Pangolin DEX 2025: The New Era of Avalanche’s Legacy AMM

How Pangolin evolved from an early Avalanche AMM into a modern, capital-efficient, multi-product exchange with Perpetual Futures and a fully redesigned V3 engine.

Pangolin is one of Avalanche’s earliest decentralized exchanges, having launched during the explosive AMM boom of 2021. While many DEXs faded after incentive programs dried up, Pangolin survived multiple market cycles and continued generating real, consistent on-chain activity.

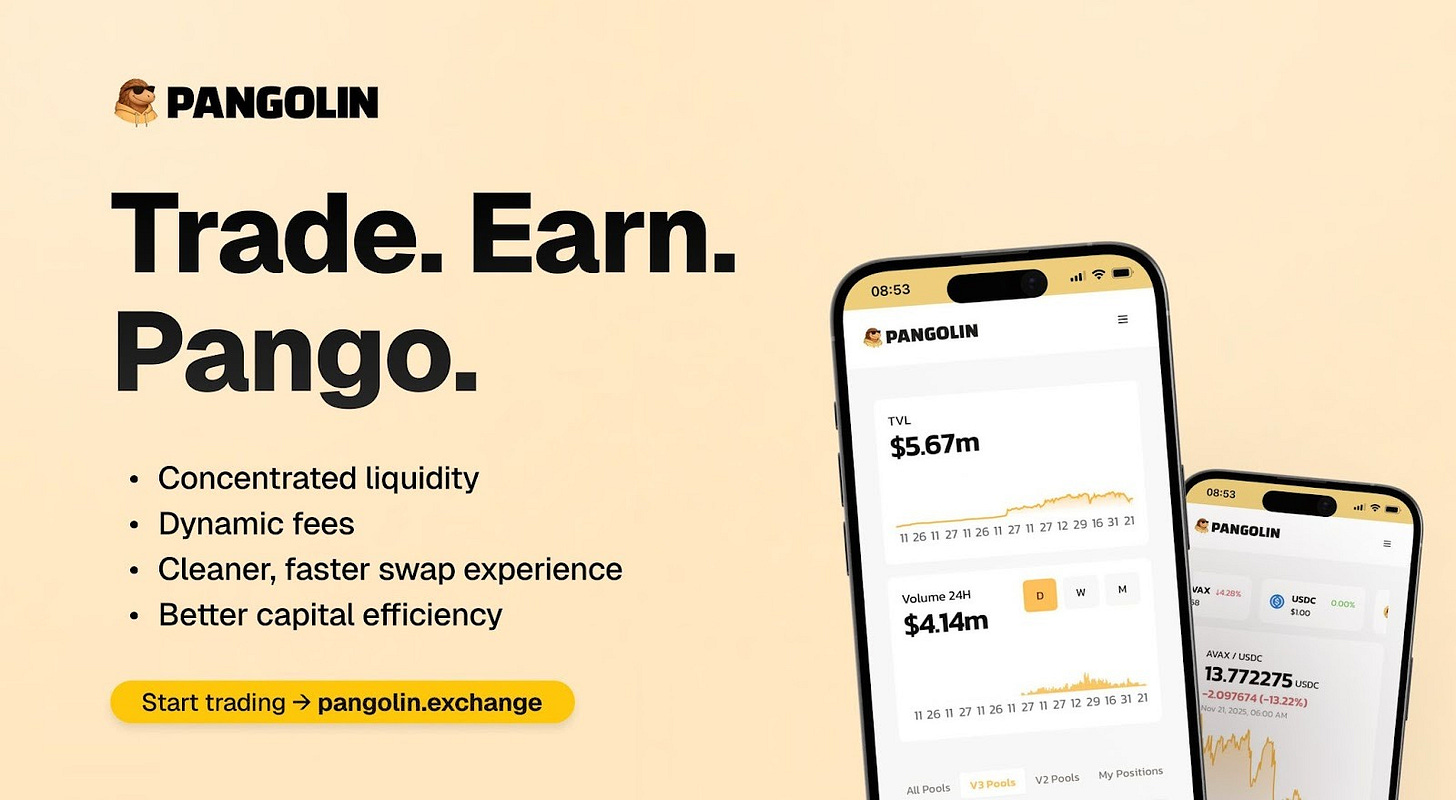

Pangolin is no longer just a legacy AMM. With the release of Pangolin V3 and the launch of Perpetual Futures (Perps), the protocol has entered its most transformative era yet.

This report explores:

Core AMM mechanics

Liquidity depth and market performance

PNG token economics

The new V3 liquidity engine

Perpetual Futures and their economic importance

Pangolin’s strengths, challenges, and long-term outlook

Core Protocol Architecture: How Pangolin Works

AMM Foundation

Pangolin operates as an Automated Market Maker (AMM), where users trade against liquidity pools instead of order books. This model enables:

Permissionless swaps

Continuous liquidity

Predictable mathematical pricing

Avalanche-Native Advantages

Avalanche provides Pangolin with key structural benefits:

Fast finality

Low gas fees

High throughput capacity

Smooth UX through Core Wallet and other integrations

These properties position Pangolin as a cost-efficient, high-speed DEX suitable for both retail and professional flows.

PNG Token Utility

The PNG token functions as:

A governance and voting token

An incentive mechanism for LPs

A long-term alignment tool for the protocol and its community

This remained largely unchanged until Pangolin’s two major upgrades: V3 and Perps.

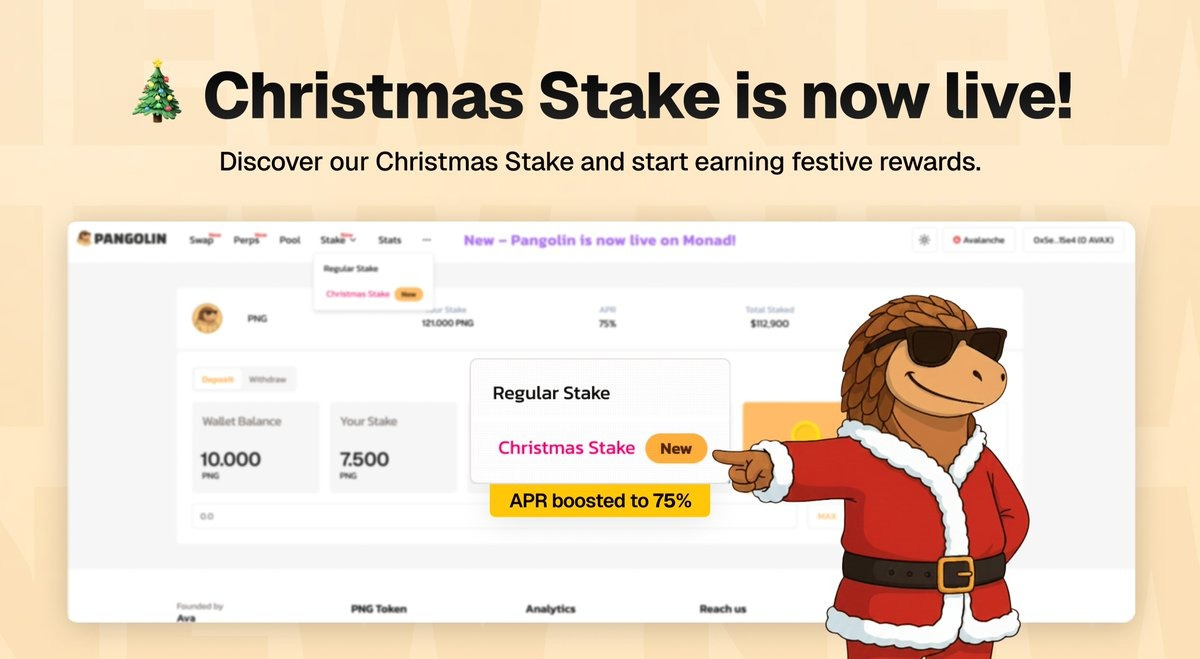

If you are considering staking PNG, the latest update may be relevant.

Pangolin has adjusted its reward and fee distribution mechanics, resulting in improved earnings for users who stake PNG.

You can review the updated details here → http://app.pangolin.exchange

Liquidity Profile: Understanding Pangolin’s Market Depth

Pangolin’s most active liquidity pools include:

AVAX / USDC

PNG / AVAX

USDC.e / USDT

WETH / USDC

These pools anchor the protocol’s routing and volume.

Liquidity is deep enough for mid-sized trades, though not equivalent to the largest AMMs on Avalanche. This context makes V3’s efficiency upgrades especially important, allowing Pangolin to amplify liquidity depth even without substantial TVL increases.

Pangolin V3: A Structural Upgrade, Not a Cosmetic One

Pangolin V3 represents a complete redesign of the protocol’s liquidity engine. It introduces advanced AMM features seen in industry-leading DEXs and transforms Pangolin into a capital-efficient, customizable liquidity platform.

Concentrated Liquidity: The Core of V3

Liquidity providers (LPs) can now deploy capital within specific price ranges.

This results in:

Greater capital efficiency

More depth per unit of TVL

Higher potential fee earnings

Improved execution for traders

For a protocol with modest TVL, concentrated liquidity is a powerful equalizer.

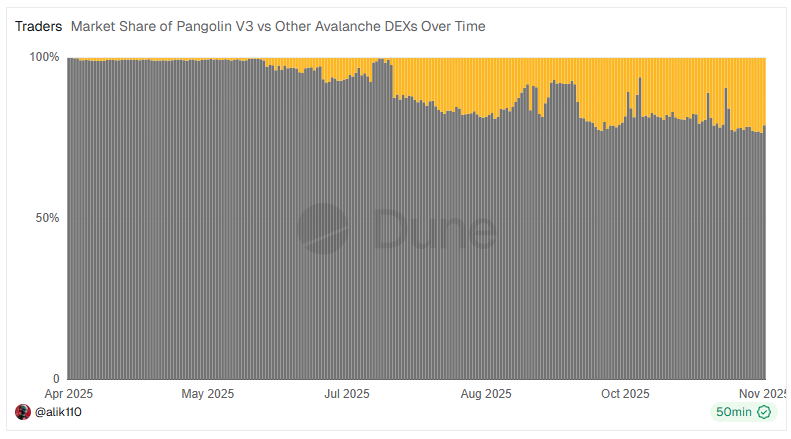

Pangolin’s market share on Avalanche DEXs has increased from 10% at V3 launch in July 2025.

Dynamic Fees

Pangolin V3 introduces variable swap fees that adjust automatically according to:

Market volatility

Liquidity conditions

Trading behavior

LPs earn more during high-risk conditions, while traders enjoy lower fees during stable market periods.

Multiple Fee Tiers

To accommodate different asset profiles, V3 introduces multiple fee tiers:

Ultra-low fees for stable pairs

Moderate tiers for blue-chip assets

Higher fees for volatile tokens

This allows Pangolin to optimize liquidity across a wide spectrum of markets.

In-Range Farming & Superpools

To complement concentrated liquidity, V3 adds:

In-range farming (rewards only when LP capital is active)

Superpools offering dual-token or boosted incentives

A deeper, strategically deployed liquidity model

This shifts Pangolin from passive AMM liquidity to intelligent, curated liquidity.

Risks Introduced by V3

While V3 offers major improvements, it also introduces:

Higher operational complexity for LPs

Potential liquidity fragmentation

The need for active range management

Variable fees that may impact predictability for traders

Despite these challenges, V3 positions Pangolin on par with modern AMMs and ready for its next evolutionary step.

Perpetual Futures: Pangolin’s Most Ambitious Expansion

The launch of Perpetual Futures (Perps) marks Pangolin’s entry into the derivatives market, the most revenue-rich sector in on-chain trading.

Perps enable:

Long and short positions

Leveraged exposure

No expiry

High-frequency trading

These features fundamentally redesign Pangolin’s market identity.

Why Perps Matter

Perpetual DEXs like GMX, dYdX, Hyperliquid, and Vertex have demonstrated that:

Perp traders are more active

Derivatives generate higher sustained revenue

Protocols become less dependent on TVL

Growth accelerates through professional trader acquisition

Introducing Perps allows Pangolin to tap into a significantly larger opportunity segment.

Perps Engine: How It Works

Pangolin’s Perps system uses:

Oracle-based pricing

Leverage options (typically 10–50x)

Funding rates balancing long/short demand

Multi-layered fee generation

Risk management tools for market exposure

This model aligns Pangolin with modern derivatives platforms rather than classic AMMs.

Economic Impact of Perps

Perps bring powerful economic advantages:

Multiple fee streams → higher protocol revenue

Higher trading volume → deeper liquidity network effects

Professional traders → stronger market identity

Reflexive growth loop: more traders → more liquidity → better execution → more traders

With Perps, Pangolin moves from a single-product DEX to a multi-product trading platform.

Strengths, Risks, and Strategic Outlook

Strengths

Modern architecture combining V3 + Perps

Real, persistent organic usage

Avalanche-native execution speed

High upside due to small market cap

Broader appeal for LPs, traders, and advanced DeFi users

Risks

Higher complexity for LPs using V3

Competition from other AMMs and Perp DEXs

Liquidity fragmentation in narrow ranges

Oracle and liquidation risks introduced by Perps

Conclusion

Pangolin is undergoing the most transformative evolution in its history. What started as a simple AMM has evolved into:

A capital-efficient V3 DEX,

A full-featured derivatives venue,

A multi-product exchange capable of competing with modern DeFi leaders.

Despite its relatively small size, Pangolin now operates with a sophisticated architecture and a broader market footprint. Adoption across 2025–2026 will determine how far this transformation carries the protocol, but the groundwork for real growth has already been laid.

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.

go pango go

Fantastic breakdown of the V3 upgrade and perps integration. The concentrated liquidity model basically lets Pangolin compete with way bigger TVL platforms, which I saw firsthand testing diferent AMMs on Avalanche. What stands out tho is how the perps revenue could subsidize LP rewards during low volume periods, creating a natural hedge. Curious if dynamic fees might intorduce slippage unpredictability for high-frequency arbs.