DeFi Playbook: Advanced DeFi Tactics on Avalanche (Part 3)

Explore impermanent loss, lending loops, yield aggregators, perpetual futures, and arbitrage—learn how to manage risk and optimize DeFi strategies on Avalanche.

Congratulations on moving well beyond the basics. Swaps, staking, yield farming, and leveraged trades are all part of your toolkit now. The next step is to sharpen that edge.

If you want to maximize the Avalanche ecosystem, you need to learn how to balance opportunity with risk. This is where advanced tactics come in with strategies for protecting capital, maximizing yield, trading perpetual futures, and even automating arbitrage. Here we go.

Impermanent Loss Deep-Dive

Impermanent loss (IL) is one of those concepts every liquidity provider eventually encounters, and it deserves a closer look.

Suppose you deposit into an AVAX/USDC pool when AVAX is $20. If AVAX doubles to $40, the pool automatically rebalances so you hold fewer AVAX and more USDC. Instead of doubling your money like a holder would, your LP position might be worth 30–35% less than if you had simply held AVAX alone. That gap is impermanent loss.

Mitigation Tips

Provide liquidity in stablecoin pairs (like USDC/USDT) where price divergence is minimal.

Use pools with boosted incentives (yield farming rewards) to offset IL.

Explore concentrated liquidity protocols, which let you target a narrower price band and reduce exposure outside it (Blackhole or LFJ).

Always compare projected yield vs. potential IL before committing capital.

Think of IL as “opportunity cost exposure.” The pool reshapes your portfolio whether you like it or not.

Borrow/Lend Loops & Yield Aggregators

Before diving into how it works, it’s important to understand why looping exists. In bull markets, traders look for ways to magnify their exposure and squeeze extra yield out of lending incentives. Looping is essentially a leverage tactic built on lending protocols. It amplifies rewards but also magnifies downside risk. You can think of looping as leverage in disguise: powerful in a bull market and dangerous when market conditions flip.

The mechanics

You deposit 100 AVAX into a lending protocol and borrow $1,000 USDC against it. You use that USDC to buy 25 more AVAX. You deposit again, borrow more, and repeat. After two loops, you might be sitting on 150–160 AVAX exposure while only starting with 100.

Risks

Price volatility makes loops fragile. If the token falls too far, liquidation can hit fast.

Interest rates fluctuate; if the borrowing APR climbs above the farming yield, the loop bleeds money.

Benqi is a well-known platform for lending and borrowing where you could experiment with looping.

Yield Aggregators

Yield aggregators like Yield Yak or Beefy Finance pool user deposits and then automatically route them into the highest‑yielding strategies across multiple protocols. They handle compounding rewards, rebalancing positions, and shifting capital where it’s most efficient. This automation saves time and boosts returns, but it also adds abstraction, meaning that users may not fully see the underlying strategies or risks.

Spot vs. Perpetuals

Trading spot assets is straightforward because all you do is buy and hold the asset directly. Buying spot is a great choice if you believe in an asset, think it will improve its price over a longer timeframe, and don’t want any exposure to leveraged trading.

But perpetual futures (perps) introduce more flexibility and complexity, along with new risks. Here are the concepts we need to understand:

Traditional Futures

A futures contract is an agreement to buy or sell an asset at a set price on a specific future date. Traders use them to hedge or speculate on price moves. You only need to post margin (a fraction of the contract’s value), which introduces leverage.

Derivative Contracts: Futures trading uses a derivative contract whose value is tied to (or “derived from”) an underlying asset. Derivatives let you gain exposure to the price movements of an asset without owning it directly.

Expiry: Most futures contracts come with an expiry (expiration) date. This is the date when the contract must be settled.

Perpetual Futures

Perpetual Futures (Perps): Unlike traditional futures, perps have no expiry date. They track the spot price continuously and let you hold positions indefinitely as long as margin requirements are met. You can go long or short, and add leverage to amplify potential gains (or losses).

Funding Rates: To keep perp prices tethered to spot, traders pay or receive small periodic fees. For example, if a token’s perps trade higher than spot, long positions may pay 0.01% every 8 hours to shorts. If perps trade lower, shorts pay longs. This ensures perp markets don’t drift too far from reality. Funding fees make holding a perp similar to paying “interest” on your position. If you’re on the paying side, costs accumulate over time. If you’re on the receiving side, it can offset other costs.

Having an understanding of funding mechanics is essential because they quietly shape profitability over longer holding periods.

When Perps Make Sense

Hedging: Offset risk by shorting a token’s perpetual contracts to protect your holdings of that token against price declines.

Speculation: Take leveraged positions to potentially magnify gains. But remember, losses are amplified too.

Considerations: Be aware of ongoing funding fees and the risk of liquidation if your collateral value falls.

It boils down to this: perps offer precision but demand discipline.

If you want to trade a token via perpetual futures, Bitunix is a wonderful platform that doesn’t require KYC and you can fund your account just about any way imaginable. Make sure to do all of the free training on the site before opening your first position.

Arbitrage

Arbitrage is the practice of exploiting price differences for the same asset across different markets. In DeFi, it often means buying a token cheaper on one DEX and selling it at a higher price on another, pocketing the difference. These opportunities arise because liquidity, trading volume, and pricing algorithms differ between protocols.

Types of Arbitrage

DEX vs. DEX: Spotting price gaps between automated market makers.

DEX vs. CEX: Moving between decentralized and centralized markets.

Triangular Arbitrage: Taking advantage of mispricings across three token pairs on the same exchange.

For example, a trader might notice AVAX priced at $40 on one DEX and $41 on another. By buying 100 AVAX at $40 and selling at $41, they net $100 (minus fees and slippage) instantly.

Considerations

Fees and slippage can erase profits.

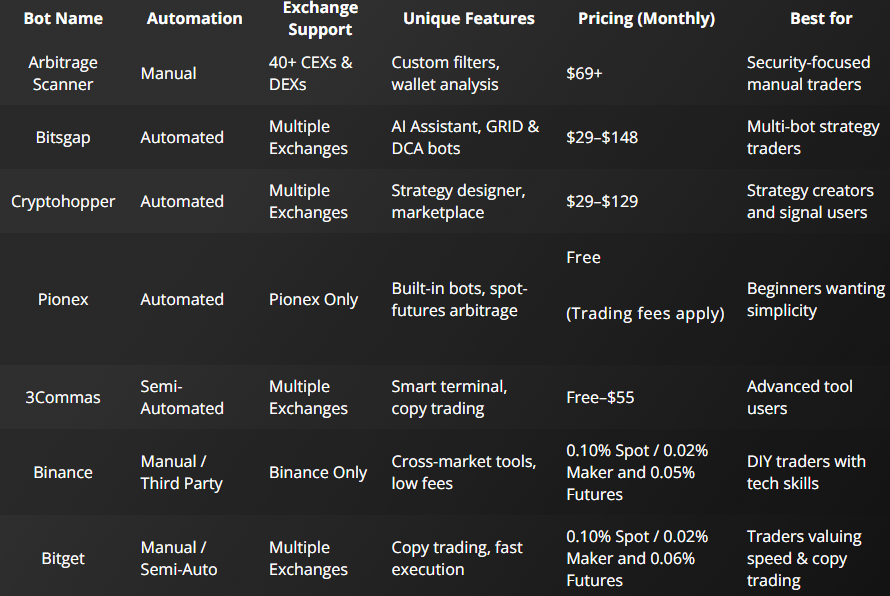

Competition is fierce - most arbitrage is executed by automated bots programmed to scan dozens of markets simultaneously and trigger trades within seconds. These systems make arbitrage highly competitive, leaving little room for manual traders unless they have specialized tools or unique strategies.

If you want to explore some arbitrage bots, check out this article from CoinBureau.

Final Thoughts

By now, you’ve explored impermanent loss, loops, yield aggregators, perpetuals, and arbitrage. These are advanced strategies that demand caution, but also open doors to new levels of efficiency and profit.

The real skill in DeFi isn’t chasing every opportunity, it’s knowing when the reward outweighs the risk. Master that, and you’ll be ahead of most.

Keep learning, stay adaptive, and keep your eyes on what’s next. Avalanche and DeFi are still evolving, and those who stay curious will be the ones best positioned to thrive.

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.

Looking forward to being in that final 5% of applications to Team1! The love continues if i'm not accepted!