Hypha: The Liquid Staking Engine Powering Avalanche’s Next Wave of L1s

Hypha is emerging as the backbone of Avalanche’s growth, combining an LST with capital-efficient validation and tools for new L1s.

Avalanche is expanding quickly through custom Layer 1 blockchains built for gaming, DeFi, enterprise, and beyond. Every one of these chains depends on reliable validators, yet Avalanche’s 2,000 AVAX requirement per validator makes scaling costly. Meanwhile, AVAX holders want attractive yields without giving up liquidity.

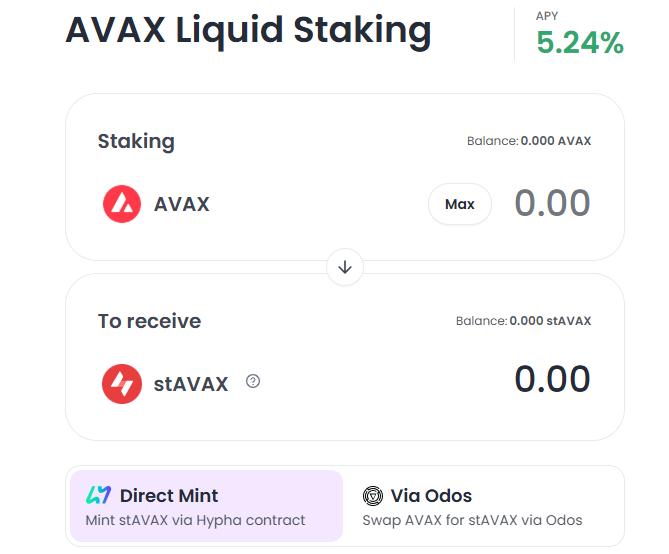

Hypha tackles both challenges at once. It offers liquid staking with roughly 5.24% APY while keeping AVAX usable across DeFi, and it supplies the validator infrastructure that makes multi-chain security far more capital efficient. Stakers earn steady yield, operators run validators with 50% less AVAX, and new L1s gain the infrastructure they need to launch securely.

This dual model positions Hypha as an emerging infrastructure layer shaping Avalanche’s modular future.

Hypha’s Product Suite

1. Liquid Staking With stAVAX

Deposit AVAX and receive stAVAX, a liquid staking token that grows in value as rewards accrue (~5.24% APY). Unlike locked staking, stAVAX is liquid and can be used freely across Avalanche’s DeFi ecosystem to boost returns in many ways:

Money Markets: Use stAVAX as collateral or lend it out to earn interest (protocols like Euler, Silo, Folks).

DEXs: Provide liquidity by pooling stAVAX with AVAX and earn trading fees (Balancer, LFJ, Pharaoh).

Yield Aggregators: Deposit stAVAX into vaults that automate and compound earnings (Yield Yak).

Restaking: Use yield-bearing stAVAX to help secure other protocols and earn extra rewards (Suzaku).

Hypha’s key differentiator: it shares MEV (transaction ordering profits) in addition to base staking rewards. Most LST protocols only pass along standard staking yield; Hypha adds an additional revenue stream.

Two exit routes are available:

~15-day unbonding queue for full-value redemption

Instant DEX swaps for immediate conversion to AVAX

Institutional adoption is increasing: SwissBorg integrated stAVAX into their managed bundles, and BitGo added Hypha support in November 2025, enabling institutional staking.

2. The Staking Engine

Launched in October 2025, Hypha’s Staking Engine routes deposits to the P-Chain, diversifies across top validators, and maximizes returns streamed back to stAVAX.

It combines multiple strategies simultaneously:

Minipool pairing with node operators

MEV capture through specialized validators

Direct validation via Hypha-run nodes

Smart delegation that rebalances in real time

Validators compete for stake by sharing rewards. The engine automatically spreads risk, shifts away from underperformers, and captures new yield opportunities faster than manual delegation.

For L1 projects: The engine can route rewards directly into liquidity or treasuries, reinforcing early ecosystem growth.

3. Minipool Validators

Running an Avalanche validator typically requires 2,000 AVAX. Hypha’s Minipools cut this to 1,000 AVAX plus 10% GGP collateral. The remaining 1,000 AVAX is supplied from liquid stakers.

How Minipools function:

Operators stake 1,000 AVAX + GGP collateral

Hypha matches them with 1,000 AVAX from the staking pool

Operators retain control of validator keys (non-custodial)

Validators can secure multiple L1s simultaneously

Rewards include AVAX, GGP, and native tokens from each L1

This model makes it economically viable to validate multiple L1s simultaneously, which is exactly what Avalanche’s scaling model requires.

4. L1 Validator Marketplace

For new L1s, Hypha offers a marketplace where projects sell “node licenses” to supporters. Buyers stake tokens and become early participants in the chain, while Hypha connects the project to professional validators who run the infrastructure.

This creates aligned incentives:

Projects secure funding and engaged supporters

Validators obtain predictable income

Community members gain early exposure to projects they believe in

GGP Token: Incentives and Security for Hypha’s Validator Network

GGP supports Hypha’s validator ecosystem by providing the collateral that Minipool operators stake and the governance power that guides system rules. Operators must stake GGP equal to 10 percent of their position, which creates accountability and protects liquid stakers without affecting validator custody. As the number of Minipools grows, more operators need GGP, tying demand to network expansion.

Operators also earn GGP as part of their reward mix, and holders participate in governance decisions that shape parameters like collateral requirements and validator onboarding. With a market cap around $7.4 million and trading only on DEXs, GGP remains small but is positioned to scale with Hypha’s role in Avalanche’s growing L1 ecosystem.

Future Outlook

Hypha is developing critical infrastructure for Avalanche’s next phase: a landscape of thousands of custom Layer 1s secured by scalable, capital-efficient validators. Through MEV-enhanced liquid staking, reduced validator capital requirements, automated yield routing, and turnkey support for L1 launches, Hypha provides meaningful utility for users, operators, and builders.

It is early, but Hypha’s architecture and positioning give it a credible path to becoming foundational in Avalanche’s modular ecosystem.

Learn More

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.

Defi protocols is always one of my best use defi tools, i love the breakdown

let's gooo