Empower Your Digital Assets with Colony Labs on the Avalanche Platform

Discover How Colony Labs Empowers Investors and Builders Alike with Seamless Access to DeFi Tools, Early-Stage Investments, and Yield Opportunities on Avalanche

Welcome to an exploration of Colony Labs, an exciting initiative within the Avalanche ecosystem that’s redefining how we interact with digital assets. If you’re new to the world of blockchain or DeFi, Colony Labs offers a gateway to understanding and participating in this dynamic space.

Here, we’ll guide you through how Colony Labs innovates within the Avalanche network, making it accessible and engaging for everyone, not just the seasoned crypto enthusiasts.

What is Colony Labs?

Colony Labs is a community-driven accelerator for the Avalanche ecosystem that invests in early-stage projects. Colony Lab’s mission is to help early-stage projects build on Avalanche and to provide seed investment opportunities for its community.

The platform’s ecosystem includes:

The Early-Stage Program, Validator Program, Colony Avalanche Index, Liquidity Provision program, and Airdrops. The CLY token is central to the Colony Lab ecosystem, and staking the token is required to participate in early-stage investment opportunities.

What Colony Labs Offers

Colony Lab offers four products: an Early-stage Program with Liquid Vesting, a Validator Program, the Colony Avalanche Index ($CAI), and a Liquidity Provision Program.

These products expose users to various aspects of the Avalanche ecosystem and offer Passive Income Opportunities through:

$AVAX rewards from the Validator Program

Platform fees in $CLY (from Staking/Unstaking)

Airdrops from early-stage projects invested in by Colony

$CAI fees from the Colony Avalanche Index

Special rewards from Colony’s DeFi liquidity positions on Avalanche

1) Early-stage Program with Liquid Vesting Solution

This program grants $CLY stakers the chance to invest in early-stage Avalanche projects via Seed and Private sales, an opportunity once reserved for venture capital firms, elite funds, and notable angel investors. Community members can interact with these projects by upvoting, commenting, rating, and viewing community-generated project scores. The Liquid Vesting solution allows investors to trade their locked or vesting tokens freely on Colony’s decentralized exchange (DEX), ushering in a new level of liquidity and flexibility in the primary market.

The major steps of the Early-Stage Program are as follows:

Staking CLY and receiving ANT tokens, which are used to interact with Colony’s investment opportunities.

Deal Flow: Upvoting projects and committing ANT tokens to express investment interest.

Analysis: Evaluating the project and investing USDC.

Investment Committee: Arbitration and confirmation of users’ allocations.

Colony’s Portfolio and Liquid Vesting: ceTokens allocations associated with investments can be claimed, traded on Colony’s DEX, provided as liquidity to enjoy a boosted APR (in ceTokens), or swapped for the project’s native token.

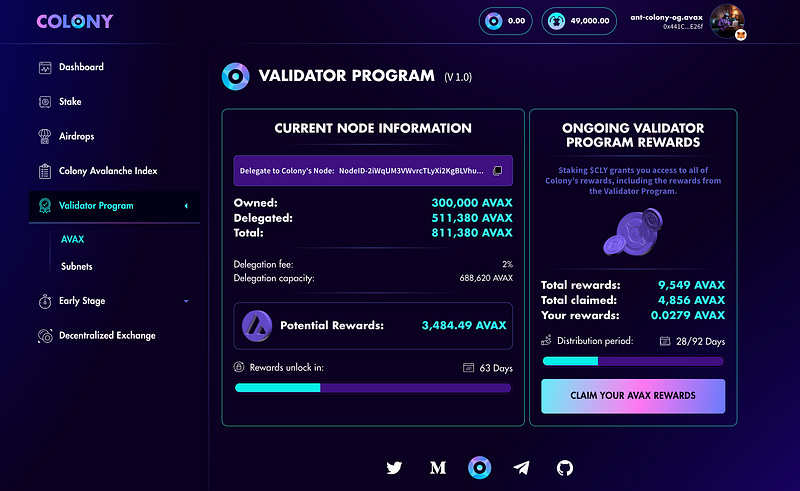

2) Validator Program

Participants can earn $AVAX airdrops over a year without the need to stake, trade, or provide liquidity themselves. Colony uses its AVAX holdings to run nodes, enhancing network security.

The rewards from these nodes are largely redistributed to $CLY stakers. The upcoming V2 of this program will introduce liquid staking features.

Each year, the community of $CLY stakers is projected to receive around $2 million in $AVAX rewards, calculated at AVAX’s all-time high price. This estimate does not account for the extra yield from delegations to Colony’s node.

These rewards could significantly increase if AVAX exceeds its previous peak and if more delegations are made to Colony’s node.

3) Colony Avalanche Index ($CAI)

$CAI serves as a benchmark for the Avalanche ecosystem, tracking $AVAX and leading applications on the platform.

The index’s assets are utilized to generate yield, improving stakeholder returns. $CLY stakers earn from the fees generated by activities like minting and redeeming $CAI.

Recommended for

Investors: For investors seeking exposure to the entirety of the Avalanche ecosystem, well beyond just AVAX. Invest in CAI to benefit from yield opportunities without the hassle of farming yourself.

Institutions: For institutions seeking exposure to the entirety of the Avalanche ecosystem, well beyond just AVAX. CAI allows you to diversify treasury assets with simplicity and less management hassle.

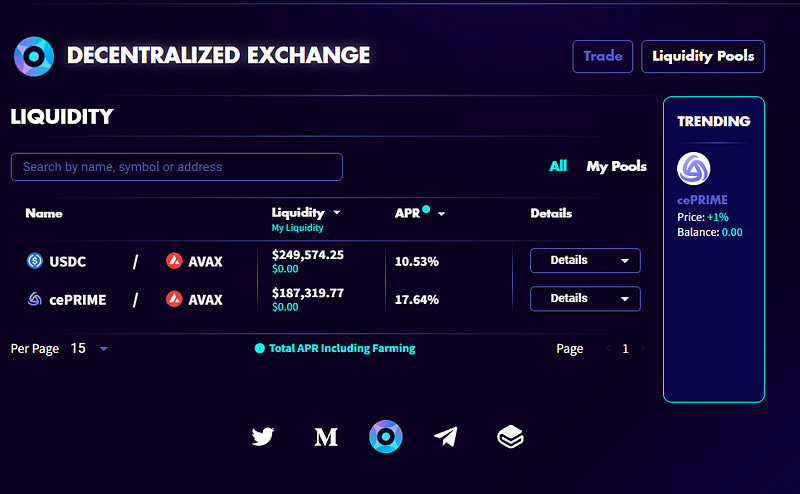

4) Liquidity Provision Program

This program enables users to benefit from special rewards derived from Colony’s liquidity positions in Avalanche’s DeFi space. As an accelerator for the ecosystem, Colony supports burgeoning DeFi protocols by providing liquidity, which in turn increases their Total Value Locked (TVL). The yield from this liquidity is shared among $CLY stakers, fostering growth and engagement within the community.

The major steps of the Liquidity Provision Program are as follows:

Step 1: Accessing Liquidity Pools

Navigate to Liquidity Pools:

Start by locating and clicking on the “Liquidity Pools” button on the Colony platform. This will open up the section where all available liquidity pools are displayed.

Step 2: Understanding APR and Staking

Maximizing APR:

To receive the maximum Annual Percentage Rate (APR) shown on the platform, you don’t just provide liquidity; you must also stake your Liquidity Provider (LP) tokens into the farm. This step is crucial for optimizing your returns.

Compounding Rewards:

After you’ve staked your LP tokens, you’ll earn rewards. By claiming these rewards and reinvesting them back into the same pool, you can compound your earnings. This practice can lead to an APR higher than initially advertised. You can repeat this process to keep enhancing your APR over time.

Step 3: Providing Liquidity

Choose Your Pool:

Browse through the list of available pools, or use the search if necessary. Click on “Details” for more information about a specific pool, or directly click on the pool you’re interested in to proceed.

Add Liquidity:

Select Amount: Decide how much of one token you want to provide. The platform will automatically calculate how much of the second token is needed for the pool’s current ratio.

Customize Slippage (Optional): If you’re concerned about price changes during the transaction, you might want to adjust the slippage tolerance. This setting helps prevent transaction failures due to price fluctuations.

Confirm: Once you’re satisfied with your inputs, click on “Add Liquidity”.

Note: If the pool’s state changes during your selection (which can happen due to market volatility), your transaction might fail. If this occurs, simply refresh the page and try again with the same or adjusted amounts.

Step 4: Staking LP Tokens for Increased APR

Stake Your LP Tokens:

After you’ve added liquidity, you need to stake your newly acquired LP tokens to benefit from the boosted APR, especially in pools like USDC/AVAX.

Here’s how you do it:

Locate the Staking Option: After liquidity addition, you’ll see your LP tokens in your wallet. Find the option to stake these tokens, often labeled as “Stake” or “Farm”.

Stake Tokens: Enter the amount of LP tokens you wish to stake, or choose to stake them all at once, and confirm the transaction.

Reinvesting Rewards: Once you start earning farm rewards, collect them periodically and reinvest them into the pool to enhance your APR further. This step might be automated in some platforms or require manual input.

Remember, engaging with liquidity pools and staking can significantly boost your returns in the DeFi space, but it requires attention to both market conditions and platform specifics.

5) Airdrops

Airdrops from early-stage projects are a significant benefit for Colony’s $CLY stakers. These airdrops occur when Colony invests in new projects on the Avalanche blockchain.

When these projects grow and launch their tokens, Colony’s community benefits. Tokens are often distributed as airdrops to $CLY stakers.

This means that by staking $CLY, participants can receive tokens from these fledgling ventures, allowing them to gain early exposure to potentially successful projects before they gain widespread recognition or increase in value. This system not only incentivizes staking but also aligns the interests of the investors with the growth and success of the Avalanche ecosystem.

Getting Started with Colony Labs

Stake $CLY to access the Colony Labs Platform

To engage with Colony’s platform, access rewards, and join the investment DAO, stake your $CLY. Staking more $CLY increases your rewards and potential allocations in Seed/Private sales during fundraisings.

Upon staking $CLY, you’ll receive ANT tokens at a rate of 1 $CLY = 100 ANT.

ANT Utility:

ANT tokens allow interaction with Projects’ NESTs (Seed/Private sales).

Commit ANT as collateral to show investment interest, unlocking USDC investment opportunities in sales, with allocations based on each NEST’s specifics.

After committing USDC, ANT tokens are freed up for additional project commitments.

Stake ANT for VIP Program benefits.

KYC Verification

KYC verification is exclusively needed for Colony’s Early-Stage Feature; all other application parts remain KYC-free.

The Early-Stage Feature offers unique investment opportunities in Seed/Private sales for new Avalanche projects. To comply with global regulations, users wishing to partake in these sales must complete KYC verification, which is required to access these investment opportunities.

Conclusion

Colony Lab is a pivotal force in propelling the growth of the Avalanche ecosystem. Beyond being merely a platform, Colony Lab is helping new projects grow and gives the community exciting opportunities to get involved. Its mission is dual-focused: to empower nascent projects on Avalanche and to open new avenues of opportunity for its community.

Through Colony Lab, emerging builders and projects access vital early-stage funding, comprehensive ecosystem support, authentic initial visibility, and an engaged community of investors and potential users, thereby turning their innovative visions into reality. Concurrently, the community benefits from exclusive opportunities for seed investments alongside a broad spectrum of yield-generating financial products. To learn more about Colony Lab, check out their website here.

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more. Your Avalanche journey starts now!

I so much love what is happening with Colony Labs

Avalanche is the opportunity for your projects to reach the next level; scalability is infinite.