AVALANCHE 2025: YEAR-IN-REVIEW

10 billion transactions. Three ETF filings. Institutions building in production. 2025 was the year Avalanche became critical infrastructure.

January 2025 started with promises. December 2025 ended with proof.

Between those twelve months, Avalanche transformed from a high-performance blockchain into the foundation for how the world will transact, game, and tokenize value

The trajectory was clear from the start. January opened with upgraded network economics through Avalanche9000, slashing fees by 75% and unleashing developer creativity. By February, MapleStory’s 250 million players were migrating onchain. March brought BlackRock tokenizing $500M into its BUIDL fund. June saw the U.S. Department of Commerce publishing GDP data onchain, triggering a 66% transaction surge. November delivered partnerships with FIS Global ($9T in annual processing) and Thailand’s second-largest bank. December closed with the network crossing 10 billion lifetime transactions.

But numbers alone don’t capture what happened. 2025 was the year “real-world adoption” stopped being a marketing phrase and became measurable reality.

This is how Avalanche built the foundation for what comes next.

The network’s technical evolution in 2025 was relentless. Following December 2024’s Avalanche9000 upgrade that cut fees by 75%, the Octane upgrade pushed costs down another 42.7%, while the Etna upgrade made custom L1 deployment nearly free. These weren’t incremental improvements, they fundamentally changed the economics of building on Avalanche.

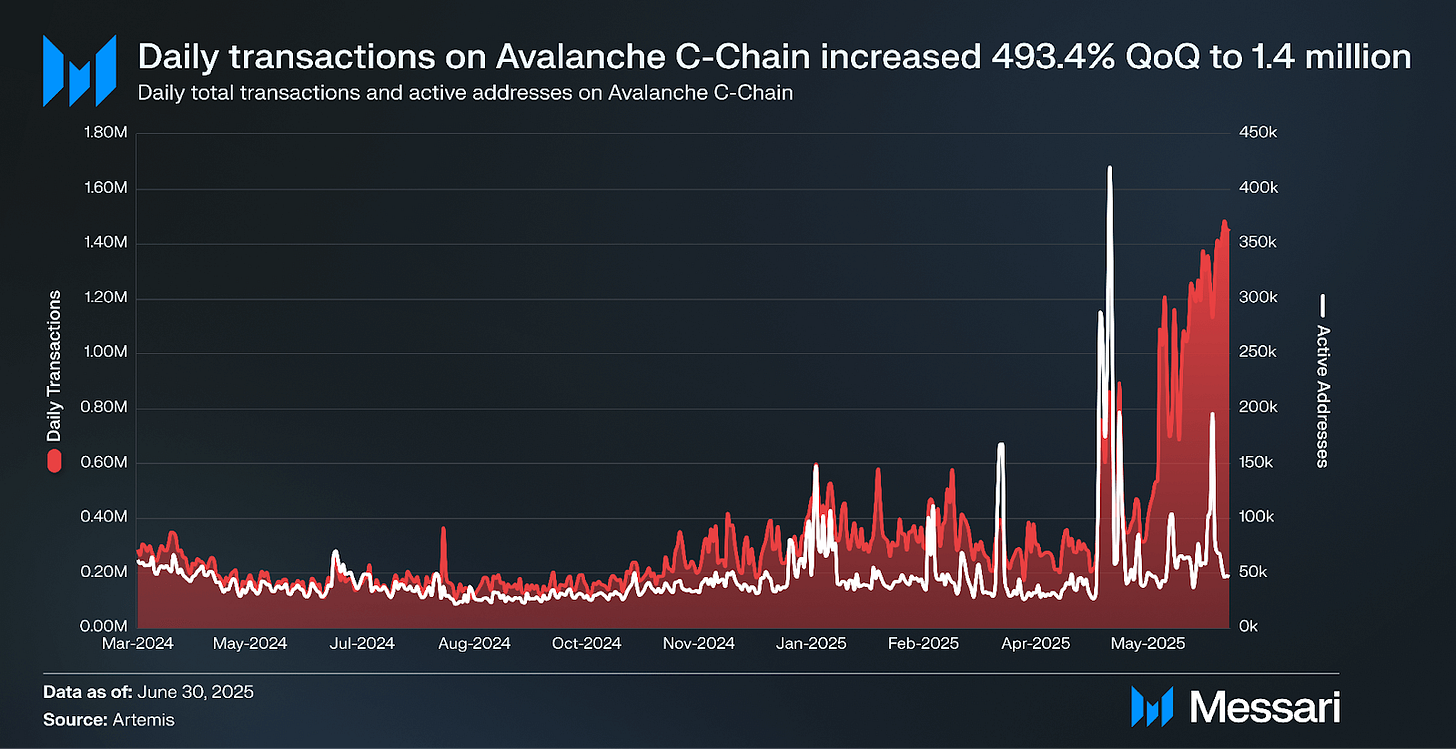

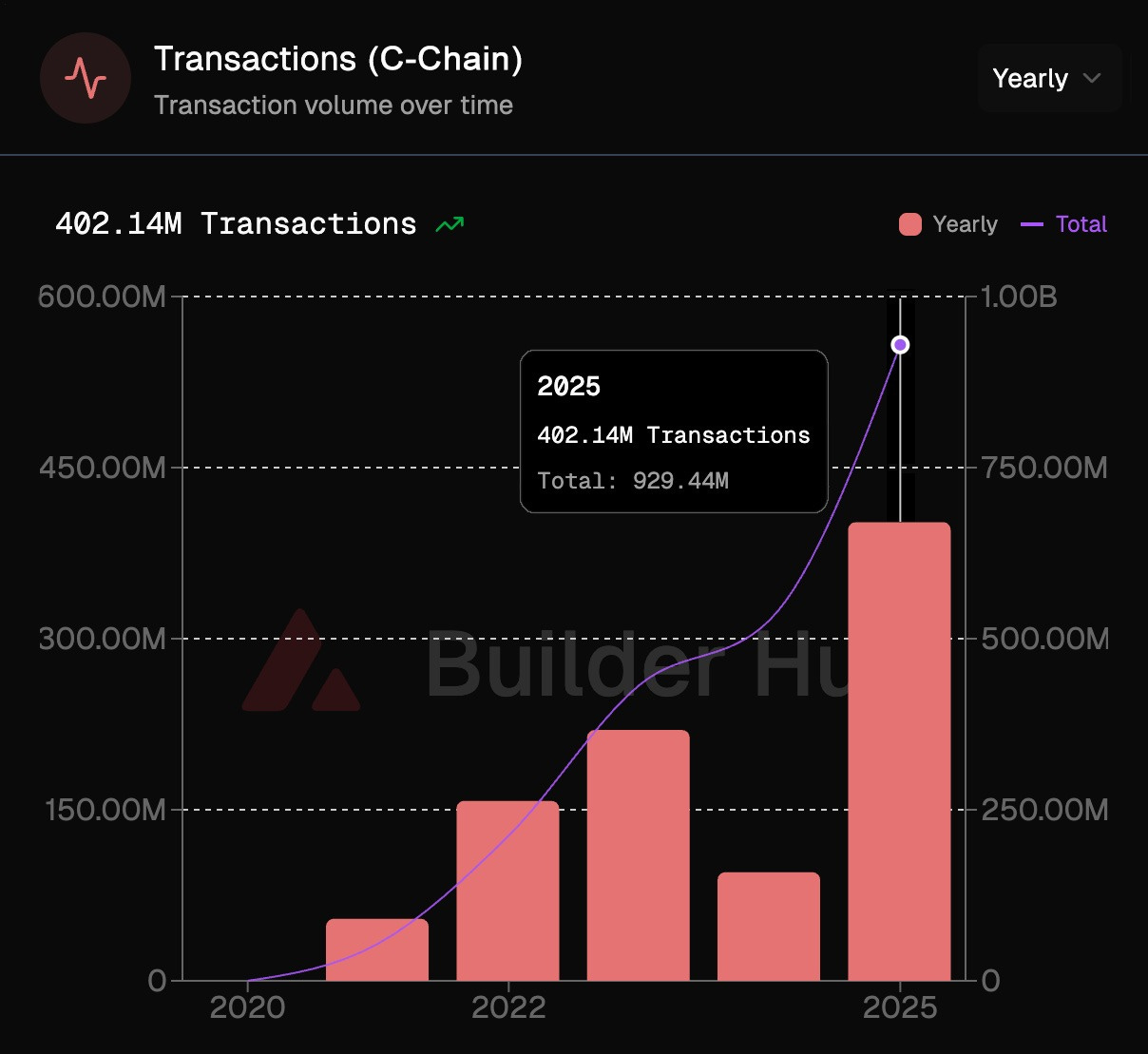

The results showed immediately. Daily transactions surged 493% quarter-over-quarter in Q2, reaching sustained peaks of 1.4million. By year’s end, the C-Chain alone processed over 400 million transactions, 25% above any previous record. December’s 651.2 million monthly active addresses positioned it as the largest month in network history.

November’s Granite upgrade brought the sophistication institutions demanded: dynamic block times that enable faster confirmations, biometric authentication via secp256r1 for FaceID/TouchID-style integration, and more stable validator views that significantly improve cross-chain messaging reliability.

These advances also enhance cost efficiency and performance while maintaining Avalanche’s sub-second finality targets, laying a stronger technical foundation for institutional deployment at scale.

The Avalanche Ambassador DAO evolved into Avalanche Team1 rewarding top contributors with exclusive perks and paid roles.

The scale is remarkable: 500+ events across 250+ cities in 35+ countries, partnering with over 100 universities worldwide. February alone saw 60+ events across five continents.

India’s 7-city hackathon tour drew 3,500 developers, narrowing to 15 finalists in Goa. A $100,000 Mini Grant Fund followed, offering $500-$5,000 per project. Turkey hosted 11 events across 10 universities in 8 cities. Brazil conducted 7 workshops, and Seoul launched its first developer workshop.

Latin America flourished: Builders Connect during Buenos Aires Devconnect, a Spanish Bootcamp with 800+ signups and 300 builders in the first session backed by $25,000 in prizes, plus a Spanish-language blog for the growing community.

When applications reopened, 1,500+ people applied. Avalanche Cascade received significant upgrades, transforming it into one of the most accessible entry points for exploring and building on Avalanche.

What distinguishes Team1 is its decentralized authenticity with hundreds of grassroots events driven by local leaders, supported by meaningful grants and education, all building toward making blockchain accessible everywhere.

Avalanche’s commitment to builders manifested in systematic support. Retro9000 distributed over $125K across multiple cohorts rewarding measurable ecosystem impact. Codebase Season 3 launched with $50,000 stipends and a $500,000 prize pool. The Builder Credits program partnered with top infrastructure providers to reduce deployment costs.

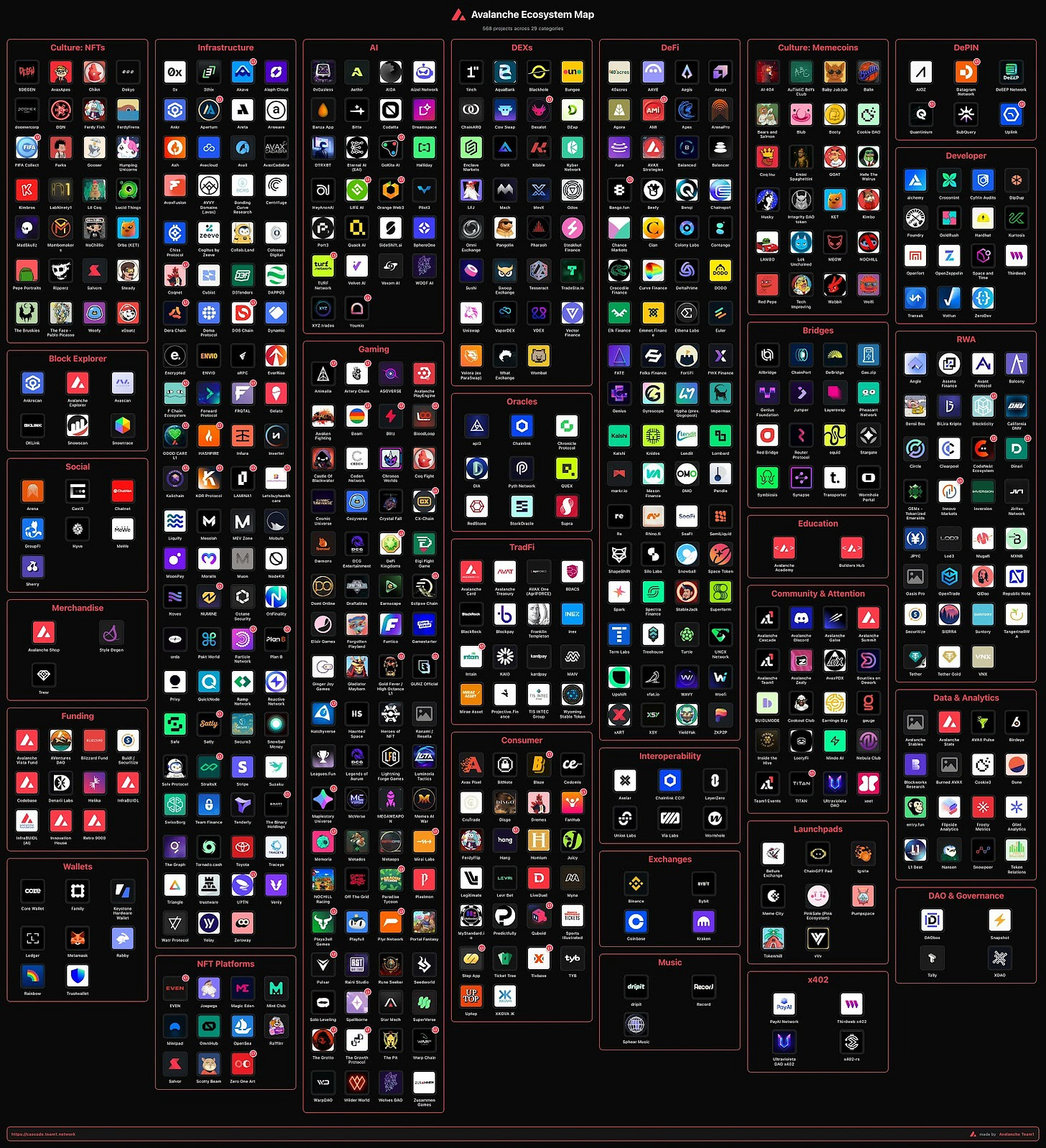

The results: 550+ active projects by year’s end spanning every vertical. Thirdweb added x402 chain support. Zeeve launched Cogitus for one-click L1 deployment. WheelX integrated as an AI-powered bridge aggregating 40+ networks. Critical infrastructure from StableFlow, Neox, and others expanded network capabilities.

Gaming in 2025 demolished the “blockchain can’t handle real users” narrative.

- MapleStory Universe crossed 100 million transactions on its custom L1 with 479,536 active wallets averaging 26 hours of playtime.

- Off The Grid began migrating 16.8 million wallets from testnet to its Gunz L1. Dexalot surpassed 400 million transactions on its application-specific chain.

The ecosystem matured beyond transactions. Playfull launched on Amazon, bringing blockchain gaming assets to mainstream shoppers. GAM3 Awards partnered with OpenSea for commemorative Battle Pass minting. Cleveland Cavaliers launched their fan rewards app delivering direct-to-wallet engagement. Sports Illustrated Stadium committed to blockchain ticketing for 2026.

Avalanche Battle Pass Season 3 offered $25,000 in rewards across 30 titles. The GameLoop Tournament showcased 15 new games built during month-long game jams. The Avalanche x Helika Game Accelerator supported five studios through intensive 12-week development cycles.

These weren’t isolated experiments, they represented systematic infrastructure for gaming at scale.

February’s KiteAI launch established Avalanche as infrastructure for the emerging agentic economy.

By November, KiteAI’s testnet metrics told a compelling story: 715M+ agent calls, 436M transactions, 8M accounts, 20M+ contracts. Backed by PayPal, Coinbase, Animoca Brands, and LayerZero with $33M in funding, KiteAI proved AI agents need blockchain rails for micropayments and verifiable interactions.

Humanode’s integration brought biometric Sybil resistance to Avalanche, the first blockchain implementing Biomapper C1 for private, secure, multi-chain identity verification. These weren’t speculative plays but foundational infrastructure for autonomous systems requiring trust and payment capabilities.

2025 ended speculation about institutional blockchain adoption. Three separate ETF filings landed, VanEck, Bitwise, and an updated Grayscale submission, each proposing to stake up to 70% of holdings, marking the first wave of yield-generating crypto ETFs.

But the real story played out in production deployments. FIS Global and Intain launched Digital Liquidity Gateway, connecting approximately 2,000 U.S. banks to blockchain-based loan securitization. Thailand’s KBank went live with StraitsX-powered cross-border payments serving 1.6 billion tourists through Alipay+ integration. South Korea’s NH Nonghyup Bank began testing blockchain VAT refunds with Mastercard, Fireblocks, and Worldpay.

Securitize announced its pan-European Trading & Settlement System, becoming the only platform with regulated digital-securities infrastructure spanning both U.S. and EU markets. BlackRock expanded BUIDL fund tokenization to $500M on Avalanche, making it the chain’s second-largest deployment. SkyBridge Capital committed to tokenizing $300M in hedge fund assets using embedded KYC/AML compliance.

The momentum extended globally. Japan’s TIS, processing $2 trillion annually and handling 50% of Japan’s credit card transactions, deployed its multi-token platform via AvaCloud. Wyoming launched its state-backed FRNT stablecoin for public sector payments. The U.S. Department of Commerce began publishing GDP data onchain. The Avalanche DLT Foundation incorporated in Abu Dhabi’s ADGM, positioning for MENA expansion.

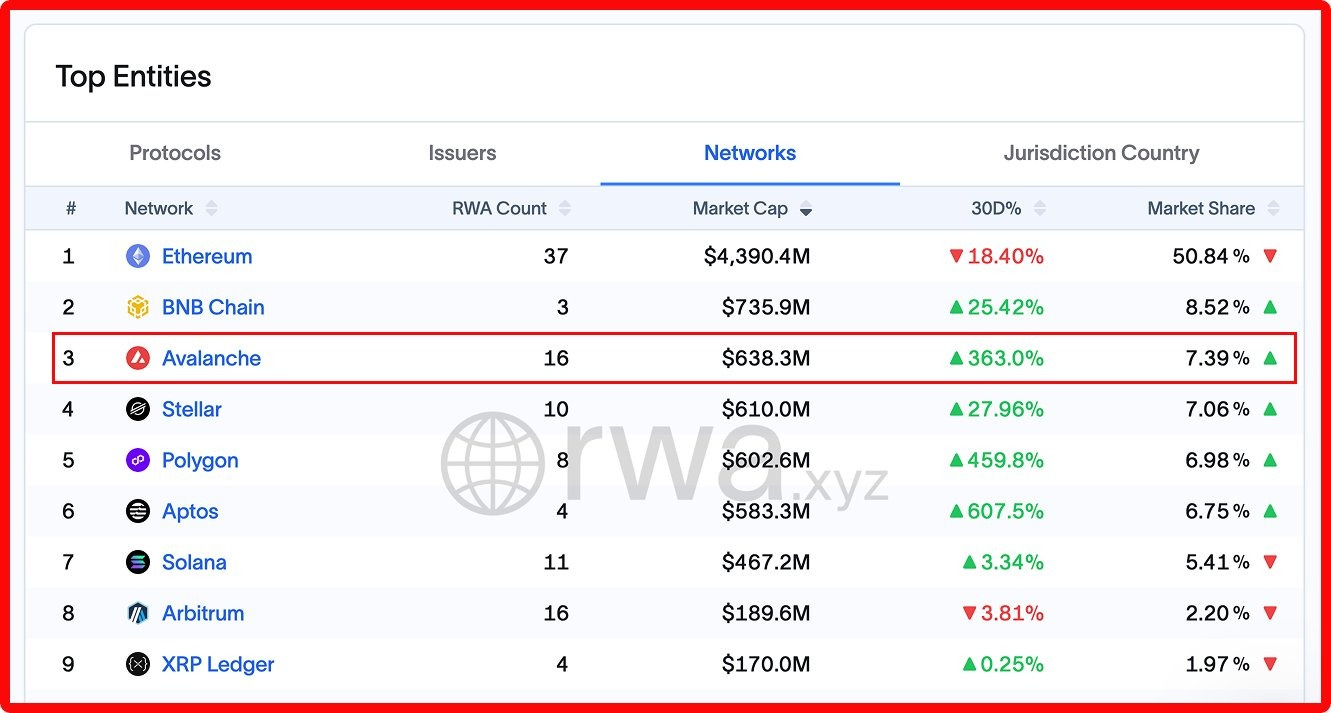

Real-world assets told the growth story clearly: from under $800M in January to over $1.2B by November, 68% quarterly growth that made Avalanche the third-largest chain for tokenized U.S. Treasuries. VanEck’s VBILL fund launched targeting institutional investors. CruTrade tokenized $60M in fine wine. EVOLVE scaled from $50M toward hundreds of millions across Southeast Asian markets.

By December, institutional alternative funds on Avalanche hit an all-time high of $604M while weekly net inflows reached $43M, second-highest among all blockchains. These and lots more weren’t pilot programs. This was production capital flowing to where infrastructure performs.

DeFi growth in 2025 was both explosive and sustainable.

- Total Value Locked climbed to $2.77B with 53% quarter-over-quarter growth.

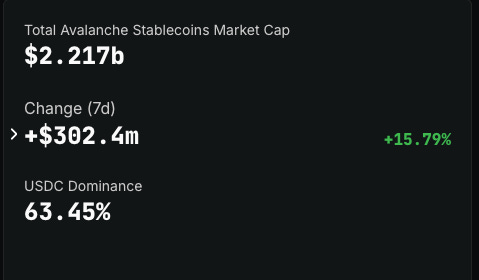

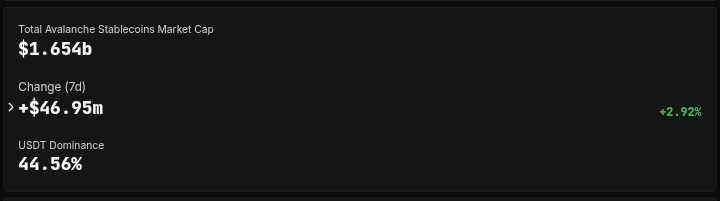

- Stablecoin market cap reached $2.27B with $54.6B in 30-day adjusted volume, and now sits at $1.654B. In one remarkable seven-day period in September 2025, stablecoins added $300M.

Visa’s formal announcement of Avalanche as a supported blockchain for stablecoin settlement validated the infrastructure’s readiness for mainstream financial flows.

The year’s most significant achievement might be what users didn’t notice. NYC’s Union Square Market processed stablecoin payments for millions of holiday shoppers through Urbanspace’s app powered by Avalanche but invisible to consumers.

That’s the goal: infrastructure that works seamlessly.

Looking at 2025 holistically, the transformation is undeniable. Daily active addresses grew 277% quarter-over-quarter in Q3, jumping from 5.24M to 19.78M. Transaction volume exploded 493% QoQ in Q2. DeFi TVL grew 53% quarterly. RWAs surged 68% in Q4 alone. The C-Chain processed 400M+ annual transactions.

But beyond metrics, 2025 established something more fundamental: credibility. When trillion-dollar financial institutions needed blockchain infrastructure, they chose Avalanche. When 250-million-player gaming franchises went onchain, they chose Avalanche. When governments explored digital identity and payments, they chose Avalanche.

The network proved it can handle institutional scale without sacrificing the speed and flexibility that attracted builders initially. Four major upgrades maintained momentum while Etna, Octane, and Granite systematically addressed cost, performance, and enterprise requirements. Three ETF filings validated long-term institutional interest. Strategic expansions into Abu Dhabi, Vietnam, and broader MENA positioned Avalanche for global growth.

Perhaps most importantly, 2025 created the network effects that define inevitable infrastructure. With 550+ projects building, $604M in institutional funds deployed, major banks running production systems, and gaming titles generating 100M+ transactions, Avalanche isn’t just ready for 2026, it’s positioned to define it.

The question entering 2026 isn’t whether Avalanche can scale. It’s what happens when ETF approvals bring institutional capital to unprecedented levels, when more Fortune 500 companies recognize blockchain infrastructure as a competitive advantage, when the network effects of having global finance and gaming running on Avalanche compound.

2025 built the foundation. 2026 will prove why it matters.

The infrastructure works. The institutions are deploying. The momentum is accelerating. This is just the beginning.

Dive into the Avalanche ecosystem today! Download the Core Wallet and unlock a world of seamless DeFi, NFTs, and more.

2025 was 🔥

2026 would be 🔥🔥🔥

holy cow this is frickin amazing