAVAX, which is a liquid staking token. sAVAX represents your staked $AVAX plus the staking rewards it’s accruing. The key difference is that sAVAX is liquid, meaning you can move it, trade it, lend it, or use it in DeFi while you’re still effectively staked.

In other words, you earn staking yield and still get to use your capital.

Let’s take a deeper look at liquid staking and the key offerings from BENQI:

Main Products / Features

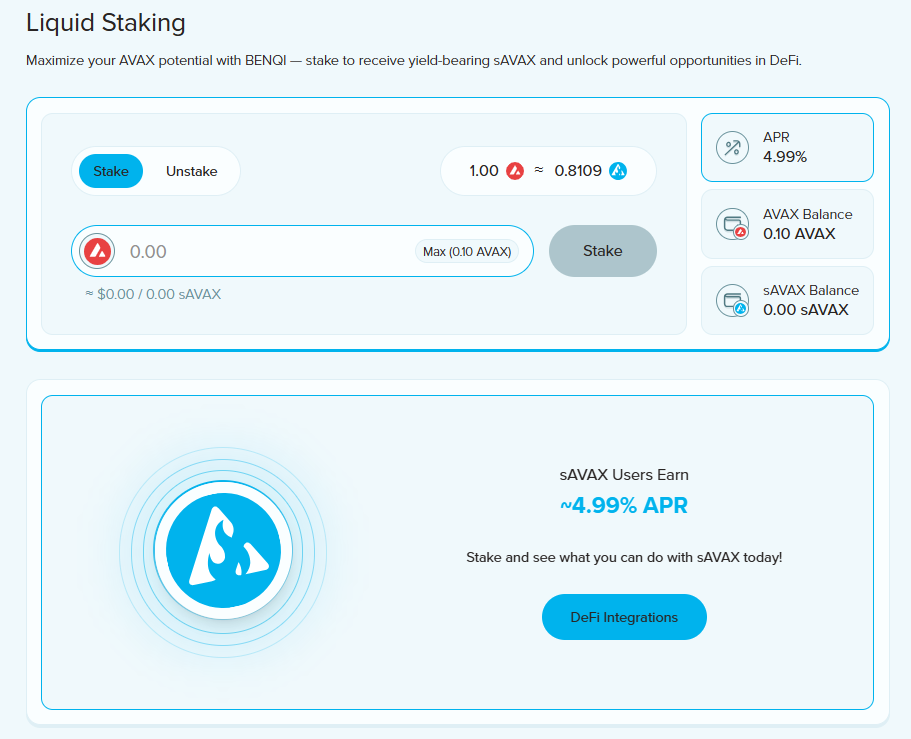

Liquid Staking (sAVAX)

BENQI’s liquid staking product is one of the most integrated assets in Avalanche DeFi. When you stake $AVAX through BENQI, you get sAVAX back. That token:

Tracks your share of staked $AVAX and the rewards it’s earning.

Increases in value over time as those rewards accrue.

Can be used across DeFi as collateral in lending markets, deposited into liquidity pools, or paired in yield strategies, instead of just sitting idle.

There are two big advantages:

No heavy validator setup

Normally, staking $AVAX involves interacting with the Avalanche P-Chain. BENQI abstracts that away. You can stake directly from Avalanche’s C-Chain, and BENQI handles the bridge and delegation to validators in the background.

Liquidity on exit

You can unstake and exit back to $AVAX. There’s a standard cooldown period, but you’re not permanently locked, and secondary markets give you same-day liquidity if you want out faster.

For Avalanche users, sAVAX is more than a tradable version of $AVAX. It’s become core collateral. Protocols across the ecosystem are now treating sAVAX as a high-quality, yield-bearing base currency.

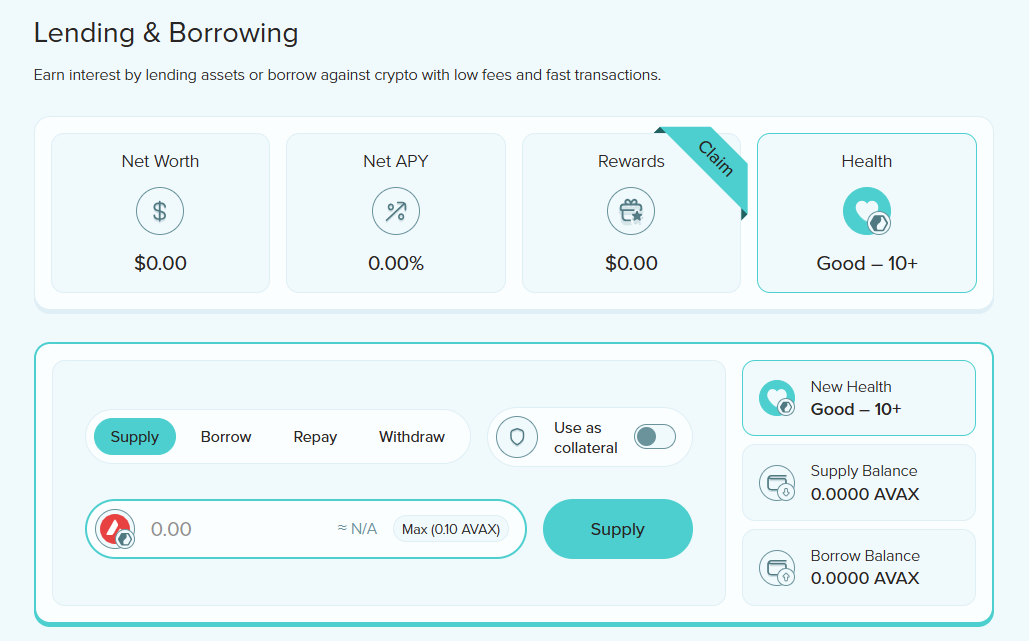

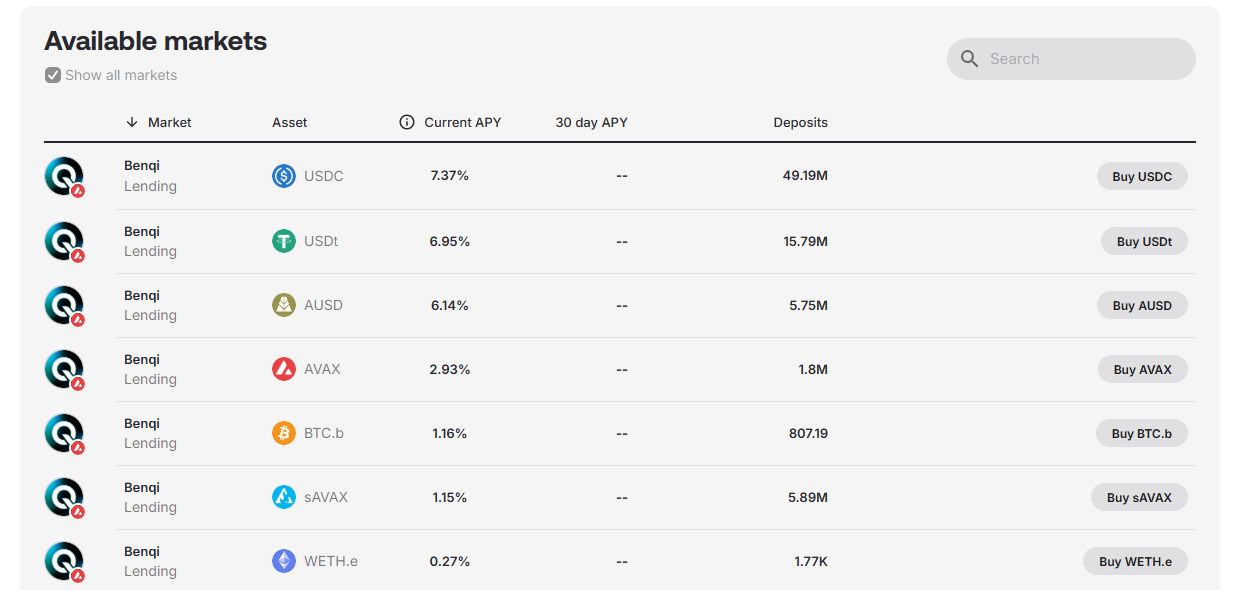

Lending and Borrowing (BENQI Markets)

BENQI Markets are a significant portion of the Avalanche DeFi lending and borrowing engine. They enable users to deposit assets like $AVAX, $USDC, $BTC.b, or $QI to earn interest while maintaining flexibility to borrow against those same assets. In short, your crypto works twice - once to earn, and once to borrow.

There are two types of lending markets:

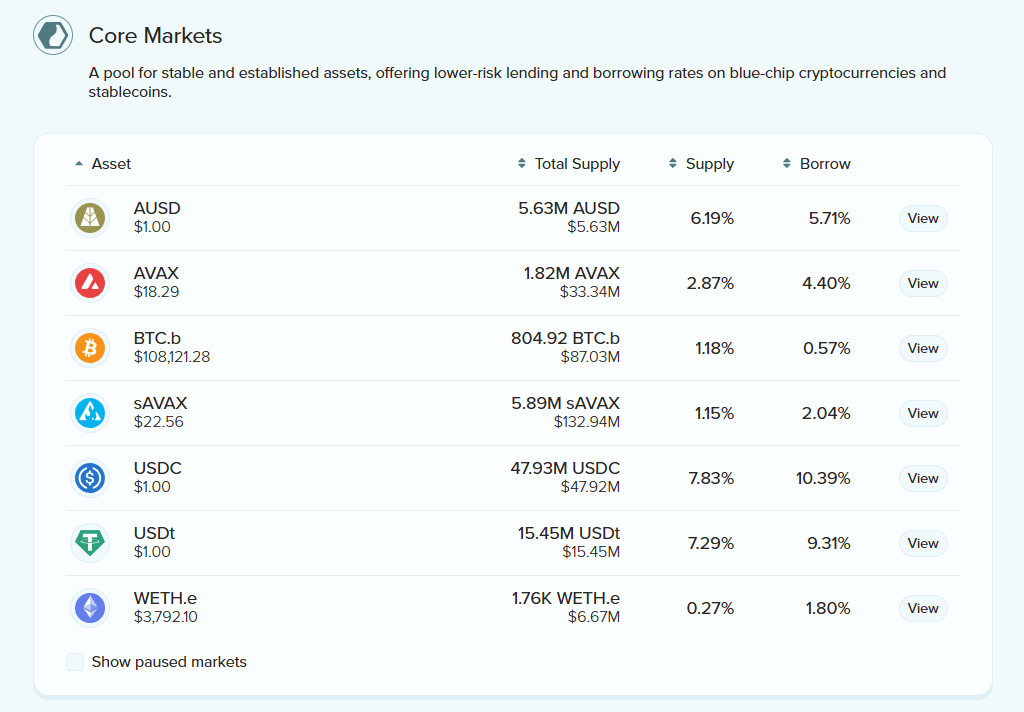

Core Markets

Designed for blue-chip, high-liquidity assets such as $AVAX and $USDC. These pools are stable, predictable, and form the backbone of BENQI’s lending system.

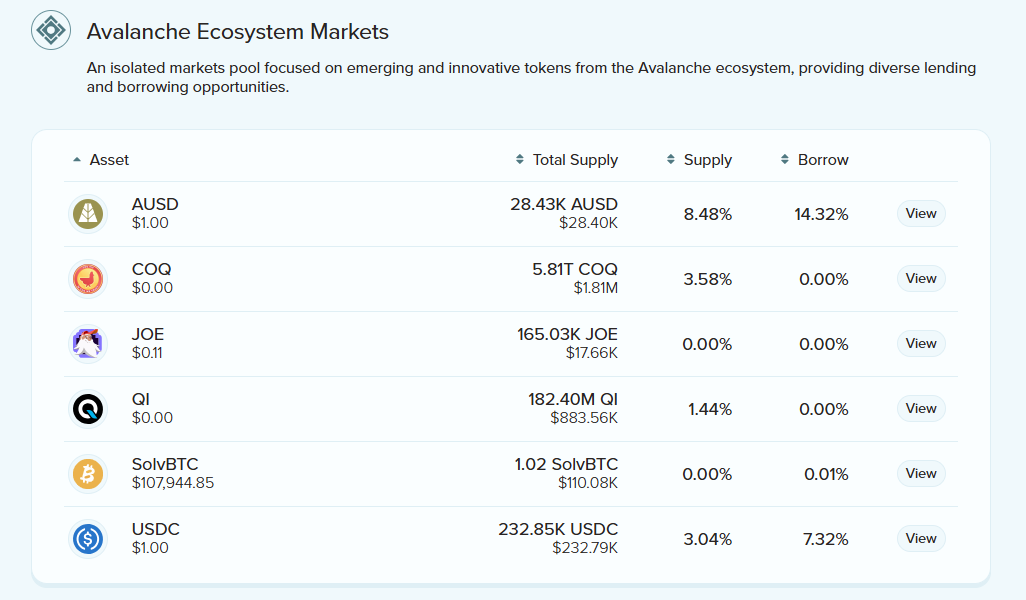

Avalanche Ecosystem Markets

Isolated pools that support riskier or Avalanche-native tokens and tokenized real-world assets (RWAs). Each operates independently, so volatility in one pool can’t spill over into others. Borrowing in these markets is restricted to $USDC in order to limit manipulation and protect liquidity.

From a user perspective, the process is simple: deposit an asset, earn yield, and if you want, use that same deposit as collateral to borrow another asset without selling what you already hold. That flexibility lets users stay long on $AVAX (or any other asset) while still unlocking liquidity for new opportunities.

BENQI’s borrowing model is overcollateralized, meaning you must deposit more value than you borrow. This structure keeps the system solvent while protecting lenders. For example, you could deposit $AVAX or $QI, borrow $USDC, and use that borrowed capital to buy another asset or enter a yield position. If both assets appreciate, you benefit from both sides of the trade. When you repay the loan, you still own your original collateral.

The system isn’t completely free from risk. If your collateral drops too far in value, it can be liquidated. BENQI mitigates this through transparent health metrics, color-coded dashboards, and adjustable collateral ratios that help users monitor and maintain safe positions before liquidation triggers.

In essence, BENQI turns passive holding into an active financial strategy, enabling Avalanche users to make their assets productive without ever giving up ownership.

Ignite

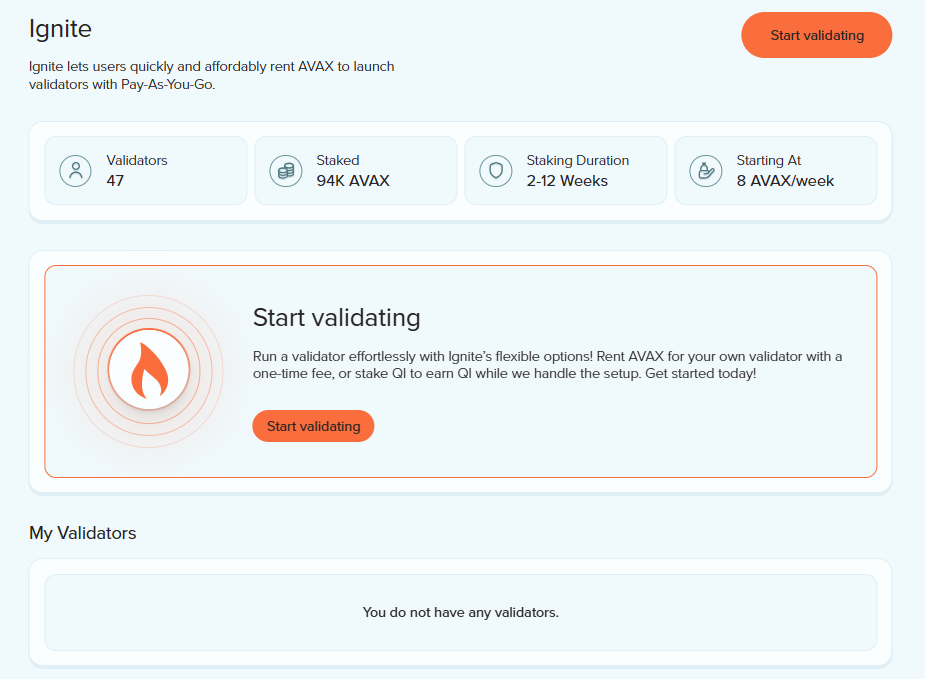

Running an Avalanche validator used to require a heavy $AVAX investment and lots of technical ability, but Ignite makes that a thing of the past.

Ignite is BENQI’s validator product and it gives you two paths to running a validator:

Pay-As-You-Go (PAYG): You effectively “rent” validator exposure by paying a weekly fee. BENQI supplies the full $AVAX stake needed to spin up a validator. This is good for short-term use cases like MEV searchers or teams testing infrastructure.

Stake: You stake $QI (and cover hosting/infra fees), and BENQI runs a validator on your behalf. You earn $QI rewards, and Avalanche gets another validator contributing to decentralization without you babysitting hardware.

Ignite does two important things for Avalanche: it lowers capital requirements for new validators, and it spreads staked tokens across more machines, which helps decentralize the network.

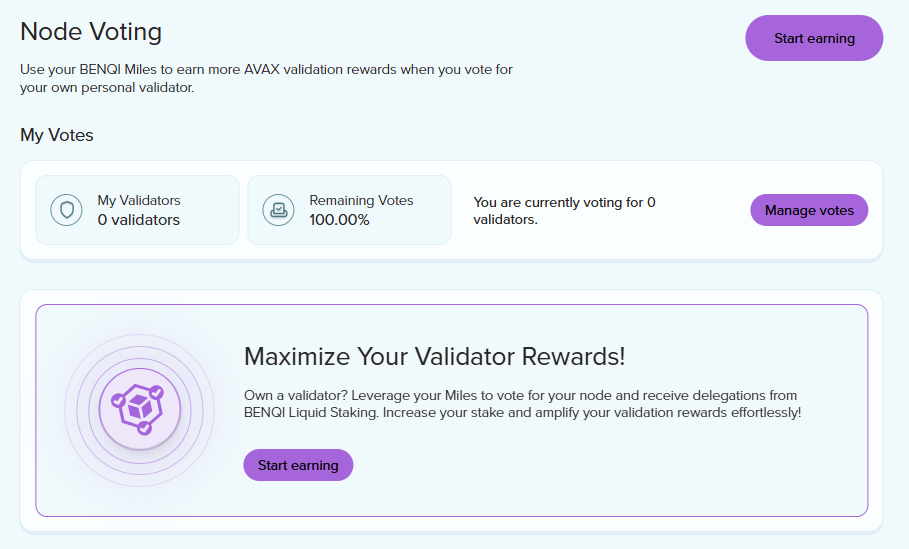

Node Voting

This is where BENQI leans into governance.

BENQI’s liquid staking pool holds a large amount of $AVAX. That $AVAX has to be delegated to validators across the network. Node Voting is how the protocol decides where the staked $AVAX goes.

The process works in two tracks:

Open Pool (65%): Random delegations go to validators that meet baseline criteria (stake, uptime, fee range) and have at least 6,000 $AVAX staked.

BENQI Miles Pool (35%): Delegations are steered by community vote. Holders of BENQI Miles, which are earned by staking $QI, can direct staked tokens toward specific validators. Validators with more Miles votes are more likely to receive delegations.

This matters because Avalanche security depends on validator diversity. BENQI is actively building a system where staked tokens are not just dumped on a handful of big operators but can be pushed toward smaller, reliable validators chosen by the community (including individual node operators).

Core Wallet Integration (Core Earn)

Avalanche’s Core wallet has introduced Core Earn, a native in-wallet yield interface. Clicking on the new “deposit” function in Core App reveals just how embedded BENQI is in Avalanche’s user experience. Core Earn integrates BENQI so users can deposit and earn yield directly from the wallet instead of hunting down the perfect DeFi protocol. This is a huge deal for onboarding because it reduces complexity and turns earning yield into a “normal wallet flow.”

$QI Token

$QI is the token that ties the BENQI ecosystem together.

You can stake $QI to earn BENQI Miles, which act as your governance weight in things like Node Voting.

$QI can be used for fee discounts in some cases, including validator setup under Ignite’s PAYG model.

It can also be used as collateral to earn yield.

Over time, BENQI’s stated direction is progressive decentralization. It wants to hand more control to $QI stakers, expand governance beyond validator delegation, and let the community influence risk parameters, supported assets, and fee structures. $QI holders aren’t just speculating, they’re slowly being handed the steering wheel.

Value to Avalanche Users

BENQI is good for Avalanche in multiple ways:

Capital efficiency. sAVAX turns staked $AVAX into productive collateral. You’re no longer forced to choose between securing the network and using assets in DeFi. BENQI allows you to do both.

Credit markets. BENQI Markets gives Avalanche borrowers and lenders a native place to source liquidity, which is critical to the longevity of any network.

Validator decentralization. Ignite and Node Voting lower the barrier to running validators and distribute staked tokens to a broader set of operators, which strengthens Avalanche’s security model.

Retail on-ramps. With Core Earn integrating BENQI yield directly into the Core Wallet, Avalanche users don’t need in-depth DeFi knowledge to access yield.

Final Thoughts

It’s hard to scale a network without reliable liquidity, distributed validation, and usable yield. BENQI is hitting all three at once.

It made staking liquid. It makes borrowing accessible. And it also makes running validators cheaper. On top of that, it’s now found its way into the wallet layer so the average Avalanche user can earn on their assets.

The next phase is ramped up governance. As BENQI hands off more control to $QI stakers and BENQI Miles holders, it will stop looking like a product run by a team and start looking like community-owned infrastructure.

Learn More Here

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.