AVALANCHE JANUARY 2026 RECAP

The first ETF goes live. C-Chain crosses 1 billion transactions. $1 trillion in cumulative volume, Team1 mini grant to the Grotto, Bears Den and more.

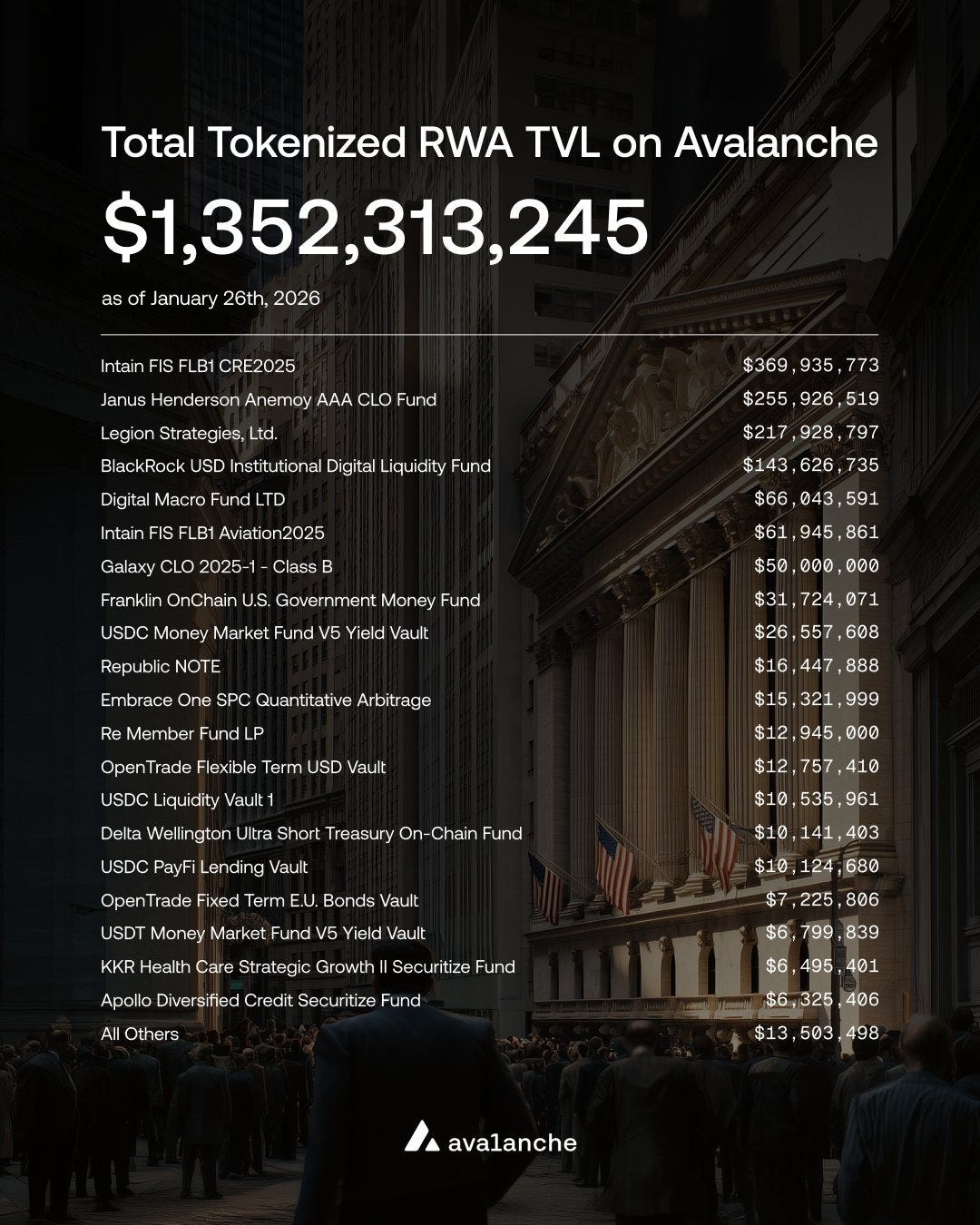

January 2026 was Avalanche in acceleration mode. VanEck’s AVAX ETF began trading on NASDAQ, marking the first-ever spot Avalanche ETF. The C-Chain surpassed 1 billion cumulative transactions while network-wide volume crossed the $1 trillion milestone. Galaxy launched a $50M tokenized CLO exclusively on Avalanche, pushing total RWAs past $1.3 billion. Interactive Brokers enabled 24/7 USDC funding for millions of users globally. The infrastructure kept scaling, institutions kept deploying, and builders kept shipping.

Let’s break down everything that made January a statement month for Avalanche.

January delivered milestone after milestone as the Avalanche network demonstrated sustained growth across every critical metric.

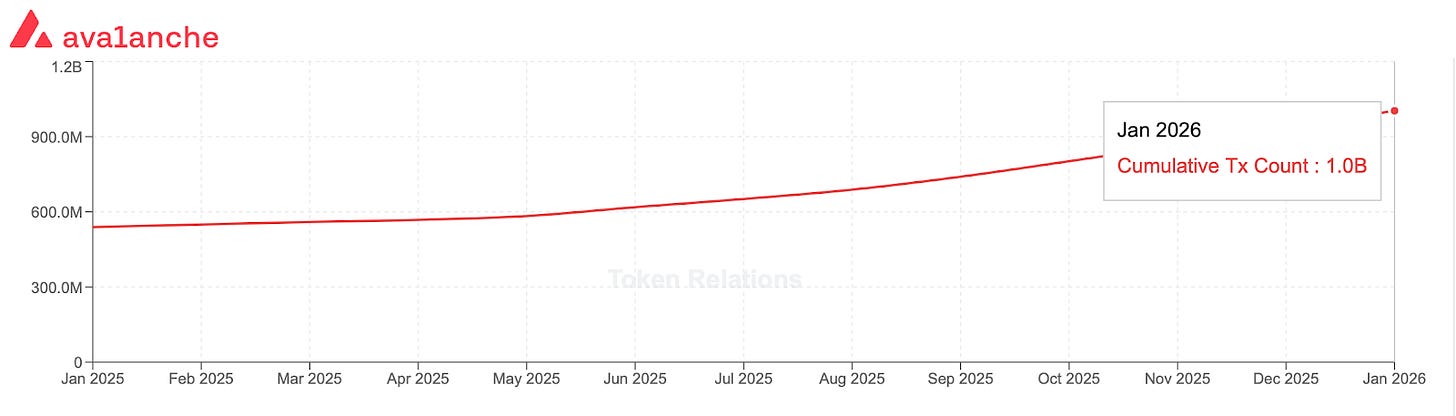

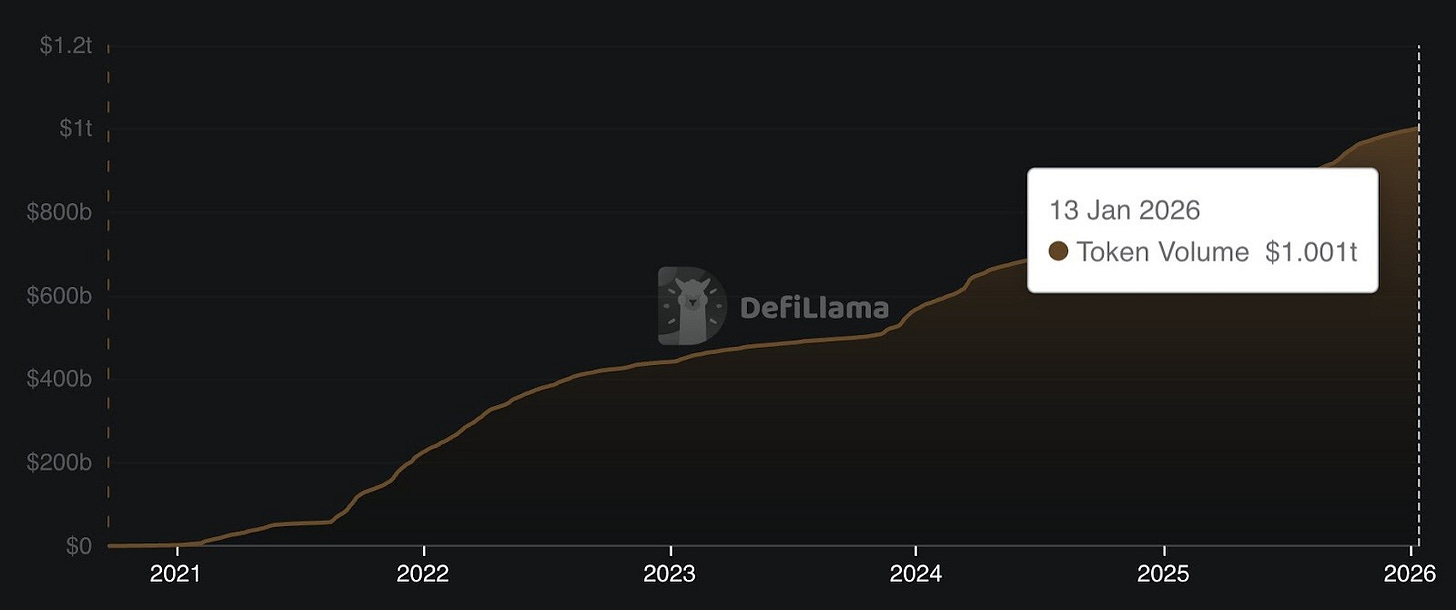

C-Chain Crosses 1 Billion Transactions & Network Surpasses $1 Trillion Volume:

The C-Chain officially surpassed 1 billion cumulative transactions while AVAX cumulative volume crossed the $1 trillion threshold.

Network Activity Hits Multiple All-Time Highs:

Daily active addresses on the primary network reached an all-time high while Interchain Messaging hit 15.4K daily messages, suggesting liquidity is moving more freely within the ecosystem than ever.

Lowest Average Fees Among Major Chains:

Avalanche posted the lowest average transaction fees of all major blockchains. Compare fees

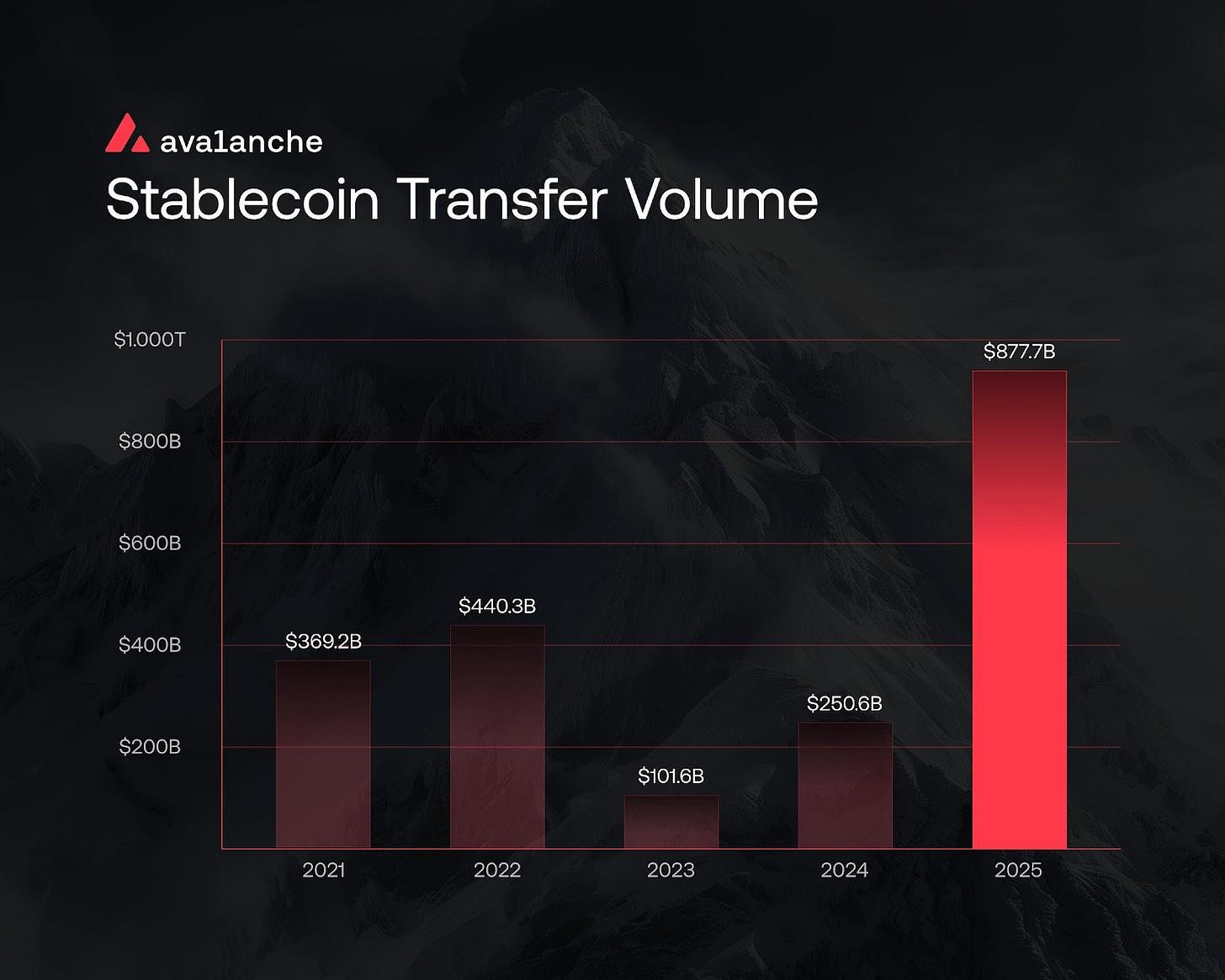

Stablecoin & Tokenized Fund Growth Accelerates:

Stablecoin transfer volume surged 250% year-over-year, approximately 2x more than the previous annual high. The combined market cap of stablecoins and tokenized funds increased by approximately 70% since last year.

Transfer volume growth | Market cap data

Team1 kicked off 2026 with global university tours and strategic grants supporting emerging builders.

University Tours Expand to Vietnam and Turkey:

Team1 visited Swinburne Vietnam in partnership with AWS Cloud, Lorr, Gafin, DAS Labs, and others. The Turkey tour covered 7 cities, 9 universities, and 500 students with developer workshops and Avalanche Academy certifications, sponsored by Bitget, Pangolin, and Dexalot.

Team1 Mini Grant to The Grotto:

Team1 awarded a $10,000 Builder Mini Grant to The Grotto L1. [Grant announcement]

January saw Avalanche double down on developer incentives with new funding rounds and major competitions.

Retro9000 L1s & Infrastructure Tooling Round Snapshot:

The Retro9000 project snapshot took place on January 13th, with participating projects in the Avalanche L1s & Infrastructure Tooling Round reviewed for funding eligibility. [Learn more]

Core Extension UX/UI Overhaul Complete:

Core shipped the final step of its complete UX/UI overhaul across extension, web, and mobile. [Read the update]

Retro9000 Expands with C-Chain Round:

Avalanche Foundation announced the Retro9000 C-Chain Round featuring new incentives from the $40M funding pool, rewarding projects based on real onchain activity measured by AVAX burned. [Full details]

Build Games: $1M Builder Competition Announced

Avalanche unveiled Build Games, a $1,000,000 builder competition designed to reward the best projects building on the network. [Competition details]

Gaming infrastructure and community engagement expanded significantly in January with new L1 launches, competitive tournaments, and innovative social trading integrations.

Paradise Chain L1 Goes Live:

Paradise Chain L1 launched on Avalanche, powering Paradise Tycoon with a real player-driven economy and interoperability across games without disrupting gameplay. [Launch announcement]

Arena Perps Launch: First Social App with Built-In Perpetual Trading:

Arena became the first social app with built-in perpetual futures trading, integrating Hyperliquid to offer trading across 200+ markets directly in-app, 24/7 from any location worldwide. [Explore Arena Perps]

ProTennis (PTDF) Launches Exclusively on Avalanche:

ProTennis announced its exclusive launch on Avalanche and as an Arena app in January, bringing fantasy sports and prediction markets to the ecosystem. [Learn more]

Bears & Salmon Ecosystem Voting and Bears Den:

Community voting went live for Bears & Salmon ecosystem projects building on Avalanche and we had episodes of the Bear’s Den [Cast your vote]

Even.biz Music Sales Powered by Avalanche:

NBA star Kyrie Irving paid $11,001 for LaRussell’s upcoming album on Even.biz, showcasing how Avalanche is powering the evolution of the music industry and direct artist-to-fan transactions. [Read the story]

GrottoL1 First Game Jam Goes Live:

The Grotto launched its first game jam hosted by Wrathtank with prizes in $HERESY for horror games in WebGL format, with games playable at enterthegrotto.xyz/game-jams.

AI infrastructure continued maturing with major testnet milestones demonstrating real-world utility.

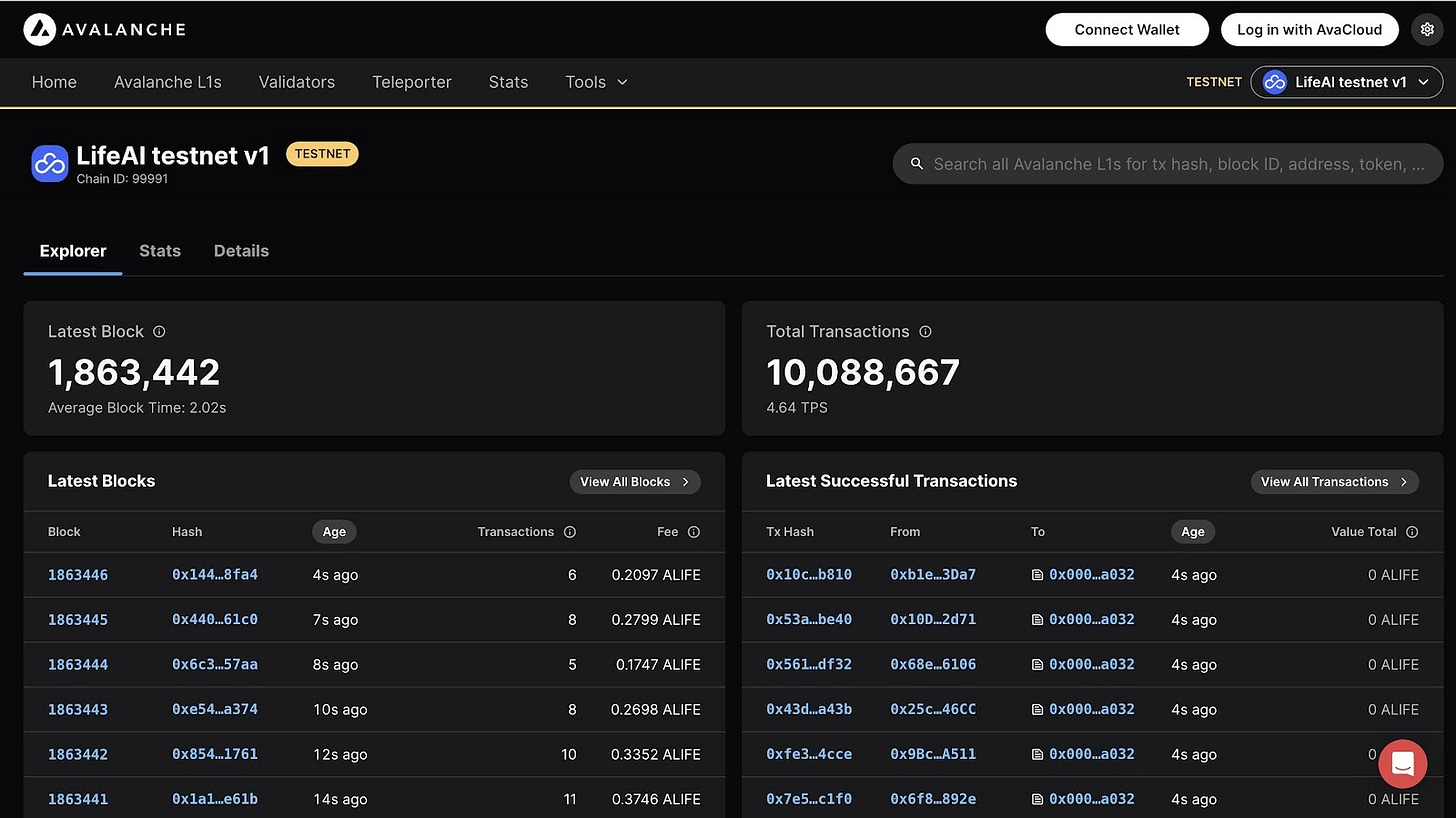

Life AI Testnet Surpasses 10M Transactions:

Life AI Testnet crossed 10 million transactions on Avalanche as healthcare intelligence takes shape onchain. [See the milestone]

January was defined by institutional milestones that cemented Avalanche’s position as the blockchain for regulated finance, with the first ETF trading and massive RWA deployments.

Grayscale Amends ETF Filing to Include Staking Rewards:

Grayscale became the third issuer to add staking provisions to its AVAX ETF S-1 filing with the SEC, joining VanEck and Bitwise. [Read the filing]

Interactive Brokers Enables 24/7 USDC Funding on Avalanche:

IBKR, one of the world’s largest online brokerages, enabled 24/7 account funding with native USDC on Avalanche using ZeroHash, bringing institutional-grade accessibility to millions of users. [Read announcement]

NASDAQ-Listed AVAX One Launches Institutional Validator:

AVAX One rolled out an institutional-grade Avalanche validator supporting public delegation, expanding staking infrastructure for institutional participants. [Details here]

S&P Digital Markets 50 Index Goes Live:

S&P Dow Jones Indices launched the S&P Digital Markets 50 Index, a first-of-its-kind benchmark combining 35 U.S. equities and 15 major cryptocurrencies including AVAX, selected using standard S&P methodology. [Track the index]

Total RWAs Surpass $1.3B:

Galaxy’s $50M CLO pushed Avalanche’s total RWA distribution past $1.3 billion, continuing the momentum of bringing real-world assets onchain. [View the data]

Galaxy Launches $50M Tokenized CLO Exclusively on Avalanche:

Galaxy introduced a first-of-its-kind tokenized Collateralized Loan Obligation (CLO) issued exclusively on Avalanche with a $50M allocation from Grove, later expanded to $75M to fund Arch Lending facility. [Learn more] | [Coverage]

VanEck AVAX ETF ($VAVX) Begins Trading on NASDAQ:

On January 26th, the first-ever AVAX ETF from VanEck began trading on NASDAQ under ticker $VAVX, offering institutional investors regulated exposure to Avalanche with staking provisions.[Prospectus]

Critical infrastructure expansions in January improved validator capacity, DeFi accessibility, and cross-chain functionality for the growing Avalanche ecosystem.

xLabs Expands AVAX Validator Capacity to 200K+

xLabs announced a major expansion of Avalanche validator capacity, now supporting over 200,000 $AVAX in delegations to meet growing staking demand. [More info]

Tippikl Chrome Extension Launches:

Tippikl launched its Chrome extension enabling tips on X (Twitter) powered by Avalanche, bringing crypto micropayments to social media interactions. [How to use]

BTC.b Bridge Migration to Lombard Complete:

The migration of the BTC.b bridge to Lombard Finance completed, enhancing cross-chain Bitcoin infrastructure on Avalanche. [Migration details]

Deribit by Coinbase Launches USDC-Settled AVAX Options:

Deribit introduced USDC-settled options trading for AVAX, expanding sophisticated trading instruments available to institutional participants. [Trading details]

Industry leaders continued highlighting Avalanche’s unique positioning for institutional adoption and real-world business applications.

John Wu on Why Institutions Choose Avalanche:

Ava Labs President John Wu explained on The Block’s Layer One Podcast why Avalanche was built for business from day one and why institutions can see that clearly.

January 2026 marked a turning point for Avalanche.

The first AVAX ETF trading on NASDAQ opened institutional floodgates. The C-Chain crossing one billion transactions and $1 trillion in cumulative volume proved the network operates reliably at scale. At the same time, real-world assets on Avalanche surpassed $1.3B, reinforcing a clear signal: when governments and institutions need dependable blockchain infrastructure, they choose Avalanche.

With major ETF issuers including staking provisions, the lowest fees among leading chains, and network activity reaching multiple all-time highs, momentum is compounding. Add $1M in Build Games funding waiting for builders, and the direction is clear. 2026 is Avalanche’s year to define.

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.