Club HashCash: Simulated Mining with Real Rewards

Outsmart the network, optimize your rigs, and fight for a slice of fixed emissions in this on-chain mining game built on Avalanche.

If you enjoy optimizing spreadsheets more than watching price charts, Club HashCash might be your kind of game.

Club HashCash is about strategic efficiency - you might even say hashmaxxing. The landing page leaves a little to be desired, but once you sign in with a wallet, the real fun begins. At first, it might be somewhat confusing, and you might ask yourself, what is this all about? Which miners should I fill my first facility with? Which miner is the most bang for my buck? What are some good strategies to get started? Read on to find out.

The Core Loop

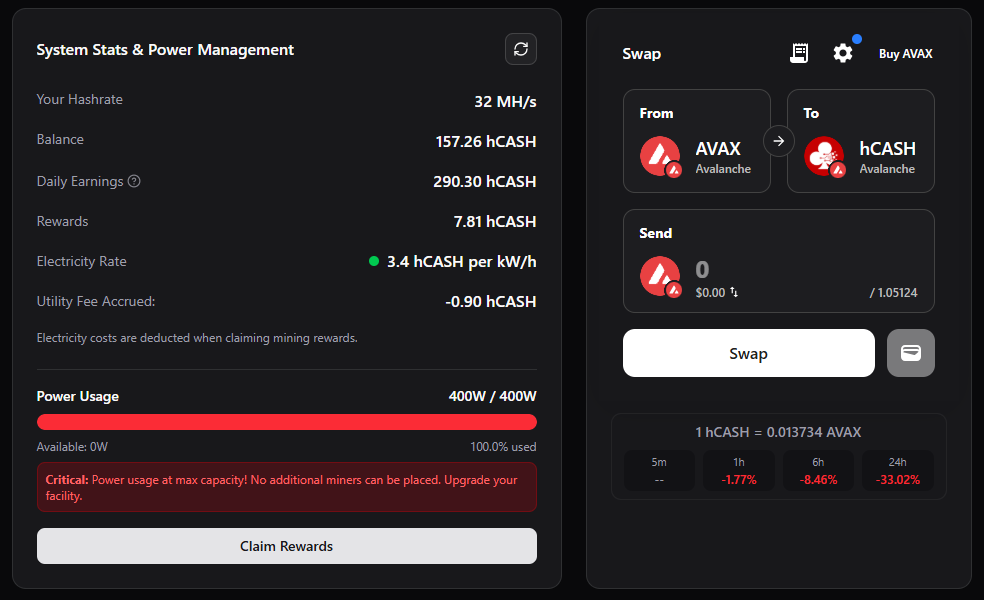

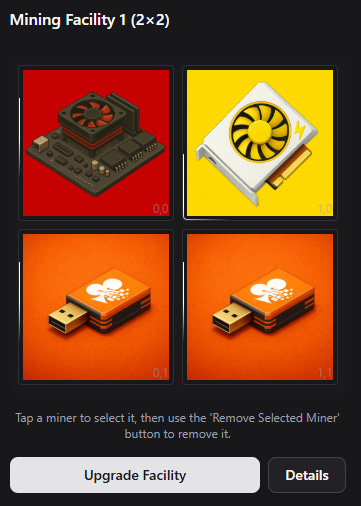

Club HashCash is an on-chain mining simulation where you purchase a virtual facility, populate it with miner NFTs, and earn $hCASH tokens based on your share of the total network hashrate.

The core gameplay simulates real-world proof-of-work (PoW) mining. The more hash rate you contribute relative to everyone else, the more of each block emission you receive. The economic logic of this simulation mirrors PoW mining surprisingly well, even though you aren’t actually running any algorithms.

Base emissions are set at 2.5 hCASH per block, with halvings scheduled every 4,200,000 blocks (roughly every 48 days) until the total supply of 21 million tokens is exhausted. There were no premined tokens and the team didn’t receive any tokens. Supply flows entirely through gameplay, which is really nice to see.

Strategy With Constraints

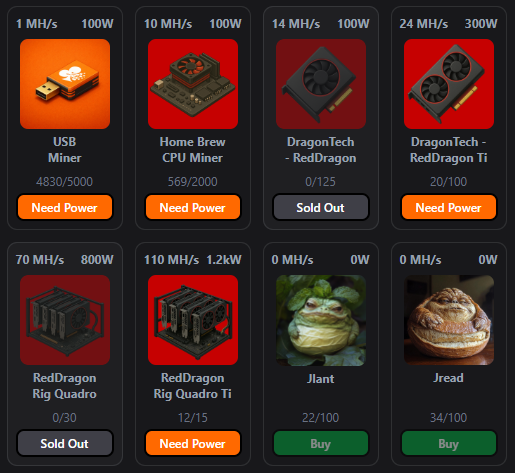

The strategic layer is interesting because it forces miners into trade-offs. Each miner NFT includes two key metrics: hashrate and power usage. And each facility has a fixed power capacity, so you can’t just add the most powerful miners without accounting for those constraints. You need to find the most efficient and affordable miner available, while also keeping in mind that some miners might be sold out or unavailable on the secondary marketplace. There is also a cooldown period after upgrading facilities, so you can’t upgrade a facility whenever you want to.

The power ceiling, hashrates, and pricing in $AVAX and hCASH forces you to do more math than Russell Crowe in A Beautiful Mind: do you run fewer high-hashrate miners or fill your grid with lower-consumption units? Electricity rates also shift dynamically, calculated for each facility tier, with a trend indicator ranging from “Normal” to “Surge Rate.” When rates spike, the fees for claiming your rewards increase. In addition to determining the optimal mining setup, you need to consider the optimal time to claim rewards (or compound into better setups).

Gamified Ponzinomics

The competitive dynamics of PoW, where growing network participation dilutes individual rewards, are faithfully represented. If the total network hashrate doubles because new players buy in, your share of each block emission drops proportionally. This creates a “hash war” environment that rewards those who reinvest their hCASH into larger facilities and more efficient hardware early. Players who start competing in the beginning phases usually have an advantage in these types of games, but such is life.

Sample Strategies for New Miners

You’re ready to start mining, but you don’t know which configuration to run initially. Here are some sample setups to consider, but keep your personal budget in mind and don’t overspend. All setups were priced as of the time of writing. Some prices were converted from hCash to $AVAX. Each strategy omits any custom setups in the Rig Assembler section.

Small Budget

Goal: Learn mechanics, minimize AVAX exposure, keep options open.

Setup:

1× Starter Facility (2 $AVAX, 4 miners possible, 400W power)

4× USB Miners (8 $AVAX)

1 MH/s each

100W each

High max supply (5,000)

This setup keeps costs predictable while allowing you to experience the full loop: facility ownership, miner placement, reward claiming, electricity management, and observing the network hashrate shift over time. USB miners have a low hash rate, but their low power consumption makes them a good fit for a starter facility. Their large max supply also means the secondary market remains liquid, so exiting or reshuffling inventory later is straightforward.

But this tier sacrifices efficiency for access. You learn how emission share works and how power caps become the first real bottleneck. It makes facility upgrades feel meaningful without committing heavily upfront.

Medium Budget

Goal: Balance power efficiency, hashrate density, and resale flexibility.

Setup:

1× Starter Facility (2 $AVAX, 4 miners possible, 400W power)

Mix of rigs depending on availability:

2x USB Miners and 2x Home Brew Rigs (23 $AVAX, 22 MH/s total, 400W total, high supply)

2x USB Miners and 2x Dragon Tech (Red Dragon) GPU miners (33 $AVAX, 30 MH/s, 400W total, Red Dragons only on marketplace)

1x USB Miner and 1x Dragon Tech (Red Dragon Ti) GPU miner (31 $AVAX, 25 MH/s, 400W total, higher supply)

This tier blends higher and lower hashrate density per slot. The Home Brew and Dragon Tech rigs offer strong MH/s per AVAX spent, and the relatively limited max supply of Red Dragon rigs adds scarcity value that often shows up on secondary markets. Mixing power profiles lets you stay right at max facility power caps while reducing the time to upgrade your facility.

Inventory management becomes more important. Power constraints matter more than slot limits, and claiming rewards requires more attention to utility fees and electricity trends.

Ape Mode

Goal: Stack hashrate density early and secure scarce miner inventory.

Setup:

Starter Facility (2 $AVAX, 4 miners possible, 400W power), with a rapid upgrade path

High-density rigs prioritized:

2 x Plasma XL GPU miners (96 $AVAX, 90 MH/s, 400W total, only available on marketplace)

This tier leans into scarcity and throughput. You’ll have to find the Plasma miners on the marketplace, and they’ll likely be higher than the base price calculated for this example. But you’ll be running an incredible, high-efficiency setup with lots of options for quick upgrades and claiming.

Final Thoughts

Club HashCash is a lot of fun. It forces you to make decisions from the start while making you feel like you’re actually mining crypto. The fixed supply of hCash and halving schedule are nice touches. They give the game a sense of scarcity rather than perpetually increasing emissions, which can be the death rattle of many projects.

The project is still in its early stages, with more UI upgrades expected in the future. You can dip your toes in or take a full ice bath plunge; it’s totally up to you. But remember, this game is primarily for entertainment, so please keep in mind that profitability isn’t guaranteed and this is not financial advice. Happy mining!

Learn More Here: Club Hash Website | Documents | X (Twitter)