ChainARQ: Building the Cross-Chain Infrastructure DeFi Actually Needs

ChainARQ is building the unified infrastructure for DeFi, enabling seamless, gasless cross-chain token swaps by aggregating all necessary bridges and DEXs into one platform.

Trading tokens across different blockchains remains one of crypto’s most frustrating experiences. You need gas tokens for multiple chains, hunt through different bridges to find liquidity, check which aggregators support your token, and hope everything executes without errors. The current state of cross-chain trading is fragmented, expensive, and unnecessarily complex.

ChainARQ is solving this by building a unified cross-chain infrastructure that aggregates DEXs, bridges, and liquidity pools into a single platform.

The result is straightforward: users can swap any token on any supported chain without dealing with the technical overhead that typically comes with cross-chain operations.

What ChainARQ Is Building

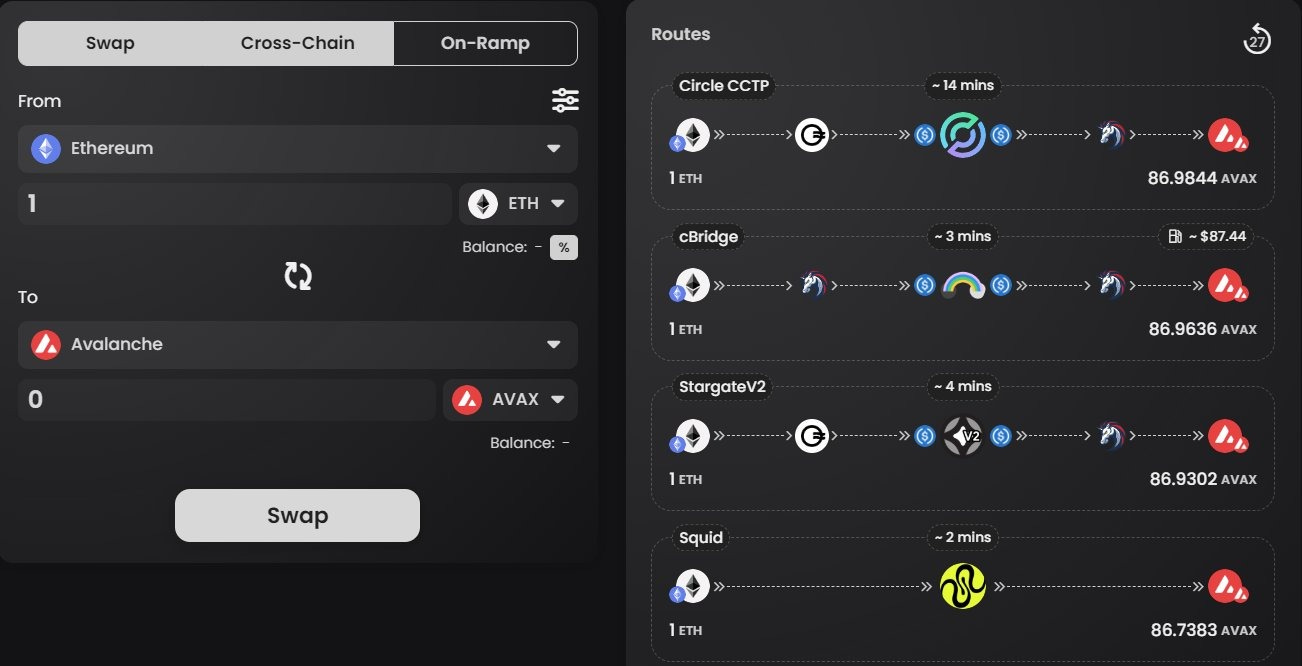

ChainARQ functions as a comprehensive aggregation layer for decentralized finance. The platform pulls data from multiple DEX aggregators, bridge protocols including Stargate and Celer, and their native ARQ Bridge to create optimized routes for token swaps across blockchains.

ChainARQ currently supports over 10,000 tokens across 8 major chains including all tokens on the chains they integrate with. It gives users a single access point to the deepest liquidity pools DeFi has to offer.

But that’s just scratching the surface.

The platform’s algorithm handles route optimization by splitting orders across different DEXs when necessary to minimize slippage and reduce gas fees. This happens automatically in the backend. Users simply select their source and destination tokens, and ChainARQ calculates the most efficient path.

ChainARQ is building critical infrastructure also for the Avalanche ecosystem through their integration with Avalanche L1s.

ChainARQ’s Core Utilities

ChainARQ’s value comes from solving specific problems that make cross-chain trading difficult. Here’s what the platform offers:

1. Gasless Swaps

Users don’t need to hold gas tokens on every blockchain they use. ChainARQ includes gas fees within each transaction, so trades can happen using only the tokens being swapped.

This removes one of the biggest friction points in multi-chain DeFi; hence, users no longer need to manage gas token balances across different networks.

2. Chain Abstraction

The platform’s chain abstraction tool removes the need for users to understand which blockchain they’re operating on.

You select the tokens you want to trade, and ChainARQ handles the routing, bridging, and execution across whatever chains are necessary. The technical infrastructure becomes invisible to the end user.

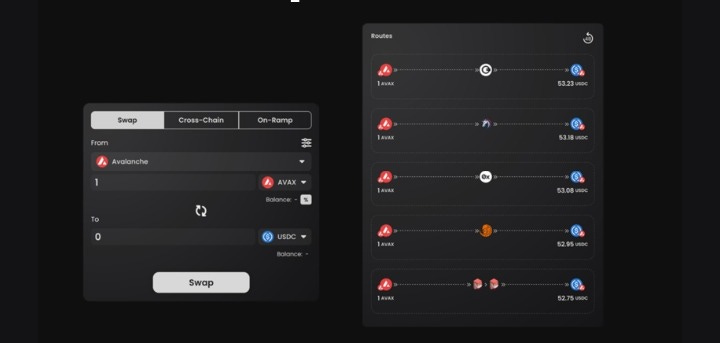

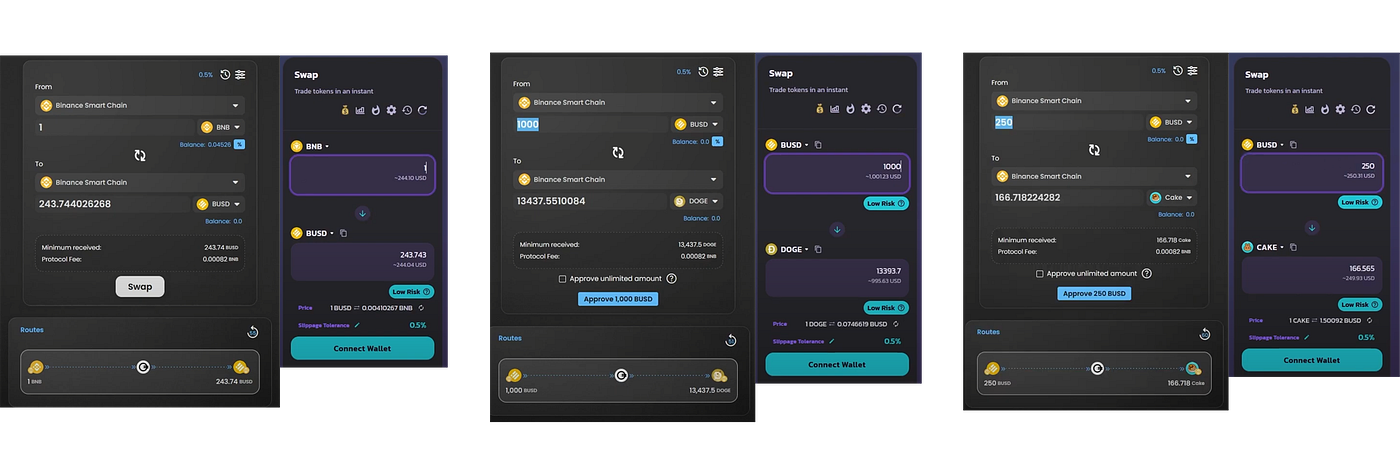

3. DEX Aggregation

ChainARQ gathers data from multiple DEX aggregators, not just individual DEXs. Since each aggregator uses different methods to find the best trade routes, combining their data gives more complete pricing information.

It also checks DEXs directly, so tokens that aren’t listed by other aggregators are still covered.

4. Bridge Aggregation

Instead of using just one bridge, ChainARQ connects multiple bridges. Hence, providing more liquidity, different routes, and spreads risk across protocols. The platform automatically picks the best bridge based on available liquidity, fees, and speed.

The ARQ Bridge uses Circle’s USDC standard to issue wrapped tokens, allowing users to easily move between different blockchains using native USDC. This also helps when other bridges don’t have enough liquidity.

5. Access to Deep Liquidity

ChainARQ provides access to thousands of liquidity pools across multiple chains. The platform’s algorithm tracks these pools in real-time to determine where the best execution price exists for any given trade. This comprehensive liquidity access means better pricing for users and reduced slippage, particularly on larger trades.

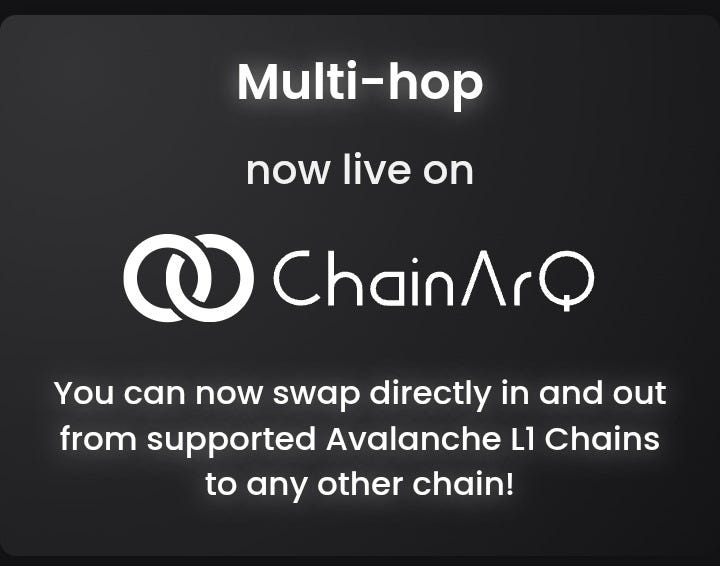

6. EVM to Avalanche L1s Integration

This is where ChainARQ brings real value to the Avalanche ecosystem. The platform connects all major EVM chains; like Ethereum, Polygon, and others, directly to Avalanche’s Layer 1 networks using Avalabs’ ICM (Interchain Messaging) and ICTT (Interchain Token Transfer) protocols.

Everything happens automatically through ChainARQ’s interface. You simply choose the token and chain you’re sending from, then select your destination Avalanche L1. ChainARQ checks liquidity on both sides, finds the best route (including any needed swaps), completes the transfer using ICM and ICTT, and sends your tokens straight to your Avalanche wallet.

This is important because Avalanche’s Layer 1 ecosystem is expanding fast. New projects launching their own L1s need simple ways to bring in liquidity and users from other chains.

Without a tool like ChainARQ, users would have to manually bridge tokens to Avalanche’s C-Chain first, then bridge again to the target L1, and finally look for a DEX to swap tokens. That’s complicated and time-consuming.

ChainARQ simplifies all that into one step. A user on Ethereum can directly swap into tokens on any supported Avalanche L1 in a single transaction. This lowers the barrier for new users and helps liquidity move more easily into Avalanche’s growing ecosystem.

7. Non-Custodial Security

The platform operates entirely non-custodially. ChainARQ never holds user funds, all assets remain in user wallets until smart contract execution. The platform implements circuit breaker modules that can halt potentially malicious transactions, providing real-time threat detection alongside the standard security benefits of non-custodial architecture.

Partnerships and Ecosystem Integration

ChainARQ has secured integrations with several major DeFi protocols. The platform has integrated top platforms, like Pangolin DEX on Avalanche, enabling secure gasless swaps and one-click cross-chain trading for Pangolin users, also coqnet amongst other Avalanche L1s

These collaborations highlight the strength of ChainARQ’s technology, showing why leading DeFi platforms are choosing to integrate its infrastructure.

Why Decentralised Finance (DeFi) needs this

DeFi’s liquidity is increasingly fragmented across Layer 1s, Layer 2s, and application-specific chains. Users shouldn’t need deep technical knowledge to move value between ecosystems, yet the current tooling requires exactly that.

ChainARQ represents infrastructure that makes blockchain interoperability practical for regular users. The platform doesn’t try to force users onto specific chains, instead, it connects them all. As more blockchains launch and more liquidity fragments across ecosystems, this type of aggregation infrastructure becomes essential rather than optional.

The platform’s approach to supporting all tokens on supported chains, including those ignored by major aggregators, opens DeFi access to projects that would otherwise lack reliable cross-chain functionality. This has ecosystem-level implications for smaller projects and emerging tokens.

Using ChainARQ

Getting started requires only a few steps:

Connect your Web3 wallet (MetaMask, WalletConnect, or other supported wallets)

Select your source token and chain, then your destination token and chain

Review the route ChainARQ provides, including DEXs used, bridges involved, and estimated fees

Confirm the transaction; ChainARQ handles gas fee abstraction for gasless swaps

Track the swap’s progress through their interface

The platform handles the complexity of cross-chain execution behind the scenes. For gasless swaps, users don’t need to acquire native tokens on any chain involved in the transaction.

The user experience remains simple; connect wallet, select tokens, confirm transaction.

For developers, ChainARQ offers white-label solutions. Projects can integrate ChainARQ’s cross-chain functionality directly into their own dApps, providing their users with comprehensive swap capabilities without building this infrastructure themselves.

Projects interested in white-label integration can reach out through ChainARQ’s Discord or Twitter to discuss custom implementations.

Final Thoughts

ChainARQ is building connective infrastructure for a multi-chain ecosystem. The platform’s gasless swap functionality, comprehensive DEX and bridge aggregation, and chain abstraction tools address real problems that make cross-chain DeFi difficult.

As blockchain adoption grows, the need for seamless interoperability grows with it. ChainARQ’s infrastructure is live, functional, and handling real volume. The team has the technical background to execute on their roadmap, and they’re positioned to scale as cross-chain activity continues increasing.

The platform makes cross-chain trading accessible without requiring users to manage the complexity typically involved. That’s the infrastructure DeFi needs to reach broader adoption.

Connect with ChainARQ:

- Website: https://chainarq.com

- Documentation: https://gitbook.chainarq.com/

- X: @chainarq

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.